-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI US OPEN: Yen Weakness Persists

EXECUTIVE SUMMARY:

- SWEDEN RIKSBANK HIKES 25BP, FRONT-LOADS TIGHTENING

- MNI STATE OF PLAY: BOJ EASY POLICY TO SHOULDER PAST WEAKER YEN

- JAPAN MOF OFFICIAL: WILL RESPOND APPROPRIATELY ON FX IF NEEDED

- GERMAN STATE INFLATION DATA SUGGESTS UPSIDE RISK TO NATIONAL READING

- META SHARES JUMP, ACCOUNT FOR 1/3 OF NASDAQ FUTURES GAINS

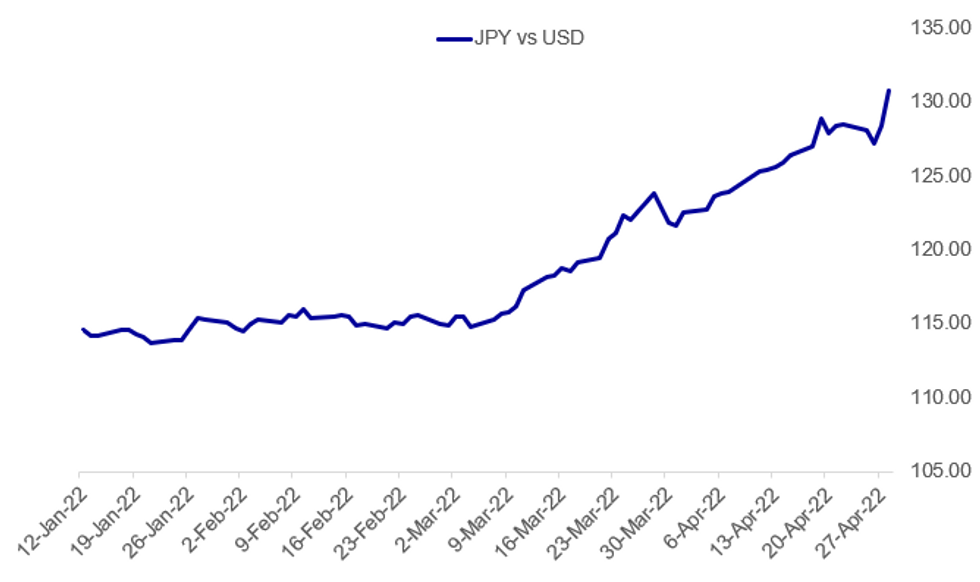

Fig. 1: Yen Continues To Weaken Post-BOJ

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RIKSBANK: The Riksbank hiked by 25 basis points to 0.25% Thursday, publishing a collective forward rate path showing a high probability of three more hikes this year and two more in 2023. The path showed the board planning to front-load tightening in response to the inflation shock. The repo rate -- to be renamed the policy rate from June -- was shown rising swiftly to 1.18% by the second quarter of 2022, with the rate path on MNI calculations showing a June hike fully priced in and a high probability of 25 basis point hikes at each subsequent meeting this year, with the Riksbank stating that there were likely to be two or three more hikes in 2022. The board also announced a slowing of asset purchases, Inflation is expected to fall back in 2023 and to be close to the 2.0% target from 2024.

BOJ (MNI STATE OF PLAY): The Bank of Japan made it clear on Thursday that achieving the 2% price target will not be hindered by a weaker yen, although the negative impact of a softer currency on the economy is a concern, MNI understands. Despite the weaker yen, the BOJ decided to maintain its easy policy and leftits easing bias of monetary policy in the forward guidance unchanged as expected. For full article contact sales@marketnews.com

JPY: Headlines crossing on BBG as MNIUS Open is published:

- JAPAN MOF OFFICIAL: RECENT FX MOVES WARRANT EXTREME CONCERN

- JAPAN MOF OFFICIAL: WILL RESPOND APPROPRIATELY ON FX IF NEEDED

GERMAN INFLATION (MNI): Looking at the German regional inflation prints so far we have three around the consensus for the national print of 0.5%M/M. We have also had two high prints (Saxony at 1.0%M/M and earlier this morning BW at 1.2%M/M). This probably points to some upside risks to the national number later, but it's hardly cut and dry.

US EQUITIES (BBG): Facebook parent Meta Platforms Inc. is fueling gains in Nasdaq 100 futures as it surged in premarket trading after the social network added more users than projected. Nasdaq 100 futures climbed 2.2% as of 4:07 a.m. in New York, halting a two-day decline. S&P 500 futures rose 1.5% and Dow Jones futures added 0.9%. China’s pledge to support its economy and promote the growth of internet platform firms also boosted equities globally. Shares of Meta Platforms jumped as much as 19% in U.S. premarket trading after Facebook’s main social network added more users than projected in the first quarter. Meta has a 3% weighting in the Nasdaq 100 and a 1.1% weighting in the S&P 500. The move accounts for about one-third of the total Nasdaq futures gains today, according to Bloomberg calculations.

RUSSIA (RTRS): Russia sees recent incidents in Moldova's breakaway region of Transdniestria as an attempt to drag it into the wider conflict in Ukraine, Foreign Ministry spokesperson Maria Zakharova said on Thursday. Tensions have been rising in Transdniestria, a Russia-backed region that borders Ukraine, after local authorities said it had been subject to several attacks.

BOE (MNI INSIGHT): Supply chain disruptions have been a recurrent factor in the global economy since the Covid pandemic began, but central bank models still fail to accommodate them, with the Bank of England likely to refer to the potential impact of China’s spreading lockdowns as merely risks around its central forecasts in its May Monetary Policy Report. For full article contact sales@marketnews.com

TURKEY (RTRS): Turkey's central bank said on Thursday that it sees annual inflation peaking around 70% by June before declining to near 43% by year-end, almost double its previous forecast, after the consumer price index soared to a two-decade high.

DATA:

MNI: BADEN-WUE APR CPI +1.2% M/M, +7.0% Y/Y; MAR +6.3% Y/Y

MNI: BAVARIA APR CPI +0.4% M/M, +7.5% Y/Y; MAR +7.8% Y/Y

MNI: SAXONY APR CPI +1.0% M/M, +7.2% Y/Y; MAR +7.0% Y/Y

MNI: SPAIN FLASH APR HICP -0.2% M/M , +8.3% Y/Y; MAR +9.8%

Headline Inflation Slows, Core Picks Up

FLASH APR HICP -0.2% M/M , +8.3% Y/Y; MAR +9.8%

FLASH APR CPI -0.1% M/M, +8.4% Y/Y; MAR +9.8%

FLASH APR CORE CPI +4.4% Y/Y; MAR +3.4%

- Spanish harmonised CPI fell back 1.5pp in the flash April meeting, substantially more than the decline to +9.0% y/y anticipated by consensus however within the range MNI expected.

- HICP fell on the month, contracting by a modest -0.2% m/m.

- A decrease in energy and fuel costs due to state intervention is the key downwards driver in this data, food prices continued to accelerate.

- Core CPI continued to climb, accelerating by one point to +4.4% y/y and reaching the highest level since 1995.

Source: INE

MNI: ITALY APR CONSUMER CONFIDENCE INDEX 100.0 VS MAR 100.8

MNI: ITALY APR SA MANUFACTURING MORALE 110.0 VS MAR 110.1

FIXED INCOME: Core FI a little lower this morning

- After some strength early in the European morning session, particularly for Bunds, on the back of a softer-than-expected Spanish inflation print, we have seen core fixed income reverse its gains and is now marginally lower than yesterday's closing levels.

- The other notable data this morning has seen some regional German CPI prints. 3/5 have been roughly in line and two higher than the consensus for the national print which is due out at 13:00BST / 8:00ET.

- Outside of European inflation prints, focus will be on the first print of US GDP for Q1. Consensus looks for a 1.0% print with most estimates in the range of 0.0-1.5%.

- TY1 futures are down -0-0+ today at 119-25 with 10y UST yields down -1.1bp at 2.823% and 2y yields down -0.8bp at 2.585%.

- Bund futures are down -0.16 today at 155.30 with 10y Bund yields up 1.8bp at 0.817% and Schatz yields up 2.4bp at 0.117%.

- Gilt futures are down -0.15 today at 119.27 with 10y yields up 2.0bp at 1.830% and 2y yields up 2.5bp at 1.507%.

FOREX: USD/JPY Through Y130 as BoJ Give The All Clear

- The Bank of Japan overnight gave the greenlight for further JPY weakness, as the board reinforced their message that yield curve control will be in place until the economy enters a sustainable recovery. This keeps the BoJ committed to easing policy going forward - running a starker contrast with Fed ahead of next week's FOMC decision.

- The market response was to run USD/JPY through Y130.00 and to new cycle highs of Y130.96. The next upside level to watch in the pair crosses at the 131.96 mark - the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing. Needless to say, JPY is comfortably the poorest performer in G10.

- At the other end of the table, SEK is rallying as the Riksbank went against consensus and lifted interest rates to 0.25%. Furthermore, the repo rate projections outline a bank that now looks certain to hike further in June, with strong possibilities of further hikes in September, November as well as February next year. EUR/SEK extended its two-day decline, taking out the 200-dma support at 10.2793 in the process.

- The Fed and Bank of England remain in their pre-rate decision blackout periods, meaning Thursday will likely be a quiet session for central bank speak - keeping focus on the recent market volatility and - in particular - the run higher in the dollar.

- National German CPI data follows later today, as well as weekly jobless claims from the US and the advanced reading of Q1 GDP.

EQUITIES: Tech Leading US Gains

- Asian markets closed higher: Japan's NIKKEI closed up 461.27 pts or +1.75% at 26847.9 and the TOPIX ended 38.86 pts higher or +2.09% at 1899.62. China's SHANGHAI closed up 17.203 pts or +0.58% at 2975.485 and the HANG SENG ended 329.81 pts higher or +1.65% at 20276.17.

- European equities are rebounding, with the German Dax up 270.31 pts or +1.96% at 14063.81, FTSE 100 up 60.56 pts or +0.82% at 7486.77, CAC 40 up 121.67 pts or +1.89% at 6568.25 and Euro Stoxx 50 up 70.77 pts or +1.9% at 3805.39.

- U.S. futures are higher, led by tech (amid a busy tech earnings schedule), with the Dow Jones mini up 368 pts or +1.11% at 33594, S&P 500 mini up 72 pts or +1.72% at 4252.25, NASDAQ mini up 302 pts or +2.32% at 13310.75.

COMMODITIES: Oil Inches Higher

- WTI Crude up $0.81 or +0.79% at $102.81

- Natural Gas up $0.01 or +0.08% at $7.342

- Gold spot up $1.51 or +0.08% at $1887.52

- Copper up $0.25 or +0.06% at $447.5

- Silver down $0.04 or -0.18% at $23.257

- Platinum up $10.35 or +1.12% at $930.59

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/04/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/04/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/04/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 29/04/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/04/2022 | 0645/0845 | ** |  | FR | PPI |

| 29/04/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/04/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/04/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.