-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: FI Well Bid as SPX Drops 3%

US TSYS: Late Stock Rout Adds to Strong Risk-Off Rate Support

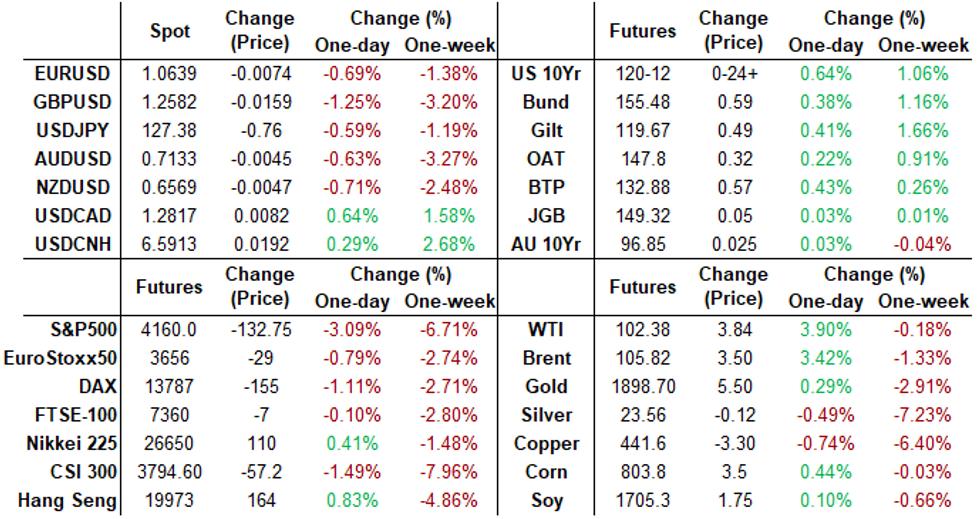

Rates continued to climb Tuesday, curves steeper (2s10s +4.674 at 23.449) as short end support remained strong while long end trades off midday highs after the bell, 2YY -.1212 at 2.5045%, 30YY -.0467 at 2.8417%.

- Short end support remained robust as market tamps down on market pricing in chances of 75bp hike(s), back to pricing in nearly five 50bp hikes over the next six meetings.

- Stocks extended rout after the bell, SPX eminis down over 3% after Alphabet Q1 EPS $24.62 Misses $26.11 Estimate, Sales $68.01B Beat $68.00B.

- Geopol risk contributing factor to FI support: Russia's state-run RIA reporting comments attributed to the Russian Ministry of Defence stating that 'London's direct provocation of Kyiv to strike targets on Russian territory will lead to a proportional response'.

- Crude rebounded as Russia moved to sever Poland from gas supplies, tit-for-tatt after Poland sanctions Gazprom among 50 Russian firms and oligarchs. WTO +3.76 in late trade at 102.30.

- Decent 2Y sale, Tsy futures holding firmer (curves steeper) after $48B 2Y note auction (91282CEK3) stops through: 2.585% high yield vs. 2.595% WI; 2.74x bid-to-cover surge vs. last moth's 2.46x.

- After the bell, the 2-Yr yield is down 8.1bps at 2.5443%, 5-Yr is down 6.4bps at 2.7954%, 10-Yr is down 5bps at 2.7701%, and 30-Yr is down 2.3bps at 2.8654%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00029 to 0.33014% (+0.00371/wk)

- 1M +0.05071 to 0.74871% (+0.04528/wk)

- 3M +0.01328 to 1.23814% (+0.02443/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.00900 to 1.82771% (+0.00400/wk)

- 12M -0.00542 to 2.54629% (-0.06042/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $273B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $898B

- Broad General Collateral Rate (BGCR): 0.30%, $342B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

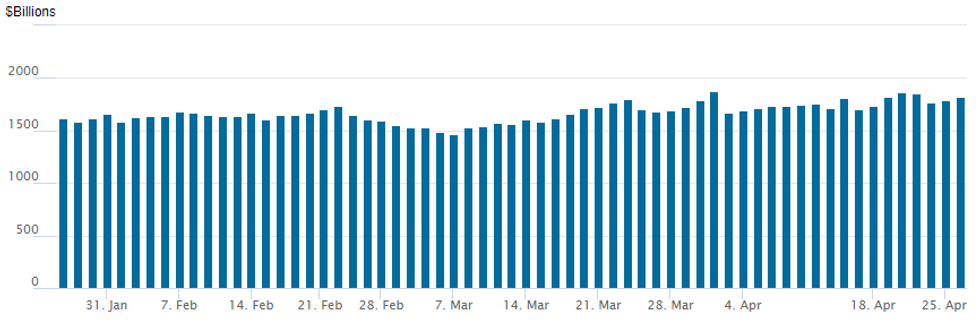

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,819.343B w/ 84 counterparties from prior session 1,783.609B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option theme pivoted to better put buying Tuesday, bucking the recent trend in buying low delta calls as pace of rally in underlying starts to slow. Eurodollar and Tsy futures surged in early trade, scaled back support in the second half, some put buyers looking for the primary downtrend to resume.- That said, short end support remained robust as market tamps down on market pricing in chances of 75bp hike(s), back to pricing in nearly five 50bp hikes over the next six meetings.

- Update, +15,000 Sep 96.25 puts, 6.5 screen/pit

- +10,000 Jun/Dec 99.75 call calendar spd, 0.5

- +2,500 Dec 97.75/98.00 call spds

- Overnight trade

- 4,000 short May 96.25/96.37/96.50 put flys

- Block, 5,000 Jun 98.00/98.12/98.25 put flys, 2.5

- -4,000 Dec 99.62 puts, 15.5 ref 96.925

- 6,000 FVM 112.5/114 strangles, 46.5

- 2,000 TYM/TYN 116 put calendar spds

- 3,000 TYM 130.75 calls, 2

- 1,500 TYM 118.25/119/119.25/120.25 put condors

- 5,000 USM 134/136/138/140 put condors 16

- 5,000 TYM 129.75 calls , 2

- 4,000 TYM 122.25 calls, 20

- 2,000 TYN 112/115/118 put flys

- Overnight trade

- +5,000 USM 134/138 put spds, 32 ref 142-03

- +9,000 wk5 TY 117.5/118 put spds, 2 vs. 119-20.5 to -21.5/0.04%

- +5,000 FVM 111.5/112 put spds, 8 vs. 112-28.75/0.09%

EGBs-GILTS CASH CLOSE: Gilts Outperform, GGBs Come Back

In another generally risk-off session Tuesday, Gilts outperformed Bunds - particularly at the short end in another bull flattening move.

- Short-end core FI yields jerked to session lows in late afternoon on headlines that Russia had halted gas supplies to Poland.

- Greece was a standout mover, with spreads reversing from ~16bp wider to Bunds (punctuated by a 5Y syndication announcement) down to just above 4bp by the close.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 0.1bps at 0.147%, 5-Yr is down 1.5bps at 0.574%, 10-Yr is down 2.3bps at 0.814%, and 30-Yr is down 3bps at 0.955%.

- UK: The 2-Yr yield is down 5.2bps at 1.501%, 5-Yr is down 4.8bps at 1.577%, 10-Yr is down 4.4bps at 1.797%, and 30-Yr is down 4.2bps at 1.905%.

- Italian BTP spread up 0.1bps at 174bps / Greek up 4.3bps at 217.9bps

EGB Options: Bund / Bobl Upside Plays (And Short Cover)

Tuesday's Europe rates / bond options flow included:

- RXM2 156.50/158cs, bought for 45 in 1k

- RXM2 159/161cs, bought for 21/22 in 2k

- RXM2 156.50/157.50/158.00 broken c fly, bought for 21 and 21 in 1.75k

- OEM2 128.5/129.5cs 1x2, bought for 6 and 6.5 in 2k

- OEM2 131.25 calls, bought for 4.5 in 7k (said to be a short cover)

- 0RZ2 99.00/99.25/99.50 call fly, bought for 2 in 2k

- SFIK2 98.55/65/70/90 broken call condor vs 70/90cs, bought for 4.5 in 2.5k

- SFIK2 98.55/65/70/90 broken call Condor vs 30/10ps, bought for 4 in 6k

FOREX: Risk-Off Boosts Greenback, GBPUSD Extends Declines Below 1.2600

- Despite the late Monday rally on Wall Street, a broad risk-off feel remains present in markets, with core yields off their highs and equity indices reversing course to within close proximity of Monday’s poorest levels.

- This price action in bond and equity markets has continued to see market participants flock to both the US dollar and the Japanese Yen with the DXY rising 0.52% and extending its impressive rally above 102.

- Monday’s pullback in EURJPY suggests the cross has entered a corrective phase. Further weakness during today’s session (-1.01%) saw the pair breach support at 136.35, the 20-day EMA, signalling scope for a deeper pullback. This could expose key trend support at 134.36, Apr 8 low.

- Euro and GBP weakness is prevailing approaching the APAC crossover with EUR/USD edging ever closer to the intra-day 1.0642 low as well as looking susceptible to key support at the 2020 low of 1.0636.

- A break below there would mark a five year low for the pair with support moving down to 1.0496, the 0.764 projection of the Feb 10 - Mar 7 - 31 price swing.

- GBPUSD also continues its downward slide, exacerbated by the breach of the September 2020 lows at 1.2676 and most recently breaching the 1.26 mark, down 1.1% on Tuesday. Support for cable moves down to 1.2495, the 61.8% retracement of the Mar 2020 - Jan 21 bull leg.

- The overnight session will focus on Australian CPI before a particularly light global data calendar ahead of Thursday’s Bank of Japan April meeting.

FX: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.2bln), $1.0700-10(E1.0bln), $1.0800(E1.5bln), $1.0900(E1.4bln)

- USD/JPY: Y126.75($540mln)

- GBP/USD: $1.2900(Gbp1.1bln)

- AUD/USD: $0.7450(A$1.9bln)

- NZD/USD: $0.6735(N$1.4bln), $0.6835(N$1.8bln)

- USD/CNY: Cny6.5000($700mln)

Late Equity Roundup: Rout Resumes, SPX -2.5%

Late sell-off in SPX eminis accelerated late Tuesday, ESM2 -110.5 to 4182.0, through key support (4195.25 Low Apr 25) on new low for April and putting the index back to mid-March levels.

- Incidentally, CBOE's vol index VIX surged to 32.01 in late trade, 31.71 +4.69 at the moment, back to mid-March levels after tapping year high of 36.45 on March 7. The surge in vol coincided with stocks trading lows for the year (ESM2 4160.50 on March 8).

- Attention on next key support level of 4129.50 Low Mar 15. Recent weakness has confirmed a resumption of the current downtrend and the outlook remains bearish.

- Earnings after the close: GM, GOOGL, MSFT, TXN, V.

- SPX leading/lagging sectors: Modest rebound for Energy sector (+0.35%) after heavy pressure Mon after crude fell. Tue crude bounce tied to Russia intent to cease gas supply to Poland.

- Laggers: Consumer Discretionary extends decline (-4.46%) weighed down by autos -- with particular focus on Tesla (-11.00% to 888.24) selling off after Musk's intent to buy Twitter for appr $44B accepted by the board.

- Meanwhile, Dow Industrials currently trades -725.8 points (-2.13%) at 33324.31, Nasdaq -465.7 points (-3.6%) at 12540.18.

- Dow Industrials Leaders/Laggers: Walgreens/Boots, Dow Inc and Chevron outperform (selling off the least). Laggers: Microsoft -9.07 at 271.65, Boeing -8.69 at 167.22.

- RES 4: 4631.00 High Mar 29 and key resistance

- RES 3: 4588.75 High Apr 5

- RES 2: 4509.00 High Apr 21 and a key short-term resistance

- RES 1: 4355.50 Low Apr 18

- PRICE: 4175.00 @ 1600ET Apr 26

- SUP 1: 4171.25 Low Apr 26

- SUP 2: 4129.50 Low Mar 15 and a key support

- SUP 3: 4094.25 Low Feb 24 and a bear trigger

- SUP 4: 4063.24 1.618 proj of the Mar 29 - Apr 18 - 21 price swing

COMMODITIES: Russia To Halt Gas To Poland In Latest Supply Side Flare Up

- Oil prices have been supported today first by PBOC measures to bolster demand and then a ratcheting up of supply tensions more generally from events in Transdniestria before headlines of Russia moving to cease gas supply to Poland.

- TTF natural gas closed +11%, with the significant escalation driven by PGNIG confirming it won’t pay in rubles.

- WTI is +3.8% at $102.28, sticking with yesterday’s range as it moves closer to initial resistance at $105.42 (Apr 21 high). The most active strikes in CLM2 have been $90/bbl puts.

- Brent is +3.1% at $105.51, also within yesterday’s range and again not yet troubling resistance at $109.80.

- Gold is only +0.1% at $1898.7 in a particularly steady session after sliding heavily the past two sessions. It continues to hover above support at the bear trigger of $1890.2 whilst resistance is the 20-day EMA of $1945.1.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 27/04/2022 | 0130/1130 | *** |  | AU | CPI inflation |

| 27/04/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 27/04/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/04/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/04/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/04/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.