-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPM, Sunak Fall Further In Poll Of CON Members As Pressure Mounts On Johnson

The latest survey of support for Cabinet members among grassroot Conservative Party members shows both Prime Minister Boris Johnson and Chancellor of the Exchequer Rishi Sunak falling down the league table of gov't ministers. In the April survey, Johnson's popularity has declined to +6.6, from +33.1 in March. Meanwhile, Sunak has fallen to the bottom of the table on a net rating of -5.1 from +7.9 previously.

- Conservative Home reported that much of the reasoning behind the declining ratings was not due to the impact of the 'partygate' scandal, but views among grassroot Conservative members that the Johnson gov't and Sunak's Treasury policies are 'too left wing'. This follows Sunak's poorly-recieved spring statement in March combined with a previously-announced increase in National Insurance Contributions.

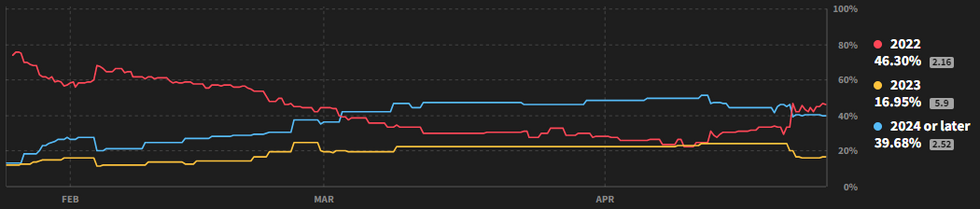

- Political betting markets have shifted further in recent days, with 2022 now viewed as the most likely year for Johnson's exit from office. An implied probability of 46.3% is assigned to Johnson leaving Downing St. this year, up from 22.7% on 10 April . according to data from Smarkets. The implied probability of Johnson lasting until 2024 or later has fallen to 39.7%, from 51.6% on 12 April.

Source: Smarkets.

Source: Smarkets.

- Should Johnson leave office/be ousted by Conservative MPs, there are few clear frontrunners. The collapse in Sunak's popularity severely damages his chances of becoming the next Conservative leader. Foreign Secretary Liz Truss (coming in second place in the ConHome table with a rating of +64.0) is the bookies favourite at present, but it is not clear whether she has widespread support among Conservative MPs. Table-topping Defence Secretary Ben Wallace (+85.0) has previously stated he would not be interested in the PM's job, but his standing among party members has soared during the course of the war in Ukraine, boosting his prospects.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.