-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessYen Remains Under Pressure As U.S. Tsy Yields Climb

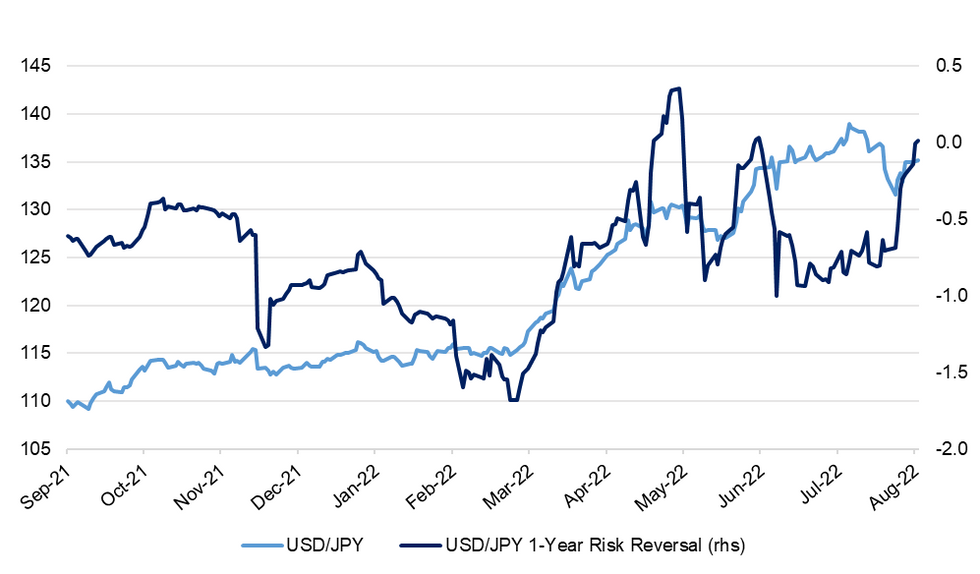

Spot USD/JPY added just 10 pips on Tuesday after recouping its modest losses registered in early Tokyo hours. The rate held a relatively tight ~50 pip range through the day, with participants were on the lookout for fresh catalysts ahead of the release of the much awaited U.S. CPI report on Wednesday.

- Even as the spot rate oscillated within a tight range, USD/JPY risk reversals kept rising across the curve, led by longer-dated skews, hitting multi-week highs. One-year tenor moved above parity for the first time since mid-June, signalling a dissipation of bullish yen sentiment among options traders.

- Worth noting that the latest CFTC Positioning Report for the week through Aug 2 showed that leveraged funds trimmed their net JPY short positions by 3,206 contracts to the least since Mar 2021. However, the expectation-busting U.S. jobs report released last Friday revived hawkish Fed bets, generating fresh headwinds for the yen.

- The Japanese currency failed to benefit from post-Asia weakness in global equity markets on Tuesday, ignoring an uptick in the VIX index. A move higher in U.S. Tsy yields took precedence, lending support to USD/JPY.

- When this is being typed, USD/JPY trades at Y135.26 after adding 20 pips as U.S. Tsys softened a tad in early Tokyo trade. From a technical perspective, a move through the 61.8% retracement of the Jul 14 - Aug 2 sell-off at Y135.96 would shift focus to Jul 27 high of Y137.46. Conversely, key initial layers of support are provided by the 100-DMA/Aug 2 low at Y131.16/130.41.

- In the absence of notable local data releases during the remainder of the day, Japan's Cabinet/LDP executive line-up reshuffle will likely steal the limelight.

Fig. 1: USD/JPY vs. USD/JPY 1-Year Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.