-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

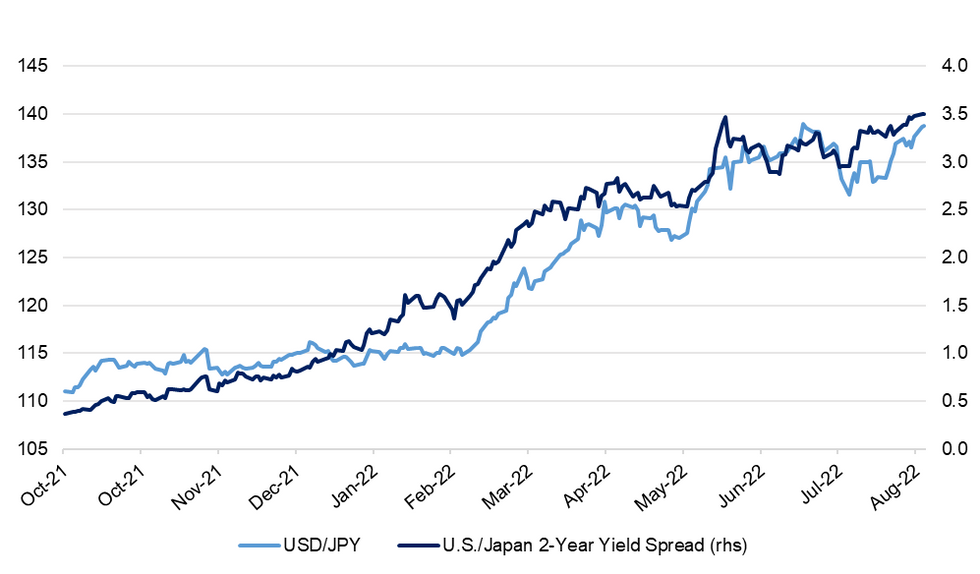

Yen Gets Beating With Monetary Policy Divergence In Spotlight

The yen got battered Monday as participants digested Fed Chair Powell's hawkish Jackson Hole speech, which drew renewed attention to interest rate spread with Japan.

- Powell's assertion that the Fed would continue to hike interest rates included in his Jackson Hole speech last Friday stood in contrast with comments delivered by his Japanese peer during the symposium. Gov Kuroda reiterated that the BoJ "have no choice other than continued monetary easing until wages and prices rise in a stable and sustainable manner."

- Negative equity sentiment failed to accentuate the yen's safe haven allure, even as benchmarks retreated and the VIX index gained. The European safe haven CHF was also softer.

- U.S. Tsy yields were wobbly but gaps with JGBs widened. 10-year spread rose ~4bp, while 2-year differential rose ~2bp. The latter gap reached its widest levels since 2007.

- USD/JPY risk reversals advanced across the curve. One-month tenor had a look above par, moving through the zero level again this morning; one-year skews showed at their best levels since 2015.

- Latest data from the CFTC showed that leveraged funds trimmed net JPY short positions by 1,779 contracts to 9,863 in the week through Aug 23. By contrast, asset managers boosted their net short positions by 29,637 contracts, the most on record, to 66,172.

- Spot USD/JPY last deals at Y138.73, little changed on the day, with bulls looking for a rally towards Jul 14 multi-year high/round figure of Y139.39/140.00. Bears look for a dip through the 50-DMA, which kicks in at Y135.89.

- On the data front, focus turns to flash industrial output, unemployment, retail sales, housing starts and consumer confidence, all due tomorrow. Later this week, capex & company profits/sales data will cross the wires Thursday.

Fig. 1: USD/JPY vs. U.S./Japan 2-Year Yield Spread (rhs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.