-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

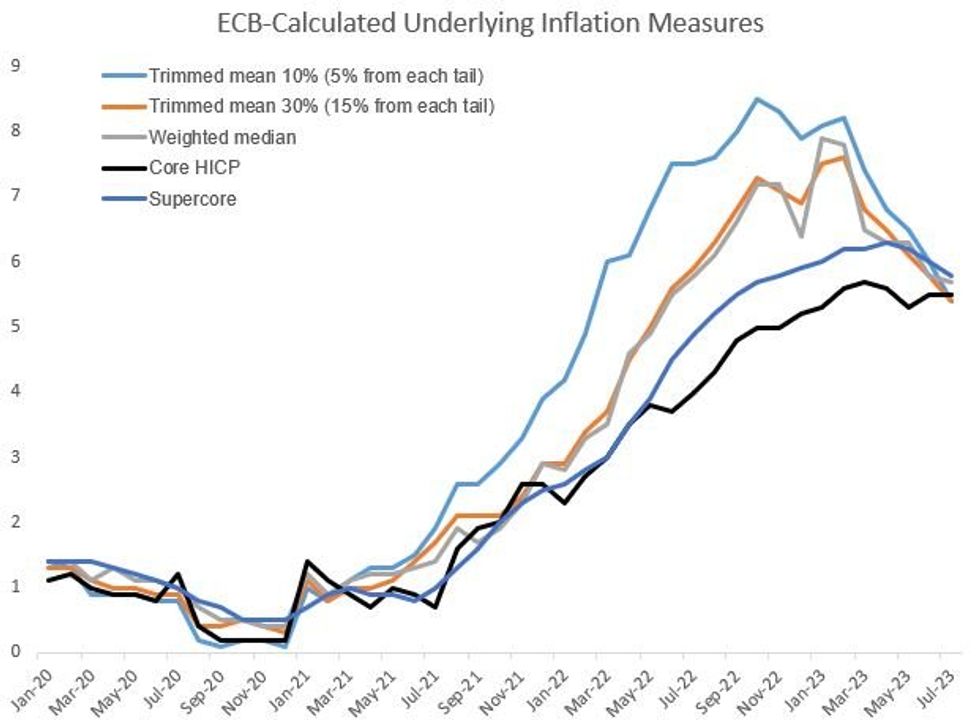

Underlying Inflation Gauges Look Disinflationary

While today's release of final July Eurozone CPI confirmed a stubbornly strong Y/Y core HICP figure (5.5% Y/Y for a 2nd consecutive month, albeit partly on base effects and other statistical factors), underlying measures that are now available look relatively more disinflationary.

- A research bulletin published by ECB staff shortly after the July flash data pointed to multiple measures of inflation momentum waning, particularly in services (a point MNI made in our July Eurozone Inflation Insight).

- Their preferred metric overall, Persistent and Common Component of Inflation (PCCI, a model-based approach), corroborated this through June. July's PCCI should be published soon, but for now, we have the ECB's Supercore measure, which posted the lowest level (5.8%) in July since November 2022.

- Other measures released today, including trimmed means (which exclude extreme movers within the inflation basket), paint a similar picture.

- Trimmed mean at 10% dropped from 6.0% Y/Y to 5.4%, the lowest since Feb 2022, and to 30% it fell from 5.8% to 5.4%, lowest since May 2022. It's the first time those measures have printed below Core HICP Y/Y since February 2021.

- The weighted median measure at 5.8% Y/Y remains above core, and is coming down more slowly than the trimmed means, but is at the lowest level since November 2022.

- Pending the PCCI data, we see the non-core underlying data as cautiously encouraging for the ECB going into the September decision - while there is a long way to go, the granular July data offer another suggestion that inflation momentum is waning.

Source: ECB, MNI

Source: ECB, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.