-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Yields Down, USD Up On China Lockdown Fears

EXECUTIVE SUMMARY:

- BEIJING LOCKDOWN FEARS SPARK STEEPEST CHINA MARKET ROUT IN 2 YEARS

- GERMAN IFO SEES SMALL IMPROVEMENT IN APRIL

- SPANISH FACTORY GATE INFLATION HITS RECORD

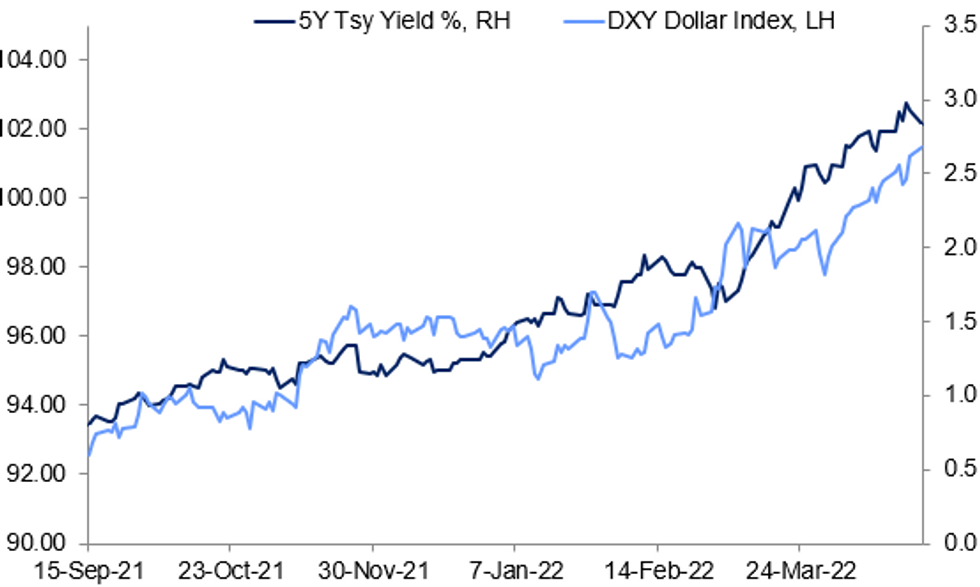

Fig. 1: Dollar Up, Yields Down

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA (RTRS): Shanghai's COVID-19 lockdown misery dragged into a fourth week, as orders on Monday for mass testing in Beijing's biggest district sparked fears that the Chinese capital could be destined for a similar fate. In their battle to stamp out the virus, authorities in Shanghai said they would reserve the harshest restrictions for smaller areas around confirmed cases, raising hopes of some respite among the millions of people currently living in strictly quarantined neighbourhoods. "Every compound, every gate, every door must be strictly managed," Qi Keping, vice-head of Shanghai's northeastern commercial district of Yangpu, told a daily news conference, describing the new, more targeted approach, and saying it would "better achieve differentiated prevention". In Beijing, all 3.45 million people living or working in Chaoyang district were ordered to have three tests this week, as authorities warned that the virus had crept into the city largely undetected during the previous week, with a few dozen cases reported.

CHINA (RTRS): China stocks plunged on Monday in their biggest slump since the pandemic-led panic-selling in February 2020, on heightened worries of a country-wide COVID-19 outbreak and fears of strict restrictions being imposed in the capital city of Beijing.The blue-chip CSI300 index fell 4.9% to close at a two-year low of 3,814.91, while the Shanghai Composite Index .SSEC tumbled 5.1% to 2,928.51 points. Both indexes have erased all gains made since Vice Premier Liu He's pledge on March 16 to support the economy and financial markets.

CHINA (RTRS): The Chinese capital Beijing reported 29 new domestically transmitted COVID-19 infections during the period of 4 p.m. (0800 GMT) April 24 TO 4 p.m. April 25, a local official said on Monday.

CHINA (BBG): China must take stronger action to boost growth above 5% in the second quarter, said a central bank adviser who warned the country needs to lay a foundation for achieving its full-year target in the face of rising economic risks. Reaching that benchmark in the April-to-June period is critical if China is to meet a government gross domestic product growth target of about 5.5% for all of 2022, said Wang Yiming, a member of the monetary policy committee of the People’s Bank of China. Wang was speaking Sunday at a forum in Beijing, according to the Securities Times.

CHINA (BBG): China’s central bank stepped up its support for several distressed developers by allowing banks and bad-debt managers to loosen restrictions on some loans to ease a cash crunch, according to people familiar with the matter. The People’s Bank of China held a meeting with about 20 major banks and asset-management firms last week to help resolve crises at a dozen large real estate firms including China Evergrande Group, the people said, asking not to be identified discussing private matters. The central bank sought looser requirements on a range of financing, from lending for property acquisitions to extending maturities on debt, the people added.

GERMANY (RTRS): The German government is set to hike its inflation forecast for this year to 6.1% due to the impact of the war in Ukraine, up from 3.3% it had forecast in January, according to government document seen by Reuters. German annual inflation rose to its highest level in more than 40 years in March as prices of natural gas and oil products soared following Russia's invasion of Ukraine and is expected to have held at that level in April as well. Berlin, which is due to present its spring economic forecasts on Wednesday, sees consumer price growth easing to 2.8% in 2023, the document showed.

UK POLITICS: The latest survey of support for Cabinet members among grassroot Conservative Party members shows both Prime Minister Boris Johnson and Chancellor of the Exchequer Rishi Sunak falling down the league table of gov't ministers. In the April survey, Johnson's popularity has declined to +6.6, from +33.1 in March. Meanwhile, Sunak has fallen to the bottom of the table on a net rating of -5.1 from +7.9 previously.

UK (BBG): Britain’s cost-of-living squeeze is starting to bite into the spending power of most parts of the country, with 43% of those who pay energy bills saying they will struggle with the costs. The same proportion said they will be unable to save over the next year as a result of a jump in household bills, the Office for National Statistics said Monday. The findings from the Opinions and Lifestyle Survey showed 87% of adults felt prices rising.

SLOVENIA POLITICS: Slovenia's legislative election on 24 April delivered a rebuke to the Central and Eastern European political trend of rising populism, with controversial Prime Minister Janesz Jansa ousted in favour of a left-leaning coalition led by businessman-turned-politician Robert Golob.Golob's liberal-green Freedom Movement (GS) entered the National Assembly with 41 out of 90 seats. Just short of an overall majority they are set to form a coalition with the centre-left Social Democrats (seven seats, down three from the 2018 election), and potentially the eco-socialist The Left on five seats (down four).

DATA:

GERMANY APR IFO BUSINESS CLIMATE +91.8

MNI: GERMANY APR IFO CURRENT ASSESSMENT 97.2; MAR 97.1r

Ifo Survey Sees Indexes Stabilising

APR IFO BUSINESS CLIMATE 91.8 (FCST 89.0); MAR 90.8

APR IFO CURRENT ASSESSMENT 97.2 (FCST 95.9); MAR 97.1r (PREV 97.0)

APR IFO EXPECTATIONS 86.7 (FCST 83.5); MAR 84.9r (PREV 85.1)

- The IFO survey saw small improvements across all three indicators in April, beating forecasts which all expected further declines of 1.6-1.8 points. The driver of these improvements was less severe pessimism.

- The business climate index rose by one point, following the initial March shock of the onset of the Ukraine war.

- Service sector business climate improved substantially, and manufacturing saw expectations improve, largely on the back of easing pandemic restrictions.

- Trade expectations remain very pessimistic and the construction industry continues to be significantly hampered by material shortages.

- Current assessment of the business climate increased by 1.2 points and expectations by 1.6 points following the record 13.3-point drop seen in March.

MNI: SPAIN MAR PPI +6.6% M/M, +46.6% Y/Y, FEB +41.2%r Y/Y

Spanish Factory-Gate Inflation at Record +46.6%

MAR PPI +6.6% M/M, +46.6% Y/Y, FEB +41.2%r Y/Y

MAR CORE PPI +13.7% Y/Y, FEB +12.3% Y/Y (1984 HIGH)

- Spanish factory-gate inflation hit new record highs in March, jumping 5.4pp to +46.6% y/y and rising by +6.6% m/m.

- On the month, energy prices rose 15.2%, followed by both intermediate goods and non-durable consumer goods by +2.8% m/m, largely due to iron and steel, chemicals and fertiliser costs. Heightened fuel prices due to the invasion of Ukraine saw substantial upticks in energy prices in Spain's MArch data.

- Core factory-gate inflation reached +13.7% y/y , with energy costs over double of 2021 at +134.6% y/y in March.

- Spain’s flash April CPI print is due Thursday, followed by the Eurozone print on Friday. Inflation in the Eurozone is running hot at 7.4%, setting a tone of urgency ahead of the June policy meeting, with July now seen as a live possibility of the first hike in rates this cycle.

Source: INE

MNI: EZ FEB CONSTRUCTION +1.9% M/M, +9.4% Y/Y; JAN +3.9% M/M

FIXED INCOME: China Covid concerns drive FI markets higher

- Core fixed income was on the front-foot through the Asian session and early European trading, but after a substantial rally and repricing of the front-end, Bunds and gilts are off their highs (although Treasuries continue to move higher).

- The moves have been driven by concerns about wider Chinese lockdowns amid rising Covid-19 cases. With China's zero Covid policies, the bars to further lockdowns (and hence more economic disruption) are much lower than in most European countries or the US. This has the impact of hitting the demand-side, particularly for commodities with oil prices down almost $5/bbl this morning. Given the sensitivity of markets to inflation developments at present, fixed income has seen some decent moves so far today.

- There is little top tier data other than the German IFO survey (which was better than expected) and with the Fed/BOE meetings next week there are no speakers other than from the ECB - Panetta is due to speak at 18:00BST / 13:00ET.

- TY1 futures are up 0-24+ today at 119-22+ with 10y UST yields down -8.6bp at 2.816% and 2y yields down -7.8bp at 2.591%.

- Bund futures are up 0.87 today at 154.12 with 10y Bund yields down -7.0bp at 0.899% and Schatz yields down -3.9bp at 0.237%.

- Gilt futures are up 0.49 today at 118.51 with 10y yields down -5.7bp at 1.904% and 2y yields down -7.0bp at 1.629%.

FOREX: Risk-Off Start Puts JPY On Top

- Markets are erring cautiously in early Monday trade, with risk proxies hit hard, while haven FX makes furtive gains. This puts JPY and the greenback at the top of the G10 table, while AUD, GBP and SEK are the poorest performers. Risk-off is also evident elsewhere, with equities weak and Treasury yields retracing sharply.

- Oil prices have taken a considerable leg lower, with Brent and WTI prices off close to 5% apiece as perceived commodities demand slips on concerns over renewed rolling lockdowns across China. Beijing is being watched carefully after reports of a COVID breakout in the city, with markets clearly worried the city will undergo similar measures to Shanghai. The worst case scenario would be a strict lockdown policy in adherence with China's COVID Zero approach, hampering economic growth that is already well below target.

- For the single currency - a relief rally on the re-election of Macron as French President was short-lived, with EUR/USD's gap higher at the open fading through Asia-Pac trade and well into the European morning. The pair's now put in a near 150 pip range so far today, keeping a number of option expiries in view for today's NY cut - most notably $1.0700(E712mln), $1.0800-03(E521mln) and $1.0825(E502mln).

- The Monday schedule is light, with few data points to digest and a quiet central bank speaker slate after the FOMC entered their pre-decision media blackout period over the weekend. As such, the highlights Monday include a speech from ECB's Panetta and an appearance from BoC's Macklem.

EQUITIES: Global Weakness After China Stocks Plunge

- Asian markets closed weaker, with Chinese stocks plunging: Japan's NIKKEI closed down 514.48 pts or -1.9% at 26590.78 and the TOPIX ended 28.63 pts lower or -1.5% at 1876.52. China's SHANGHAI closed down 158.407 pts or -5.13% at 2928.512 and the HANG SENG ended 769.18 pts lower or -3.73% at 19869.34.

- European equities are down sharply, with the German Dax down 264.68 pts or -1.87% at 13878.32, FTSE 100 down 171.69 pts or -2.28% at 7350.94, CAC 40 down 171.13 pts or -2.6% at 6411.79 and Euro Stoxx 50 down 96.65 pts or -2.52% at 3743.67.

- U.S. futures are lower, with the Dow Jones mini down 340 pts or -1.01% at 33388, S&P 500 mini down 46.5 pts or -1.09% at 4220.75, NASDAQ mini down 129.25 pts or -0.97% at 13225.25.

COMMODITIES: Oil And Copper Hit On China Covid Concerns

- WTI Crude down $5.02 or -4.92% at $97.09

- Natural Gas down $0.13 or -1.91% at $6.409

- Gold spot down $13.62 or -0.71% at $1918.28

- Copper down $11.15 or -2.42% at $449.05

- Silver down $0.39 or -1.63% at $23.7565

- Platinum down $5.64 or -0.61% at $925.64

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/04/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/04/2022 | 1500/1100 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/04/2022 | 1700/1900 |  | EU | ECB Panetta Speech at Columbia University | |

| 26/04/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.