-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

Williams' Comments Point To Steady Longer-Run "Dot"

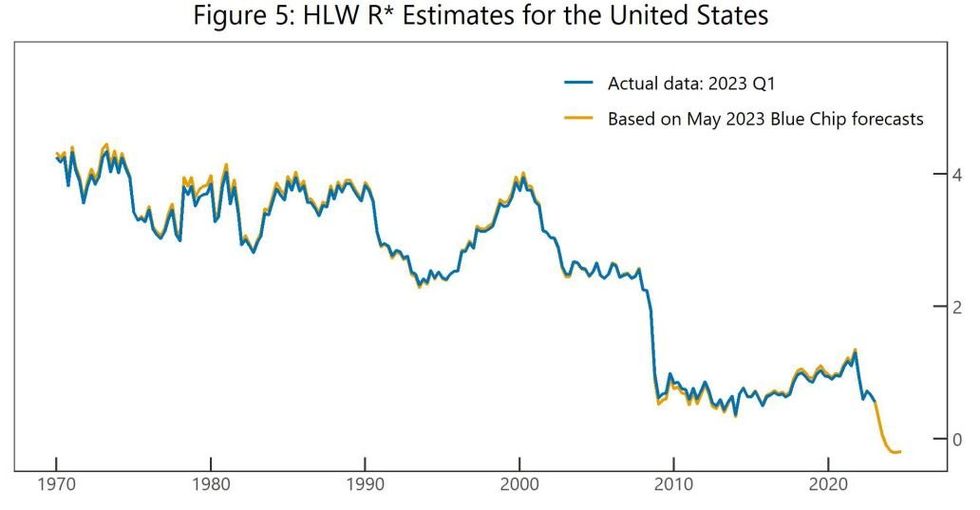

The key takeaway from NY Fed Pres Williams' speech today is his announcement that the Fed will resume publication of their r-star (real natural rate of interest) estimates which they abandoned in 2020 due to COVID shocks which threw off the model.

- While the headlines say Williams didn't comment on current monetary policy, it certainly would have been impactful if he had said his estimate of r-star had changed substantially, and thus potentially impacting where the FOMC saw longer-run Fed funds in the quarterly Dot Plot (which since mid-2019 has been 2.5% - or roughly 0.5% r-star plus 2% inflation).

- But a paper published today co-authored by Williams that updates the r-star estimate, finds that for the US/Canada/Eurozone they saw little change (within 0.2pp of the 2019 estimates).

- Williams notes that r-star for the US was about 0.5% in Q1 2023, and using private sector economic forecasts as inputs, the model indicates that it "subsequently falls to slightly below zero" in the quarters ahead. While Williams notes that the pandemic's fallout may have impacted on r-star by reducing potential output, he says the effect is modest, and "there is no evidence that the era of very low natural rates of interest has ended."

- He said in the post-speech Q&A that it's possible the r-star estimate could rise again, but this was qualified by saying this could arise from an unexpected upward productivity shock, etc, rather than anything he's seeing now. And r-star estimates "are very imprecise and subject to real-time measurement error."

- Given Williams' conclusion that no major changes to r-star is warranted for the post-pandemic era, it's doubtful any adjustments to the Dot Plot longer-run median is likely any time soon.

Source: NY Fed

Source: NY Fed

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.