-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

Treasury Dynamics Could Play A Key Role In Reserves Trajectory (2/2)

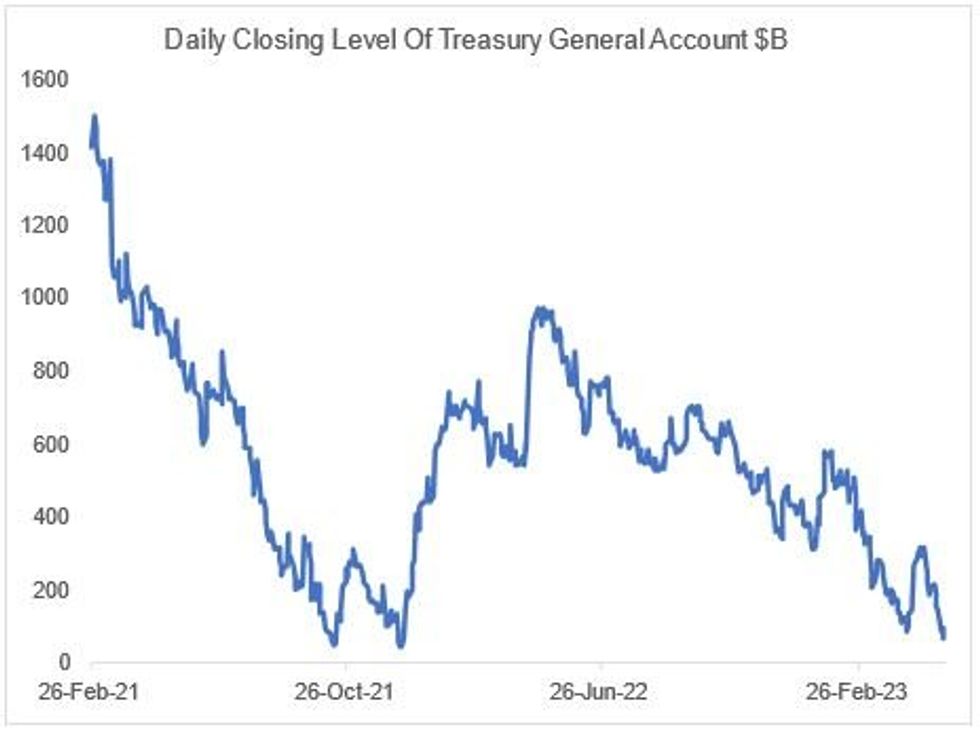

Banking system reserves have fluctuated heavily over the past two months, but between ongoing QT and takeup of the Reverse Repo facility, sit about $1T below the Dec 2021 peak.

- One factor buoying reserves in recent weeks is the ongoing debt ceiling impasse, which has seen the Treasury’s General Account (TGA) at the Fed depleted to $68.3B as of Wednesday’s close, the lowest amount of the year and vs $316B at the end of May. All else equal, a lower TGA balance means more bank reserves, and vice versa.

- While the TGA will fluctuate in the weeks ahead, falling cash levels put focus on the Treasury’s warning that the “x-date” could arrive as soon as June 1.

- That said, an informal MNI client poll run earlier this week saw no respondents expect an outright default, with an 80/20 split between those expecting a short-term stop gap versus a long-term debt ceiling increase. And there's the potential for a near-term deal between Republicans and Democrats on raising the debt limit.

- If there is a resolution by early June, and the Treasury can resume borrowing, it’s expected to quickly replenish its cash pile by issuing sizeable amounts of T-Bills – with an end-of-June cash balance assumption of $550B (per the latest quarterly Refunding update), that could be on the order of a half-trillion quickly. Some analysts see the bill issuance running up to $1T in the coming quarters.

- Unless there is a sudden drop in takeup of RRP– which looks unlikely – reserves could drain out of the system quickly as the Treasury rebuilds its cash pile, putting renewed pressure on system liquidity.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.