-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessWon Rises On Strong CPI

USD/KRW gapped lower at the open following CPI data, last trades at 1120.75, down 3.10. The pair rose through the session yesterday and has retraced around half of the gain.

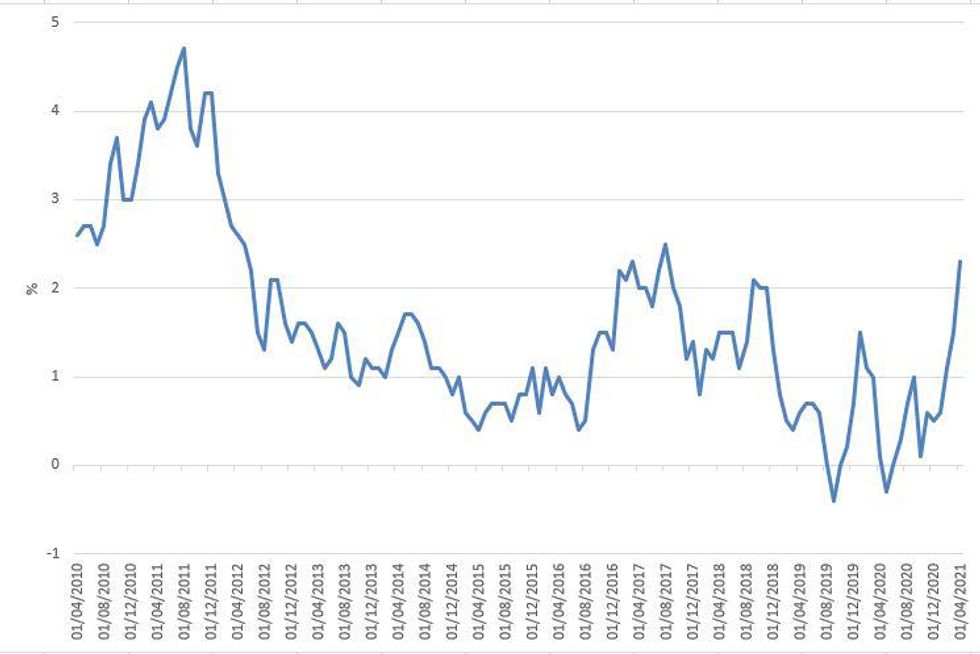

- Data pre-market showed South Korean CPI rose at the fastest pace since 2017 in April, rising 2.3% Y/Y against estimates of a 2.1% gain and faster than the 1.5% rise in March. Core CPI rose 1.4% against estimates of 1.2%. Tracking subcomponents, the increase was driven by commodity and energy prices thanks to a low base effect, while agricultural products also rose. At the April meeting BoK Governor Lee noted that inflation would hover around the bank's 2% target with the possibility of an overshoot, before slipping later in the year. The Vice Governor has said that the bank will seek to stabilize prices in Q2.

- Fig.1: South Korea CPI Y/Y

Source: MNI/Statistics Korea

Source: MNI/Statistics Korea

- The BoK will release the minutes from its April meeting at 0800BST/1600KST ahead of a market holiday in South Korea tomorrow. Markets will look to the minutes for confirmation that policy normalization is still a long way off despite possible overshoots on growth and inflation.

- On the coronavirus front South Korea reported 448 daily new virus cases,l back to the 400s as fewer people took new virus tests over the weekend with concerns over another round of the pandemic still worrisome amid a low vaccine supply. Due to worries over a potential rise in new cases amid warm weather, health authorities extend social distancing rules and a ban on private gatherings of five or more people for three more weeks until May 23.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.