-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Senate Confirms Brainard as Fed VC

EXECUTIVE SUMMARY

- MNI INTERVIEW: Consumers Can Take Fed Hikes - Conference Board

- MNI: UBS: Powell Likely Won’t Rule Out Future 75BP

- MNI: Russian MoD: London's Provocation Will Lead To Proportionate Response

- SENATE HAS VOTES TO CONFIRM BRAINARD AS FED VICE CHAIR, Bbg

US

FED: American consumers are likely to be able to withstand a series of larger interest rate increases from the Federal Reserve without too much pain even as they will continue to lower their expectations for the economy and cool spending in coming quarters, Conference Board economist Lynn Franco told MNI.

- "At least right now, we're not seeing any indications that would point towards a recession," she said about fresh Conference Board statistics on consumer confidence for April. "We will continue to see fluctuations, which is normal, but as long as we have strong labor market growth, we should be able to maintain these levels."

- "What we're seeing is that consumer confidence is holding relatively steady. We did see a little bit of a decline in consumers assessment of the present situation, but that still remains at a very strong level, which signals that the economic expansion is continuing," said Franco, who is director of consumer indicators and surveys at the Conference Board. For more see MNI Policy main wire at 1417ET.

FED: The FOMC will hike rates by 50bp in May and formally announce the start of QT, writes UBS. The QT announcement will include 3-month phase in period between May and July moving up to $60B and $35B respectively.

- Statement: Will keep "anticipates that ongoing increases in the target range will be appropriate"; will no longer say assessments will take into account “readings of public health”. Hawkish risk: no longer includes "supply and demand imbalances related to the pandemic" as among the reasons for the elevated inflation.

- No dissents (Bullard said 75bp not his base case).

- Press conference: The terms "expeditious" and "more neutral" will be included in Powell’s prepared remarks. Powell “may not endorse” a 75bp hike in future, “but likely will not rule it out”. He will “talk tough on inflation, and note that the 50 bp increase is another step, but does not get them to the "more neutral" stance the Committee deems appropriate.”

- Future action: Another 50bp hike in June, after which 25bp hike per meeting through 2022 (to 2.25-2.50%). QT pace slightly above $1T/year through late 2023, coming down in early 2024.

EUROPE

UK/RUSSIA: Russia's state-run RIA reporting comments attributed to the Russian Ministry of Defence stating that 'London's direct provocation of Kyiv to strike targets on Russian territory will lead to a proportional response'.

- Earlier today, UK Armed Forces Minister James Heappey stated in an interview with the BBC that it was “not necessarily a problem” if UK arms were used by Ukraine to hit Russian targets.

- Heappey: "It is completely legitimate for Ukraine to be targeting in Russia’s depth in order to disrupt the logistics that if they weren’t disrupted would directly contribute to death and carnage on Ukrainian soil”.

- The UK has been identified by Russia as a particularly 'unfriendly country', while Ukrainian President Volodymyr Zelensky has praised UK PM Boris Johnson's gov't for the support offered to Kyiv.

- Nature of Russia's 'proportional response' unknown, but could involve cyberattacks on UK gov't tech and infrastructure, a frequent weapon utilised against Moscow's adversaries.

US TSYS: Late Stock Rout Adds to Strong Risk-Off Rate Support

Rates continued to climb Tuesday, curves steeper (2s10s +4.674 at 23.449) as short end support remained strong while long end trades off midday highs after the bell, 2YY -.1212 at 2.5045%, 30YY -.0467 at 2.8417%.

- Short end support remained robust as market tamps down on market pricing in chances of 75bp hike(s), back to pricing in nearly five 50bp hikes over the next six meetings.

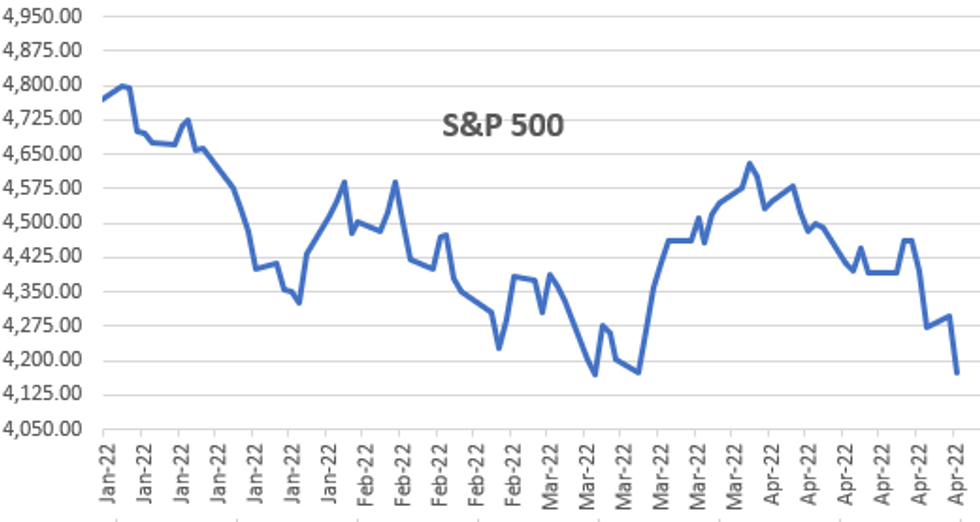

- Stocks extended rout after the bell, SPX eminis down over 3% after Alphabet Q1 EPS $24.62 Misses $26.11 Estimate, Sales $68.01B Beat $68.00B.

- Geopol risk contributing factor to FI support: Russia's state-run RIA reporting comments attributed to the Russian Ministry of Defence stating that 'London's direct provocation of Kyiv to strike targets on Russian territory will lead to a proportional response'.

- Crude rebounded as Russia moved to sever Poland from gas supplies, tit-for-tatt after Poland sanctions Gazprom among 50 Russian firms and oligarchs. WTO +3.76 in late trade at 102.30.

- Decent 2Y sale, Tsy futures holding firmer (curves steeper) after $48B 2Y note auction (91282CEK3) stops through: 2.585% high yield vs. 2.595% WI; 2.74x bid-to-cover surge vs. last moth's 2.46x.

- After the bell, the 2-Yr yield is down 8.1bps at 2.5443%, 5-Yr is down 6.4bps at 2.7954%, 10-Yr is down 5bps at 2.7701%, and 30-Yr is down 2.3bps at 2.8654%.

OVERNIGHT DATA

- US MAR DURABLE NEW ORDERS +0.8%; EX-TRANSPORTATION +1.1%

- US FEB DURABLE GDS NEW ORDERS REV TO -1.7%

- US MAR NONDEF CAP GDS ORDERS EX-AIR +1.0% V FEB -0.3%

- US APR PHILADELPHIA FED NONMFG INDEX 29.3

- US REDBOOK: APR STORE SALES +13.7% V YR AGO MO

- US REDBOOK: STORE SALES +12.7% WK ENDED APR 23 V YR AGO WK

February reading of the Case/Shiller Home Price Index is 20.20% year on year and +2.39% on a seasonally adjusted monthly basis. The Index was expected to be +19.20% on the year and +1.50% on the month.

- US MAR NEW HOME SALES -8.6% TO 0.763M SAAR

- US FEB NEW HOME SALES REVISED TO 0.835M SAAR

- U.S. APRIL CONSUMER CONFIDENCE AT 107.3; EST. 108.2

- U.S. APRIL RICHMOND FED FACTORY INDEX AT 14

- CANADA FLASH MARCH FACTORY SALES +1.7%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 558.84 points (-1.64%) at 33491.57

- S&P E-Mini Future down 80.5 points (-1.88%) at 4211.75

- Nasdaq down 351.2 points (-2.7%) at 12653.4

- US 10-Yr yield is down 5.2 bps at 2.7682%

- US Jun 10Y are up 14/32 at 120-1.5

- EURUSD down 0.0069 (-0.64%) at 1.0644

- USDJPY down 0.56 (-0.44%) at 127.57

- WTI Crude Oil (front-month) up $3.01 (3.05%) at $101.51

- Gold is up $0.7 (0.04%) at $1898.73

- EuroStoxx 50 down 36.23 points (-0.96%) at 3721.36

- FTSE 100 up 5.65 points (0.08%) at 7386.19

- German DAX down 167.77 points (-1.2%) at 13756.4

- French CAC 40 down 34.81 points (-0.54%) at 6414.57

US TSY FUTURES CLOSE

- 3M10Y -7.521, 190.9 (L: 184.215 / H: 196.131)

- 2Y10Y +3.786, 22.561 (L: 17.55 / H: 23.227)

- 2Y30Y +6.429, 32.071 (L: 23.739 / H: 32.655)

- 5Y30Y +4.063, 6.663 (L: 0.142 / H: 8.499)

- Current futures levels:

- Jun 2Y up 5.125/32 at 105-19.875 (L: 105-12.375 / H: 105-22)

- Jun 5Y up 11/32 at 113-7 (L: 112-19.25 / H: 113-12.75)

- Jun 10Y up 14/32 at 120-1.5 (L: 119-07.5 / H: 120-13)

- Jun 30Y up 28/32 at 142-13 (L: 141-00 / H: 143-09)

- Jun Ultra 30Y up 22/32 at 163-5 (L: 161-20 / H: 164-19)

US 10Y FUTURES TECH: (M2) Bounce Considered Corrective

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 120-21/121-09 20-day EMA / High Apr 14 and key resistance

- RES 1: 120-13 High Apr 26

- PRICE: 120-01+ @ 1445ET Apr 26

- SUP 1: 118-08 Low Apr 22

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

No change in the trend direction in Treasuries. Gains are considered corrective and the primary downtrend remains intact. Fresh cycle lows last week confirmed a resumption of the primary bear cycle and an extension of the price sequence of lower lows and lower highs. Moving average studies continue to point south. A resumption of the trend would open 118-02+ next, a Fibonacci projection. Initial firm resistance is at 121-09.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.025 at 98.140

- Sep 22 +0.040 at 97.365

- Dec 22 +0.050 at 96.945

- Mar 23 +0.080 at 96.740

- Red Pack (Jun 23-Mar 24) +0.110 to +0.120

- Green Pack (Jun 24-Mar 25) +0.055 to +0.10

- Blue Pack (Jun 25-Mar 26) +0.005 to +0.040

- Gold Pack (Jun 26-Mar 27) +0.005 to +0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00029 to 0.33014% (+0.00371/wk)

- 1M +0.05071 to 0.74871% (+0.04528/wk)

- 3M +0.01328 to 1.23814% (+0.02443/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.00900 to 1.82771% (+0.00400/wk)

- 12M -0.00542 to 2.54629% (-0.06042/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $273B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $898B

- Broad General Collateral Rate (BGCR): 0.30%, $342B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

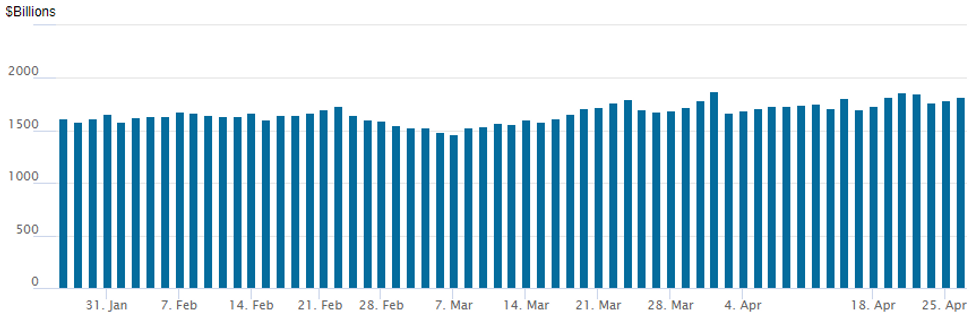

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,819.343B w/ 84 counterparties from prior session 1,783.609B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $1.2B Cintas Corp Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/26 $1.3B #Anthem Inc $600M 10Y +135, $700M 30Y +170

- 04/26 $1.2B #Cintas Corp $400M 3Y +75, $800M 10Y +125

- 04/26 $1B *Kommuninvest 3Y SOFR+25

- 04/26 $800M #SVB Fncl $350M 6NC5 +155, $450M 11NC10 +180

- 04/26 $500M Development Bank of Kazakhstan 3Y

- 04/25 $Benchmark ST Engineering 5Y +100a, 10Y +135a

- 04/25 $Benchmark American Express investor calls

- No new issuance Monday

- 04/25 $Benchmark Cintas Corp investor calls

EGBs-GILTS CASH CLOSE: Gilts Outperform, GGBs Come Back

In another generally risk-off session Tuesday, Gilts outperformed Bunds - particularly at the short end in another bull flattening move.

- Short-end core FI yields jerked to session lows in late afternoon on headlines that Russia had halted gas supplies to Poland.

- Greece was a standout mover, with spreads reversing from ~16bp wider to Bunds (punctuated by a 5Y syndication announcement) down to just above 4bp by the close.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 0.1bps at 0.147%, 5-Yr is down 1.5bps at 0.574%, 10-Yr is down 2.3bps at 0.814%, and 30-Yr is down 3bps at 0.955%.

- UK: The 2-Yr yield is down 5.2bps at 1.501%, 5-Yr is down 4.8bps at 1.577%, 10-Yr is down 4.4bps at 1.797%, and 30-Yr is down 4.2bps at 1.905%.

- Italian BTP spread up 0.1bps at 174bps / Greek up 4.3bps at 217.9bps

FOREX: Risk-Off Boosts Greenback, GBPUSD Extends Declines Below 1.2600

- Despite the late Monday rally on Wall Street, a broad risk-off feel remains present in markets, with core yields off their highs and equity indices reversing course to within close proximity of Monday’s poorest levels.

- This price action in bond and equity markets has continued to see market participants flock to both the US dollar and the Japanese Yen with the DXY rising 0.52% and extending its impressive rally above 102.

- Monday’s pullback in EURJPY suggests the cross has entered a corrective phase. Further weakness during today’s session (-1.01%) saw the pair breach support at 136.35, the 20-day EMA, signalling scope for a deeper pullback. This could expose key trend support at 134.36, Apr 8 low.

- Euro and GBP weakness is prevailing approaching the APAC crossover with EUR/USD edging ever closer to the intra-day 1.0642 low as well as looking susceptible to key support at the 2020 low of 1.0636.

- A break below there would mark a five year low for the pair with support moving down to 1.0496, the 0.764 projection of the Feb 10 - Mar 7 - 31 price swing.

- GBPUSD also continues its downward slide, exacerbated by the breach of the September 2020 lows at 1.2676 and most recently breaching the 1.26 mark, down 1.1% on Tuesday. Support for cable moves down to 1.2495, the 61.8% retracement of the Mar 2020 - Jan 21 bull leg.

- The overnight session will focus on Australian CPI before a particularly light global data calendar ahead of Thursday’s Bank of Japan April meeting.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 27/04/2022 | 0130/1130 | *** |  | AU | CPI inflation |

| 27/04/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 27/04/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/04/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/04/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/04/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.