-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSoftening Core Inflation Outlook Key To The First Cut (2/2)

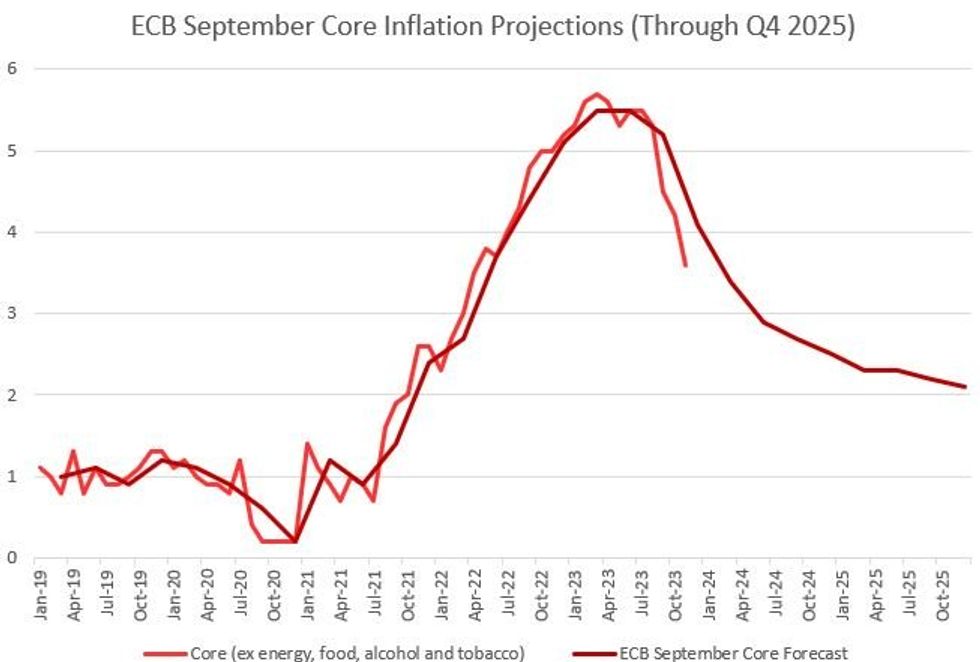

Whether downward headline inflation revisions extend beyond the next couple of quarters - and bring forward the achievement of the 2% target before the Q3 2025 timing currently implied by the ECB staff forecasts - will be influenced heavily by the ECB's expectations for core dynamics.

- The final details of the November print out Dec 19 will help determine whether any unusual distortions were at play (especially in the services categories). But it won't be out until after the ECB meeting. Anyhow, the core reading has begun to drop off faster than the ECB staff previously expected, and momentum continues to wane across multiple key categories, with forward looking indicators continuing to point to softer prints ahead.

- ECB forecasts see core HICP descending from 4.1% Y/Y in Q4 2023 (again this is due to be revised lower) to 2.5% at end-2024, overtaking headline (seen 2.9%) to the downside. After a quick 1.1pp dropoff in the current quarter, and another 0.7pp in Q1 2024 and 0.5pp in Q2 2024 to 2.9%, the descent is seen slowing to 2.3% by Q1 2025 and staying above 2% through the forecast period.

- The ongoing collapse in core goods prices (3M/3M annualised momentum is <1%) means the debate in December and beyond will revolve largely around services and thus the labour market price input, namely the interaction between productivity/wages/job markets tightness.

- That's been a major theme for ECB speakers in recent months, including ECB's Schnabel who singled out the tight labour market as a key reason why disinflationary progress was set to slow going forward. ("Productivity Dynamics Make "Last Mile" Of Disinflation Look Long", MNI, Nov 23 16:59GMT)

- If anything the weaker core inflation data seen thus far - when taken in conjunction with softer forward looking price survey indicators, and diminishing inflation expectations - has defied the ECB's (and market's) expectations to the downside, and the wage-price spiral appears at diminishing risk of playing out. MNI's read of the Eurozone labour market is that it has clearly begun softening.

- Even for all that though, the noise in the data and the potential for headline inflation to pick up in the next couple of months mean it will probably take at least a few more months of soft core prints for the ECB Governing Council to be convinced that it can afford to ease, though - hence it's hard to see first ECB rate cut expectations brought forward much more than April.

Actual Quarterly Average and Monthly Headline HICP % Y/Y; ECB Sept Forecasts From Q3 2023Source: ECB, MNI

Actual Quarterly Average and Monthly Headline HICP % Y/Y; ECB Sept Forecasts From Q3 2023Source: ECB, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.