-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

Watching US Data Outcomes

Whilst much of the focus overnight was on the FOMC decision and the subsequent press conference, we did see further disappointing data outcomes in the US relative to market expectations.

- Specifically, the US empire manufacturing stayed negate at -1.2 versus 2.3 expected. It was an improvement though on the previous reading of -11.6. Retail sales data also disappointed.

- Tonight, we have further data outcomes, most notably the US Philly Fed print. The market expects an improvement to 5.0 from 2.6.

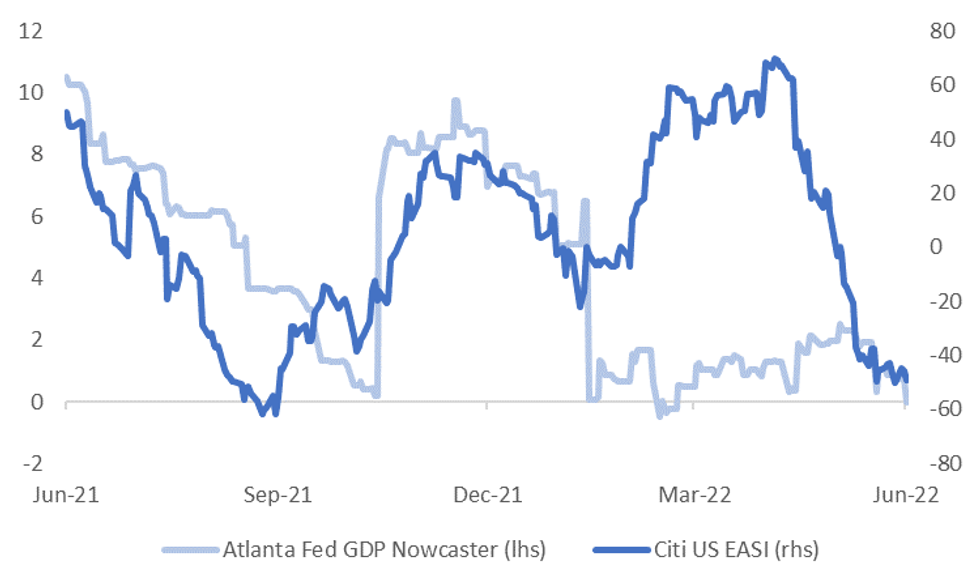

- The Citi US Economic Activity Surprise Index (EASI) remains at fairly depressed levels though, see the first chart below. The other line on the chart is the Atlanta Fed GDP Nowcaster, which edged into negative territory with the latest update.

Fig 1: Citi US EASI & Atlanta Fed GDP Nowcaster

Source: Citi, MNI - Market News/Bloomberg

Source: Citi, MNI - Market News/Bloomberg

- It could be that we are on the cusp of rebound in data relative to expectations. However, it is noteworthy the degree to which financial conditions in the US have continued to tighten. The second chart below plots the 6 month change in the Goldman's US FCI against the Citi EASI. Note the FCI is inverted on the chart.

- Now in level terms the GS US FCI is well below the 2020 highs, but the rate of change in the past 6 months has been quite sharp. Such dramatic shifts have often coincided with periods of data underperformance. In the current context the focus is on higher US interest rates/energy prices dampening housing and spending impetus.

Fig 2: Citi US EASI & Goldman Sachs US FCI

Source: Citi, GS, MNI, Bloomberg

Source: Citi, GS, MNI, Bloomberg

- Further US data/growth disappointments may not derail USD sentiment though, with inflation being the clear priority from a Fed standpoint.

- Still, through May we saw a consolidative period in US yields/Fed expectations, part of which reflected some disappointing activity outcomes.

- So, we can't rule out weaker US data taking some of the shine of the USD/yield story.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.