-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

USD/RUB Rips Below 70, Backed by Firm Oil & CBR Tightening

- USD/RUB trades -0.52% lower this morning, brushing off early BBDXY upside to focus on firmer oil and gas prices (+0.88% & +5.34% respectively).

- The cross fell -1.03% last week, spurred on by higher oil prices and a larger than expected hike from the CBR policy rollercoaster at +75bp vs a split consensus of +25-50bp - leaning slightly towards the former.

- This also eclipsed our expectation for +50bp, resulting in more bullish pressure on RUB into the weekend and this morning's session.

- Sell-side analysts still see scope for an additional 25-100bp in hikes in the coming meetings, given Nabiullina's overtly hawkish guidance and the persistence of inflationary pressures.

- This makes the next step largely contingent on the evolution of CPI data going into the next meeting.

- The CBR showed its concern about the inflation trajectory by removing phrasing expecting a moderation in 4Q21, and statements from Nabiullina should be monitored closely in the coming weeks but the bank is unlikely to guide towards letting up any time soon in order to rein in lofty expectations.

- Beyond Monpol, increased covid pressures and new lockdowns are a facto to consider, but have had little material impact on one-way bullish RUB positioning.

- Next major support seen at 69.55, 69.15, 68.59, 68.03. Intraday Sup1: 69.8305, Sup2: 69.55, Res1: 70.2971, Res2: 70.8961

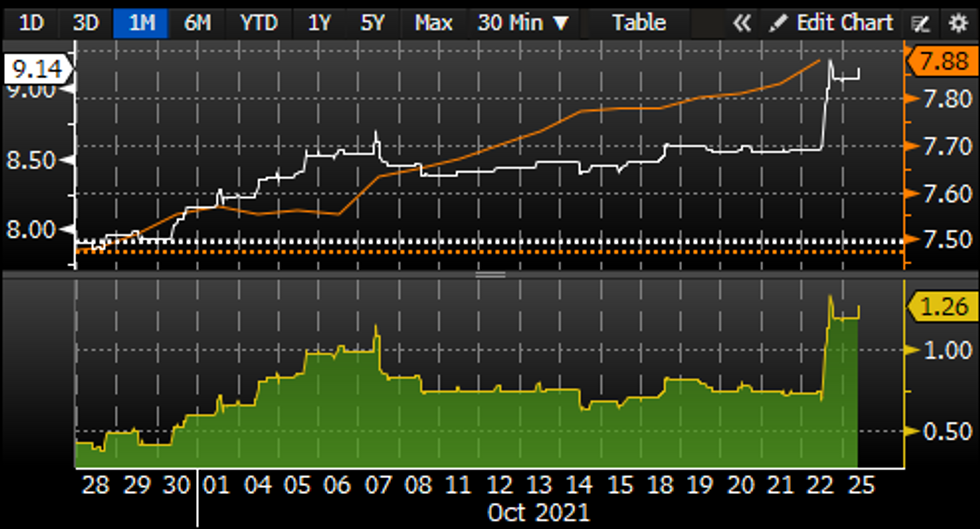

3x6 FRA-Mosprime Spreads

3x6 FRA-Mosprime Spreads

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.