-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTalk Of Potential Intervention Brings Reprieve To Baht

Spot USD/THB has eased off amid talk of potential for a BoT intervention in support of the baht. The pair last changes hands -0.045 at THB34.675, with bears looking for a deeper pullback towards May 5 low/round figure of THB34.018/34.000. Bulls need a clearance of yesterday's high of THB34.752 before taking aim at May 11, 2017 high of THB34.815.

- BoT Asst Gov Mahasandana told reporters that the central bank "will consider stepping in to take care of the baht if needed," but doesn't deem it necessary to use policy tools at this point. Talk of intervention was already doing the rounds after a senior BoT official suggested about two weeks ago that the authorities could intervene to curb THB volatility.

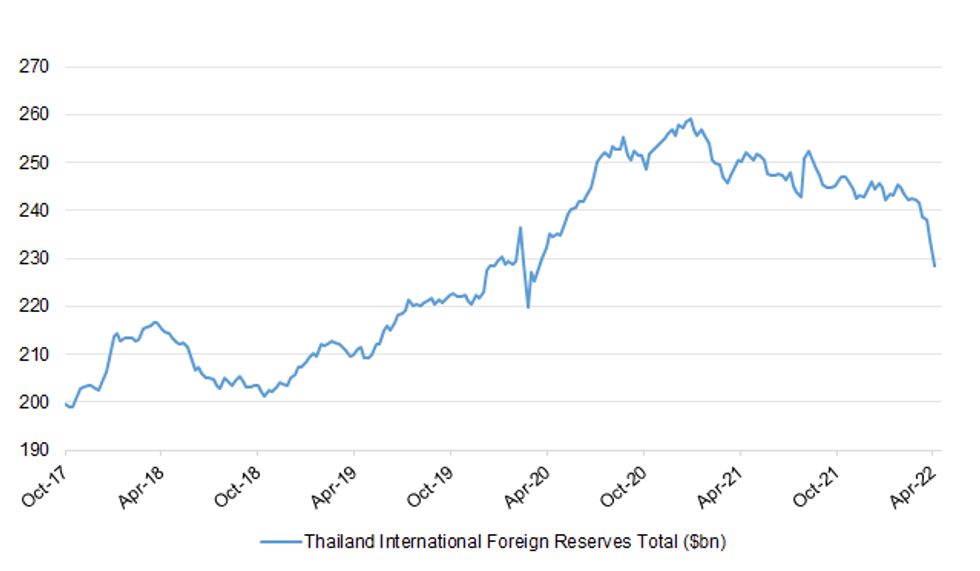

- His comments drew attention to the accelerated erosion of the BoT's FX reserves observed over the past few weeks, as the nation's stash of foreign currencies shrank to the smallest size in two years. The next update on foreign reserves is due later today.

- The risk of interventions by Asia EM central bank has risen amid the greenback's sharp rally on a YtD basis. Some of the BoT's regional peers recently stepped in to prop up domestic currencies (RBI, HKMA) or expressed readiness to do so (BI, BoK).

- Separately, the BoT unveiled plans to ease rules on FX services offered by non-bank companies as it continues to push for reforms of Thailand's FX ecosystem.

- Meanwhile, China's decision to crack down on "unnecessary" overseas travel poured some cold water on hopes for a swift recovery of Thailand's tourism sector. The decision was announced after Thai FinMin warned that the tourism sector may take some time to return to normal, with China struggling to bring its outbreak of COVID-19 under control.

- On a different front, a source told the Bangkok Post that the Finance Ministry is debating a proposal to slash the diesel excise tax by THB5/litre once the current tax reduction expires next week. The aim of the proposal is to address rising inflationary pressures.

Fig. 1: Thailand International Foreign Reserves Total ($bn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.