-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

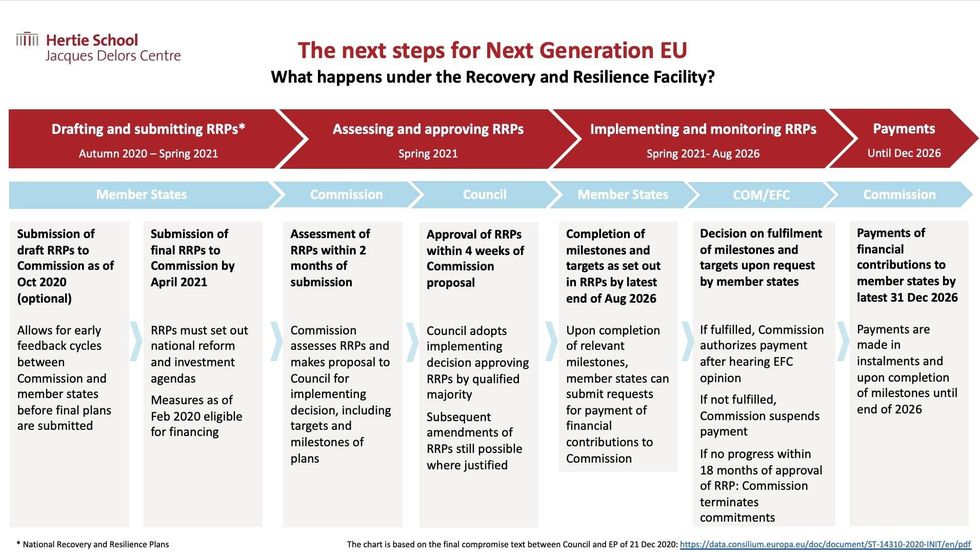

Free AccessWhat Next For EU's COVID-19 RFF?

Useful graphic from the Jacques Delors Centre, an EU-focused Berlin think-tank, on the next steps with regards to the EU's COVID-19 Recovery and Resilience Facility, the EUR750bn fund that is part of the long-term budget and which sparked major ructions within the EU during last year's negotiations:

Source: Hertie School Jacques Delors Centre

Source: Hertie School Jacques Delors Centre

The Deputy Director of the Jacques Delors Centre Lucas Guttenberg also tweets an interesting thread on the immediate steps relating to the RFF, selected sections below:

- "Member states (MS) will have to submit their final recovery and resilience plans (RRPs) by the end of April. The Commission (COM) then has two months to formally assess the RRPs and to make a recommendation to the Council for an implementing decision...The Commission then has only three options: It can endorse the RRP... it can endorse the RRP and recommend less funds if it does not buy the MS's cost calculation; or it can reject the plan."

- "It does not have the option of throwing out individual measures once they are in the final plan - its only two threats are to kill plans altogether or to reduce amounts with good arguments. In practice, this will mean all plans will be agreed prior to final submission. That is why the coming weeks in the runup to the end-April deadline will be the ones deciding how the RRF money will be spent. The action...will shift soon to the bilateral negotiations between MS and COM."

- "The fact that the European Parliament did in the end not get a formal role in approving RRPs and past experience with (lack of) Council peer review means that these interactions will likely stay bilateral - and risk happening mostly behind scenes. And by end-April, it will be over."

- "What happens then? Once the plans are approved by the Council, countries can start implementing. They also get up to 13% of their allocation as pre-financing right away. So in July or so, money will flow."

- "So to sum up: In the next ten weeks or so, the allocation of more than 300 bn euros will be decided basically for good in a process that is by-and-large untested. A lot depends on getting it right. So it might make sense to pay close attention..."

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.