-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Labor Market Cools/Continuing Claims 3+Y High

MNI ASIA MARKETS ANALYSIS: Tsys Buoyed, Strong 7Y Sale

US$ Credit Supply Pipeline: 2024 Supply Best Since 2020

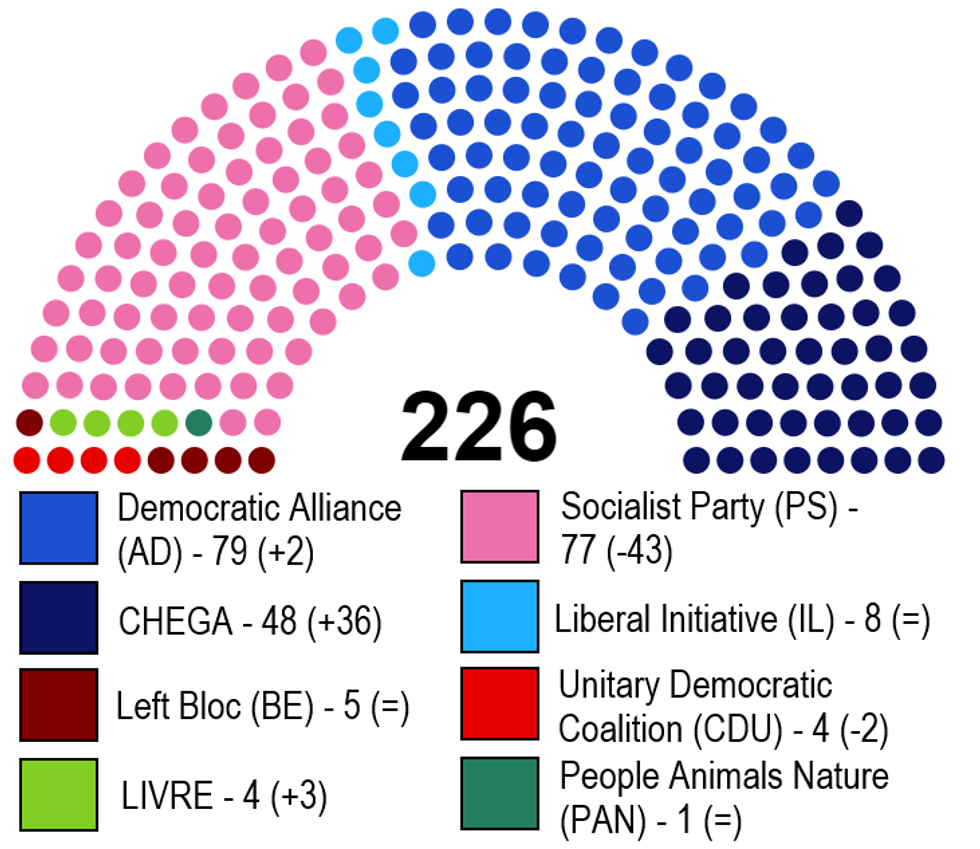

AD Claims Victory, Faces Tough Challenge In Securing Support To Govern

The centre-right Democratic Alliance (AD) won a plurality in Portugal's 10 March general election, but now faces a difficult challenge in winning a confidence vote in the Assembly of the Republic having fallen well short of a majority. AD leader Luis Montenegro's options will be to rely on the support either of the incumbent centre-left Socialist Party (PS) or the right-wing CHEGA (Enough) in a confidence and supply agreement.

- With 99.01% of votes counted, of the 230 seats in the Assembly the AD (an alliance of three centre-right parties) won 79 seats, up two on the previous election in 2022. The PS is on 77 (down 43), while Chega is the big winner of the election with its seat total up to 48 from 12 previously.

- As the vote count continued through the night, Montenegro claimed that his party would not work or do a deal with CHEGA in order to take power. However, this stance could come under significant pressure in the days and weeks ahead. The right of his party is likely to pressure Montenegro to seek support from CHEGA in a confidence vote required to form a gov't, rather than relying on the PS.

- There remains the prospect of a period of political uncertainty as efforts are made to feel out parties on both sides of the political spectrum. An emergingwar of words between CHEGA leader Andre Ventura and President Marcelo Rebelo de Sousa risks further divisions.

Source: Interior Ministry, MNI

Source: Interior Ministry, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.