-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTsy Borrowing Requirements: How Much Cash Flexibility? (2/2)

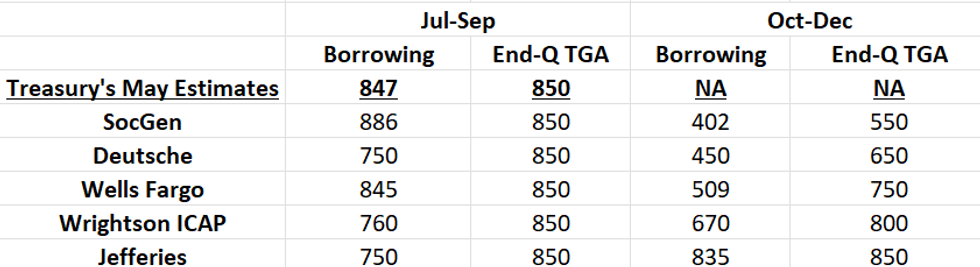

The following bullet points provide perspectives on possible end-year TGA levels, which largely come down to how analysts see Treasury interpreting its legal flexibility in determining cash levels:

- SocGen ($550B end-year TGA forecast) notes that the legal guidance re Treasury cash raising ahead of debt ceiling events "argues Treasury can legally hold a “prudential buffer of funds” even if it remains unspent at the end of the debt limit suspension. There is some uncertainty over just how large this buffer could be. Our reading of the memo is that Treasury can likely hold an amount in line with their expected outflows for a week, and therefore we reduce our TGA target for end-of-year to $550bn. The risks to this TGA target are balanced."

- Deutsche ($650B TGA) sees a higher “structural” increase in the TGA, with $850B now the “standard”. That said, the current law is that Treasury can’t push cash “above normal operating balances” ahead of debt limit crises. While those terms are up for interpretation, Deutsche sees $650B as “reasonable”, vs $450B in 2021 ahead of the previous debt limit suspension, with the increase due to higher fiscal deficits and debt. That said, “this number is $200bn smaller than what we would expect in the absence of debt ceiling influence”.

- Wrightson ICAP ($800B) notes that their projection "assumes that the Treasury believes that it can take a business-as-usual approach in picking its cash balance target... this is an unsettled question...."We had initially guessed that the Treasury might be forced to adopt a more restrictive interpretation of its cash management flexibility and target a year-end TGA level of $600 billion or so. At this point, though, we’re leaning the other way. Both sides of the aisle in Congress have an interest in giving themselves as much time as possible to work out a fiscal compromise after the election without a debt ceiling trainwreck. A December 31 cash balance of $800 billion or more would significantly improve the odds that the 2025 “x-date” would be pushed off to the summer of next year.”

- The higher/lower TGA forecasts correspond more or less equally to higher/lower borrowing requirements for Oct-Dec. If Treasury uses a lower end-year cash assumption, this would almost certainly not impact coupon issuance (to be confirmed Wednesday), but would have key impacts for bills - potentially implying big paydowns of bills toward the end of 2024, which would reverse in early 2025.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.