-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

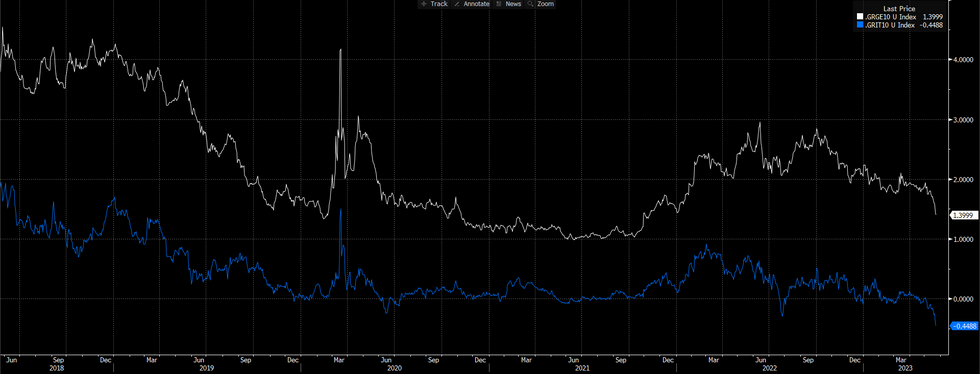

Zooming Out On Greek Spreads

Greek politics and the eventual attainment of IG status for Greece remain front and centre for GGB spreads, even during a week or so of relatively notable outright German cheapening and against the recent backdrop of hawkish ECB repricing on the OIS strip (albeit with terminal rate pricing off of April highs).

- It is hard to define clear lines in the sand re: the situation when it comes to markets, although the fresh all-time lows for Greek 10s vs. Italian paper have some suggesting that the bulk of the tightening move has run its course.

- That argument is less compelling if we get some swifter than expected action from ratings agencies if Mitsotakis can secure on outright majority in the next round of Greek elections.

- Worries surrounding TLTRO repayments on the part of Italian banks may also present further tailwinds for Greek outperformance vs. BTPs in the coming weeks.

- We also note that the 10-Year Greek/German spread is operating at levels that were last seen (on a closing basis) in ’21, showing just below 140bp as of typing. Still, these levels are over 40bp off the ‘21 (post-sovereign debt crisis) closing lows, once again suggesting further scope for tightening if Mitsotakis can secure on outright majority and ratings agencies react in a swift manner.

- We stress that such outcomes are unlikely to come via a straight-line move (if they do come to fruition at all) after the initial post-election tightening impulse wanes, and are probably contingent on swift commentary/action from ratings agencies in the event of Mitsotakis securing a majority.

Fig. 1: Greek 10-Year Spreads Vs. German & Italian Equivalents (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.