-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBank Indonesia Poised To Wait & Watch

Bank Indonesia is poised to sit on its hands at the last monetary policy meeting of this year. Currently, 21 out of 26 economists surveyed by BBG expect interest rates to stay unchanged after the Bank delivered 25bp worth of easing last time.

- At the November meeting, Bank Indonesia cut its 7-Day Reverse Repo Rate to a record low of 3.75%, even as a majority of analysts expected no change to the benchmark policy rate.

- Admittedly, Indonesian CPI inflation remains below Bank Indonesia's target range of +3.0% +/- 1.0pp, with headline metric last printing at +1.59% Y/Y. The central bank said it expects inflation to remain below +2.0% in 2020, but it should gain pace in 2021.

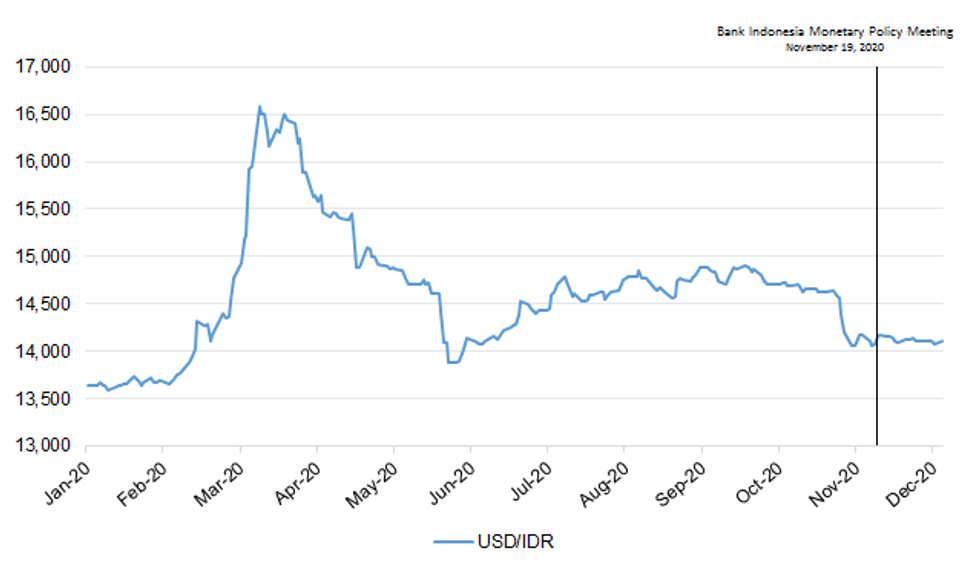

- Currency appreciation emerged as a major worry in the lead-up to the November decision, with policymakers expressing readiness to stabilise the FX rate. The rupiah has steadied since (see chart below), which will be a relief for Bank Indonesia.

- Earlier this month, Governor Warjiyo said that the central bank expects GDP to fall 1%-2% Y/Y in 2020 before a 4.8%-5.8% rebound next year, implying that economic recovery should already be underway this quarter. He noted that monetary policy will remain accommodative in 2021.

- At the same time, however, the government continues to pressure the central bank to take on a greater role in fuelling economic recovery. The day after the aforementioned speech from Governor Warjiyo, President Widodo urged the central bank to play "a more significant role in the fundamental reforms that we are currently executing."

- One of the main challenges faced by Bank Indonesia is meagre monetary policy transmission. Per SocGen's calculations, while the central bank lowered interest rates by 200bp since July 2019, lending rates dropped just 89bp, which puts the effectiveness of further easing into question. Bank Indonesia's own data for October showed that bank lending fell 0.47% Y/Y, with Assistand Governor Aida urging lenders to boost loan channelling.

- Although there is a marginal chance that Indonesian policymakers will try and fuel economic recovery and below-target inflation, the large amount of stimulus delivered to data, stabilisation of the exchange rate and weak monetary policy transmission will likely convince Governor Warjiyo & Co. to stand pat.

MNI - Market News/Bloomberg

MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.