-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

(RPT) MNI INTERVIEW: US Debt Feud Likely To Temper Sentiment

(Repeats a story first published on January 27)

Consumer sentiment climbed to the highest since April but is likely to cool as Washington debates raising the debt ceiling and risking a crisis, says Joanne Hsu who leads the University of Michigan's Survey of Consumers.

"While consumer sentiment has risen since December and has been lifting since it's all-time low in June, it still remains pretty low from a historical perspective, and consumers are still broadly expecting an economic downturn in the year ahead," she told MNI Friday.

The Michigan index rose 8.7% in December to 64.9 reflecting improving assessments of personal finances and buying conditions for durables, she said. The one-year economic outlook jumped 4.7% to 62.7, the highest in a year.

Sentiment will be affected by Washington's debt ceiling debate, Hsu said, noting debt ceiling crises in 2011 and 2013 prompted steep declines in confidence.

INFLATION VIEWS DOWN AGAIN

"We do have some growth in the share of consumers spontaneously mentioning the debt ceiling over the last three weeks, four weeks, but it's not a large number and I expect that to go up in the months ahead," she added.

Americans also still expect rising unemployment, Hsu said, noting consumers are more careful about spending. "They are expecting things to get worse before they get better."

The University of Michigan's final December report also showed a decline in median expected year-ahead inflation for the fourth straight month, falling to 3.9% in January from 4.4% in December, the lowest reading since April 2021.

"Consistent with the slowdown in CPI and a slowdown in the PCE deflator that we've seen, consumers are incorporating the same information," said Hsu, a former principal economist at the Fed board's division of research and statistics.

RATES SEEN STAYING HIGH

"It remains at a very high level of uncertainty and there's quite a bit of dispersion and so my interpretation is that this is still tentative," she said. "It's been four consecutive months but things could change very quickly if global inflationary factors suddenly change."

Long-run inflation expectations remained at 2.9%, within the narrow range that measure has been in for more than a year. "I don't know that consumers materially see a sea change in the long run, in spite of the fact that current inflation is easing."

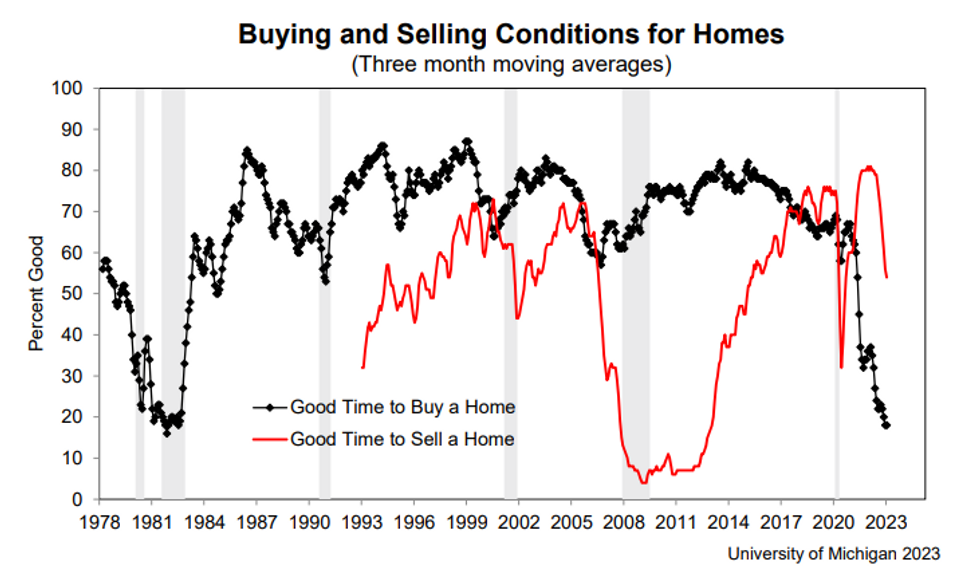

Amid consumers' view the housing market is unaffordable and buying conditions are the worst in decades, they do expect prices to come down but decreases will be offset by high interest rates. "There may be some optimism from realtors' perspective, but from the consumers' perspective, it is just not there."

The Fed is expected to slow down its rate increases next week and bring the federal funds target range to 4.5% to 4.75%, while likely repeating the message that it does not see rate cuts later this year. (See: MNI: Fed Rates Likely Headed Above 5% Despite Cooling CPI)

"Consumers are broadly expecting interest rates to continue rising in the year ahead. Even if interest rate hikes slow down, they're not expecting rates to come down."

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.