-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

USD/CNH Range Bound, Aggregate Credit Figures Due This Week

USD/CNH generally tracked lower post the Asia close, although the pair couldn't sustain downside moves beyond 6.7600. We track around this level in early trade today. As has been the norm of late, CNH is generally displaying a fairly modest beta to overall USD trends.

- Not surprisingly, given this backdrop 1 month implied vol sits not too far above 5%. Since USD/CNH broke higher in April, the 1 month implied vol range has roughly been 5-8%. We may not break lower though ahead of key event risk in the US, with CPI data due tomorrow.

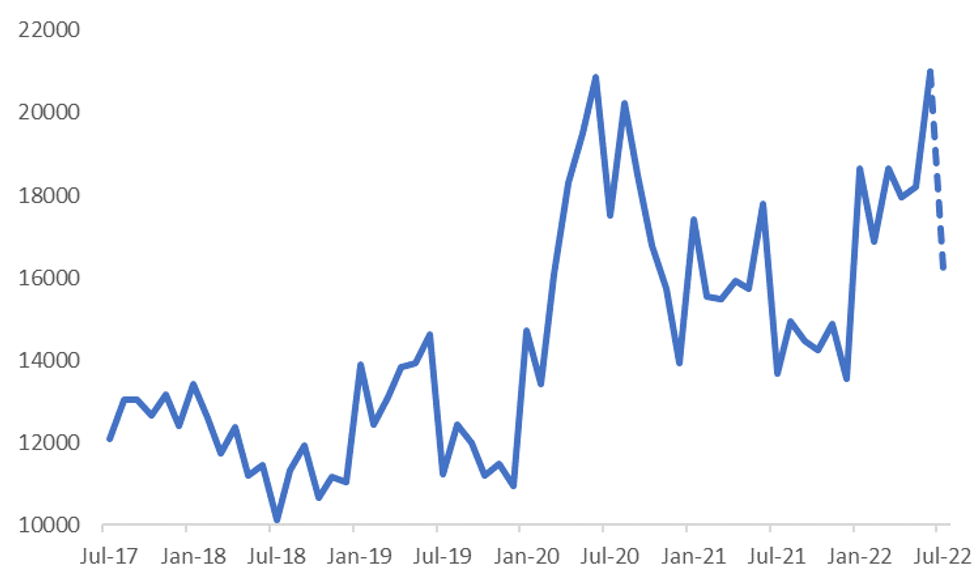

- Domestically, aggregate credit/new loan figures are due from today onwards (release window is to the 15thof August). Since late last week the consensus estimate for aggregate financing has edged down a little to 1350bn yuan, versus 5173bn yuan in June. If realized this would represent a decent slowdown in credit momentum, see the chart below. New loans are forecast to rise 1125bn, versus 2806bn yuan.

- Bloomberg notes that sale of residential mortgage back securities has dropped 92% this year, while new home sales are down 32% amidst a continued slowdown, exacerbated by credit woes for property developers and the mortgage boycott. Hence detail in credit/new loan figures will also be eyed.

- Elsewhere the focus will be on Covid trends, and on-going US-China tensions. US President Biden stated overnight that he didn’t think China would escalate things further beyond recent military drills.

Fig 1: China Aggregate Finance, Rolling 6mth Sum (Assumes July Forecast Realized)

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.