-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

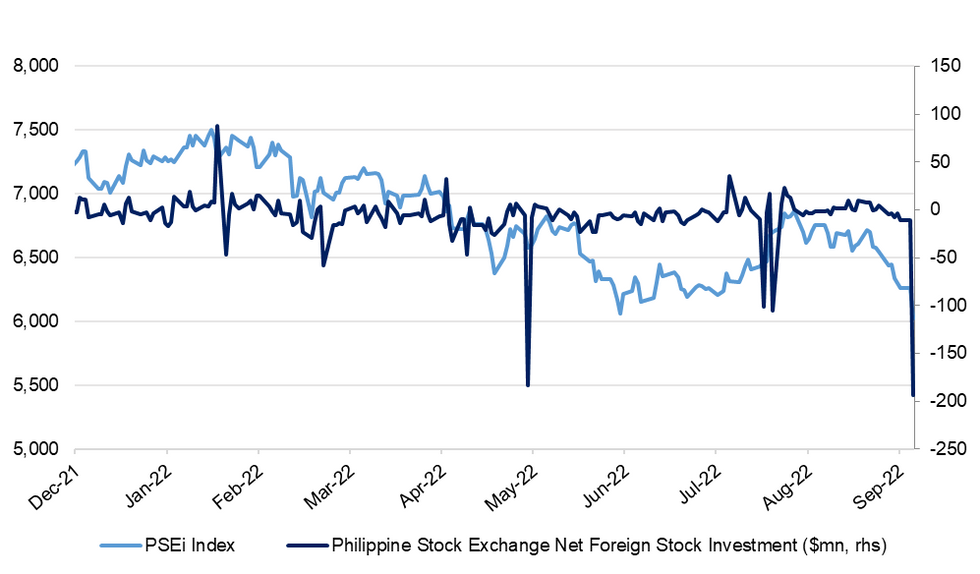

Typhoon Blows Philippine Stocks Off Their Feet, PSEi Enters Bear Market

Foreign investors were net sellers of Philippine shares Tuesday, shedding a net $193.36mn in local equities, which represented the largest net daily outflow since Mar 9, 2021.

- The figure was boosted by an element of catch-up activity, due to a closure of domestic financial markets on Monday, when strong risk-off tone drove a global equity rout. A wave of outflows swept across emerging Asia, as offshore investors were net sellers of Indian, Indonesian, Thai, Malaysian and Taiwanese stocks.

- Fresh rounds of hawkish Fedspeak and the reverberations of market turbulence in the UK helped undermine sentiment at the start to the week, generating pent-up impetus for the Philippine markets, which were shut as a super typhoon hit the main Luzon island.

- The authorities are assessing the scale of the damage wrought by typhoon Noru, but it has been confirmed that swathes of farmland have been affected. While the government refused to lower its growth target for the year, reports of widespread rice crop destruction fuelled concerns over existing food shortages, which risk accentuating price pressures and nudging the BSP towards a steeper tightening path.

- Rapid peso depreciation amplifies pressure on the Philippine equity market as USD/PHP keeps refreshing all-time highs. This bites into local corporate earnings when converted into USD, likely keeping foreign investors on the sidelines.

- The PSEi tumbled on the re-open on Tuesday, landing 3.8% lower come the closing bell and printing its worst levels since Oct 2020 in the process. The index has now shed more than 20% from its February high on a closing basis, entering bear market territory. Still, the RSI moved into oversold territory, which puts participants on the lookout for a rebound.

Fig. 1: PSEi Index vs. Philippine Stock Exchange Net Foreign Stock Investment

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.