-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Thailand To Launch Vaccination Campaign On Valentines Day

Spot USD/THB trades at THB29.96, a touch lower as we type, with trendline support at THB29.94 eyed. A clean break here would shift focus to Dec 18, 2020 low of THB29.76. Topside focus falls on the 50-DMA/Jan 18 high at THB30.11/13, followed by Jan 12 high of THB30.19.

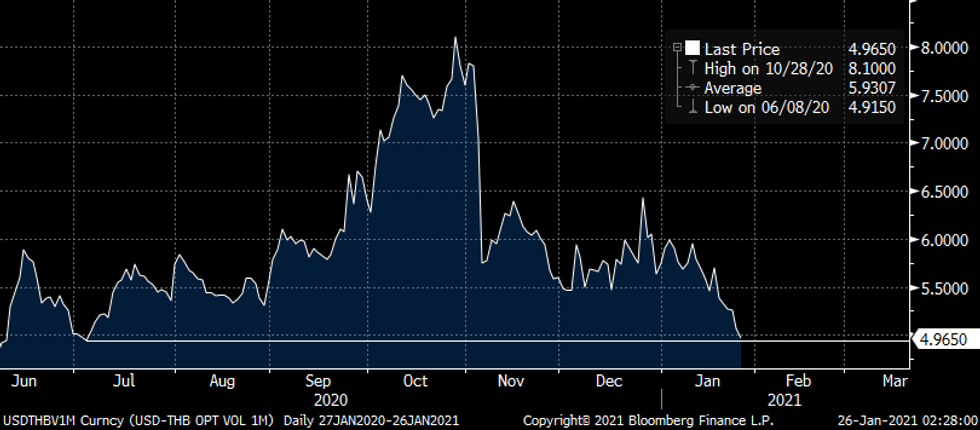

- Implieds have resumed losses today, with tenors from 1-month out printing fresh cycle lows. 1-month implied volatility has slid to its worst levels since early Jul.

- ANZ suggested that Thailand could be added to the U.S. Treasury's list of currency manipulators, as its FX purchases are expected to top the 2% threshold upon the release of Q4 GDP data.

- Thailand's Finance Ministry said it plans to sell THB60bn of savings bonds to retail investors in Feb, with proceeds to be used to fund the latest cash handout scheme.

- The Health Ministry said that the national Covid-19 jab rollout will begin on Feb 14 and will initially target healthcare & front-line workers.

- The Samut Sakhon province reported 914 new Covid-19 cases on Monday, the majority of which were detected among migrant workers. Provincial authorities will provide another update on regional Covid-19 situation later today.

- PM Prayuth chairs a weekly Cabinet meeting, ministers are expected to discuss land & building tax cuts.

- Thailand's M'fing Production Index comes out on Wednesday, while the BoT will release BoP data & weekly update on foreign reserves on Friday.

USD/THB 1-Month Implied Volatility

USD/THB 1-Month Implied Volatility

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.