-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

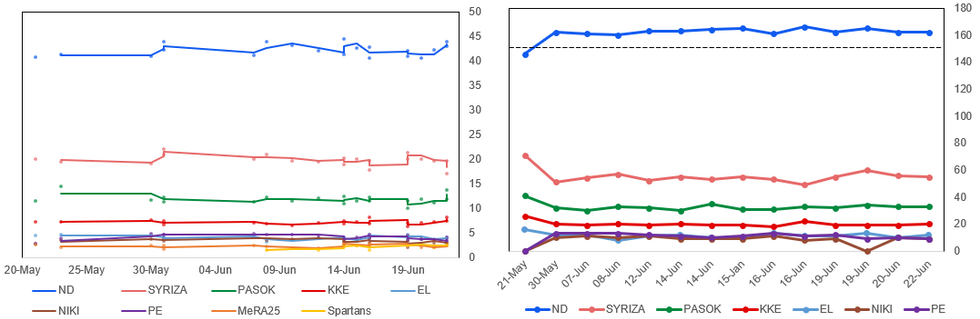

Small Parties Entering Parl't & Low Turnout Main Threats To ND's Chances

The final opinion polling ahead of the 25 June general election continues to show the centre-right New Democracy (ND) led by Kyriakos Mitsotakis on course to secure a majority in the Hellenic parliament. The greatest prospect of an upset, resulting in a hung parliament, comes if minor parties that have sat below the 3% electoral threshold outperform and enter the legislature. This would dilute the number of seats assigned to the other parties post-election and could see ND's seat total decline below the 151-seat level required for a majority.

- The far-left MeRA25 of former Finance Minister Yannis Varuofakis have polled between 2.1% and 2.8% from 15-22 June, while the far-right ultranationalist Spartans' support has stood between 1.6% and 2.7% over the same period.

- The right-wing Christian fundamentalist NIKI and the far-left anti-austerity Course of Freedom (PE) look set to enter parliament according to polls. Neither crossed the threshold in the 21 May election, but are projected to win 8-13 seats each according to polls.

- Unicredit highlights the risks relating to turnout: "At the election in May, participation was at around 60%, historically low for Greek elections,[...]. Complacency on the side of ND’s supporters might result in a lower turnout at the polls. This explains why PM Mitsotakis has been so vocal in calling Greek citizens to the ballot box on Sunday. In fact, abstention could also hurt other parties, especially the main opposition SYRIZA, which lost 11pp in May compared to 2019."

- For analysis on the potential impact on Greek assets see here.

Source: Rass, GPO, Alco, Pulse RC, MRB, Metron Analysis, Kapa Research, MNI

Source: Rass, GPO, Alco, Pulse RC, MRB, Metron Analysis, Kapa Research, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.