-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

SNB Review - September 2020: Rosier Inflation Outlook

Full PDF here: https://emedia.marketnews.com/marketnewsintl/MNISNBRevSep2020.pdf

Contents:

- Executive Summary

- Key Takeaways and Dates to Watch

- Summary of Sell-Side Analyst Views

- Exclusive Policy Analysis

Executive Summary:

• The SNB kept policy unchanged, with the Sight Deposit Rate and main Policy Rate at -0.75%.

• The Bank retained their view that the CHF is "highly valued" and that it is willing to "intervene more strongly in the foreign exchange market".

• Inflation and GDP forecasts were lifted slightly, with inflation now seen turning positive early 2021.

Key Takeaways:

In keeping policy unchanged, the SNB continue to signal to markets that they will look through deeply deflationary conditions and that the bar to further rate cuts is high – despite the Committee stressing that it remains an option. Instead, it seems the SNB will continue to rely on FX intervention to defend against financial market fragmentation and the continued use of the negative rate exemption thresholds to shield the domestic banking sector against the pitfalls of negative interest rate policy. The COVID-19 refinancing facility (CRF)

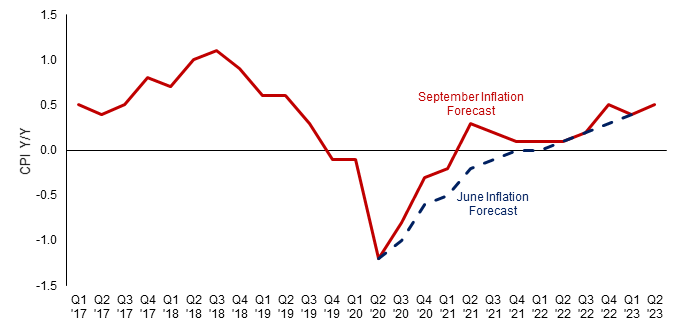

A slightly rosier inflation forecast will have alleviated some pressure on the SNB this quarter. After seeing outright deflation out to the beginning of 2022, higher-than-expected energy prices have brought this forward by four quarters.

Figure 1: SNB less pessimistic on inflation, with CPI seen turning positive in Q2 2021

Source: MNI/Swiss National Bank

While warning of unusually high uncertainty that clouds the inflation outlook, the SNB anticipate that higher oil prices will have an upward influence on prices in the short-term, but the longer-term forecast is unchanged. Its baseline scenario is that the global COVID pandemic will be kept under control "without a renewed serious impairment of economic activity", but carry over the phrase from the prior report that scenarios remain subject to a high degree of uncertainty.

Markets continue to discount the possibility of negative interest rates being pushed lower still, and any domestic concerns over the impact of negative rates have been soothed by the increase in the negative rate exemption thresholds earlier this year. The SNB noted that around 75% of bank sight deposits don't fall under the negative rates anyway, thereby reducing materially any pressure for banks to apply negative rates to smaller savers.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.