-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

RBNZ's Hawkesby Suggests Gradual Hiking Path

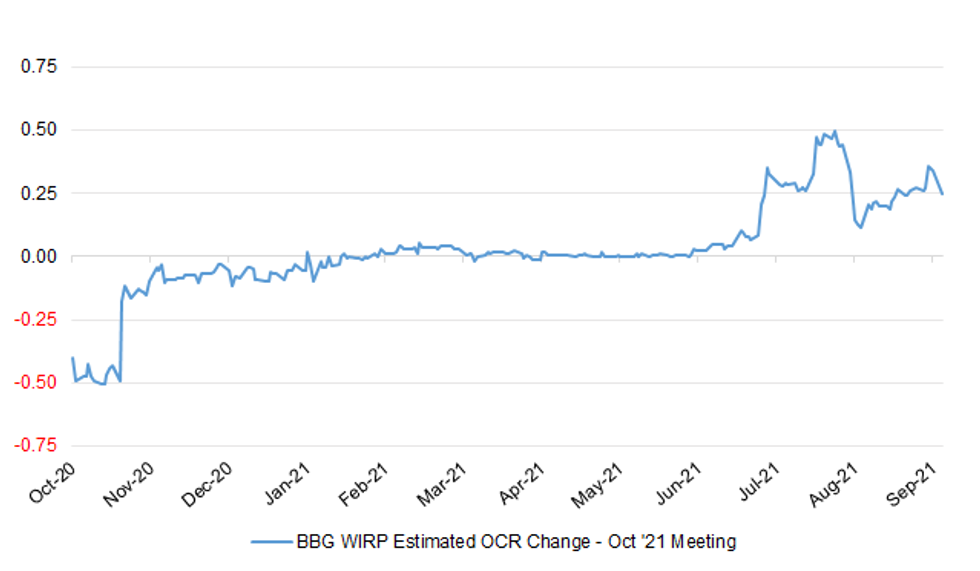

NZD/USD ground lower Monday as China's Evergrande saga dented risk appetite, with the rate briefly probing the water under its 50-DMA. It has remained heavy as trading resumed this morning and last sits at $0.7022, just shy of neutral levels. Some mild pressure to the kiwi has been generated by RBNZ speak, which poured some cold water on expectations of double-barrel rate hikes.

- The RBNZ released comments from Asst Gov Hawkesby on "a least regrets approach to uncertainty". The official suggested that the Reserve Bank is inclined to tighten monetary policy settings gradually, noting that "when there is a typical amount of uncertainty, and the risks are evenly balanced, then central banks globally tend to follow a smoothed path and keep their policy rate unchanged or move in 25 basis point increments".

- The OIS strip now fully prices just one standard 25bp OCR hike in October, in contrast with 34bp worth of policy tightening priced yesterday.

- As a reminder, PM Ardern yesterday announced that Auckland will move to alert Level 3 from Level 4 at midnight today and remain at that level for at least two weeks.

- Statistics New Zealand will publish credit card spending for the month of August today. Later this week, trade balance will take focus on Friday.

- The 50-DMA at $0.7011 continues to provide the initial bearish target and a clean breach of that moving average would open up Aug 30 low of $0.6987. On the flip side, a rebound above Sep 16 high of $0.7138 would expose Sep 14/10 highs of $0.7151/56.

Fig. 1: BBG WIRP Estimated OCR Change - Oct '21 Meeting

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.