-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSoft Goods To Offset Sticky Services In Core (2/3)

- Energy prices (+ve factor) – 10% of EZ HICP Basket: An uptick in energy prices on an annual basis is the main upside driver to the headline rate in December. This effect will be most pronounced in Germany, where energy subsidies depressed prices in December 2022. This trend is expected to continue in the coming months, as beneficial base effects from 2022 drop out of the annual comparison. However, on a monthly basis energy components are expected to soften again, with fuel prices in particular falling through December. November EZ energy: -11.5% Y/Y, -2.2% M/M.

- Food prices (-ve factor) – 20% of EZ HICP Basket: Analysts expect food prices continue to soften on an annual and monthly basis. Base effects will pull the annual rate lower, while easing supply chain pressures and lower wholesale food prices should help sequential inflation continue to moderate. November EZ processed food inc. alcohol and tobacco: +7.1% Y/Y, +0.1% M/M; Unprocessed +6.3% Y/Y, +1.0% M/M.

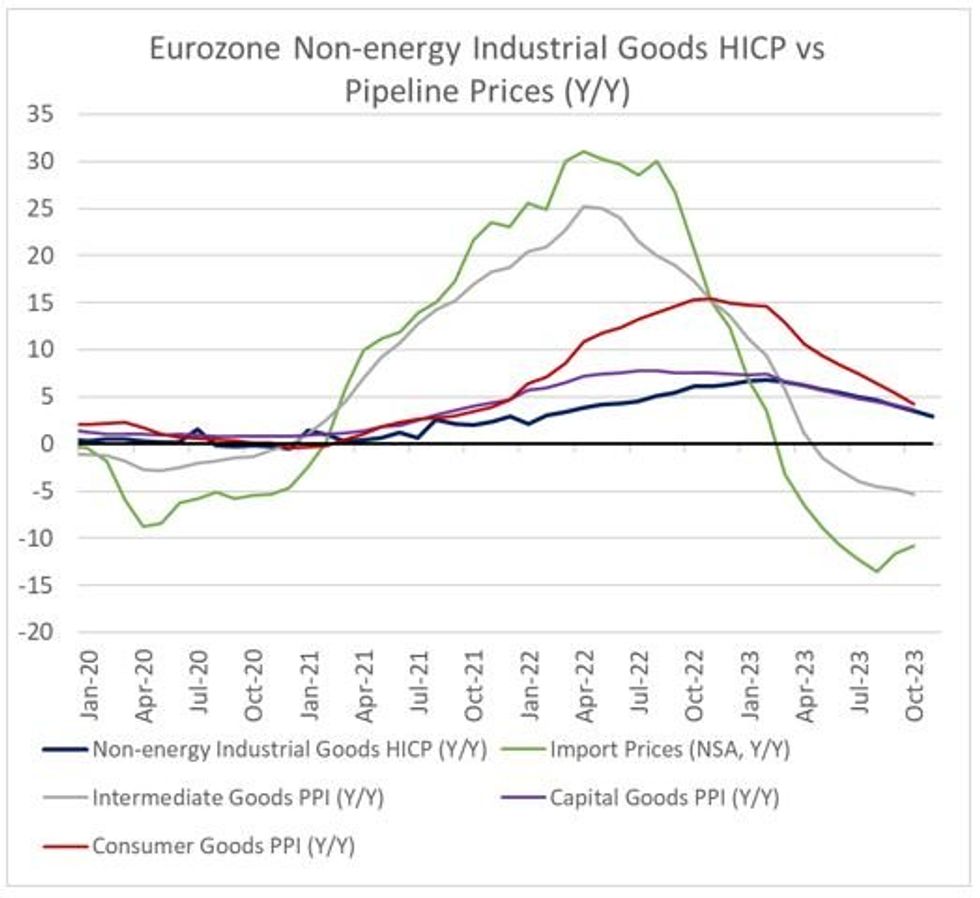

- Core goods prices (-ve factor) – 26% of EZ HICP Basket: Easing pipeline pressures and beneficial base effects should continue to pull non-energy industrial goods inflation down on a Y/Y basis, after the 0.6pp fall in November. The latest PPI and import price figures (for October 2023) continued to disinflate/remain in deflation, indicating that NEIG should continue to drag on headline and core HICP in the coming months. Additionally, the December Eurozone final manufacturing PMI indicated further falls in manufacturing input and output prices. October EZ non-energy industrial goods: +2.9% Y/Y, -0.1% M/M.

- Overall services prices (+ve) – 44% of EZ HICP Basket: December is a month where services prices generally rise on a monthly basis. This month, analysts see travel-components (particularly German package holidays) acting as an upside driver, exacerbated by 2023 vs 2022 weighting changes (more on this point below). Additionally, the December flash PMIs cited wage costs as a source of stickiness in services prices. In its latest projections, the ECB cited labour costs as the main upside driver of core inflation in 2024, bringing further attention to domestic inflation (i.e. services) components in the coming months.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.