May 23, 2024 13:55 GMT

A Large Services-Led Beat For Flash PMIs

US DATA

Metals bulletEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsEnergy BulletsBulletMarketsFixed Income BulletsForeign Exchange Bullets

- The S&P Global US PMIs saw a large upside surprise in the flash May release, indicating its sharpest growth for just over two years, driven by services.

- Manufacturing: 50.9 (cons 49.9) after 50.0

- Services: 54.8 (cons 51.2) after 51.3

- Composite: 54.4 (cons 51.2) after 51.3

- Further details from the press release: "Although companies continued to report lower employment, the rate of job losses moderated amid improved business confidence for the year ahead and higher order book intakes."

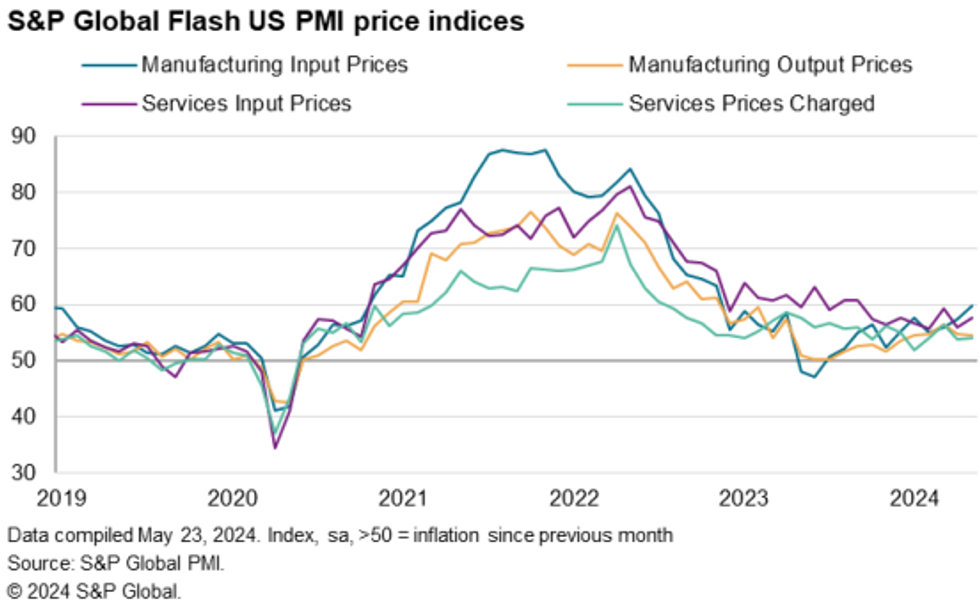

- "Both input costs and output prices meanwhile rose at faster rates, with manufacturing having taken over as the main source of price growth over the past two months. However, the overall rate of selling price inflation remained below the average seen over the past year"

- “Companies again sought to pass higher costs onto customers in the form of higher selling prices, the rate of increase of which accelerated slightly compared to April. However, although still elevated by pre-pandemic standards, the rate of inflation across both goods and services remained below the average recorded over the past year.”

Source: S&P Global

Source: S&P Global

186 words