-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI BRIEF: Aussie Q3 GDP Prints At 0.3% Q/Q

RBNZ Finalise Deliberations With New Zealand Locked Down

New Zealand entered a strict nationwide lockdown Tuesday after detecting a new case of Covid-19 in Auckland community, which turned out to be the Delta variant. Panic selling of NZD ensued amid fear that the highly contagious variant could spread rapidly, mirroring the grim scenario from across the Tasman. OCR hike bets were trimmed, which applied heavy pressure to the kiwi ahead of today's RBNZ monetary policy meeting. NZD/USD tanked onto the psychological $0.6900 barrier, printing its worst levels since Jul 21.

- New Zealand has since identified further 4 cases in the community, one of which was an Auckland Hospital worker. Auckland and the Coromandel Peninsula will remain under alert level 4 (highest) at least for seven days and the rest of the country at least for three days. The initial case is deemed to have been infectious since Aug 12.

- We have published our usual comprehensive preview of the RBNZ decision yesterday, but also flagged that the situation was evolving. The latest developments in New Zealand have arguably reduced the odds of a hike today to a virtual coin toss.

- The kiwi extended losses Tuesday as Westpac and ASB scrapped their forecasts of a 25bp hike today. ANZ still expect the MPC to tighten policy today, while BNZ believe that the odds are evenly split.

- Interest.co.nz cited FinMin Robertson as noting that he spoke with RBNZ Gov Orr on Tuesday afternoon, who confirmed that the MPS would be released as planned. Robertson added that "it's the job of the RBNZ to look to the medium-term" and "that's exactly what they're asked to do".

- NZD/USD trades flat at $0.6921 and bears look for further losses past Jul 20 YtD low of $0.6881, which would open up Nov 13, 2020 low of $0.6811. Bulls look to a rebound above yesterday's high of $0.7029.

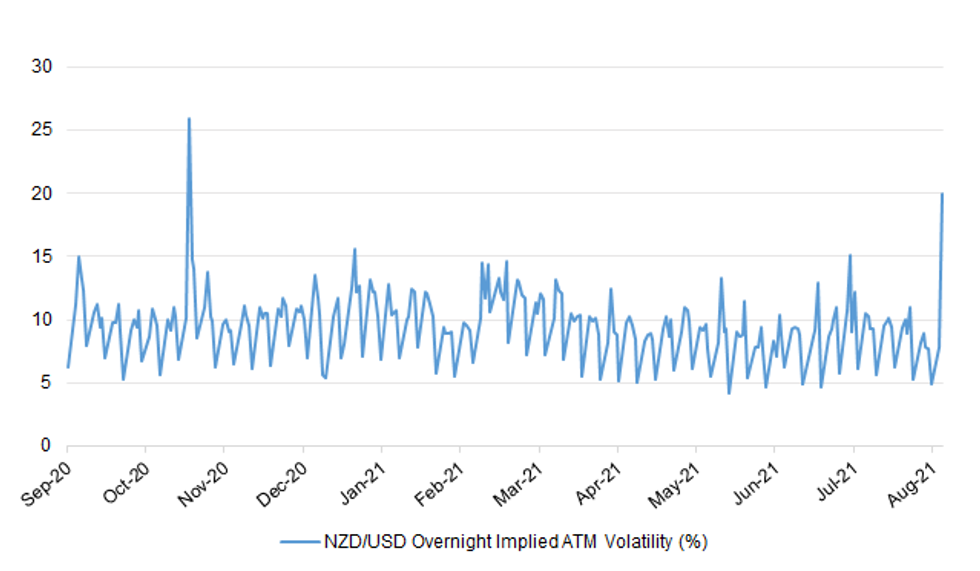

- NZD/USD implied vols climbed Tuesday, with a notable lift seen in the overnight tenor. It reached multi-month highs and last sits at 20.93%.

- For the record, New Zealand's quarterly PPI will hit the wires shortly, but the RBNZ's policy announcement is set to be the main game-changer today.

Fig. 1: NZD/USD Overnight Implied ATM Volatility (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.