-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessAn Overview Of The Outlook For Japanese Investors Post-BoJ

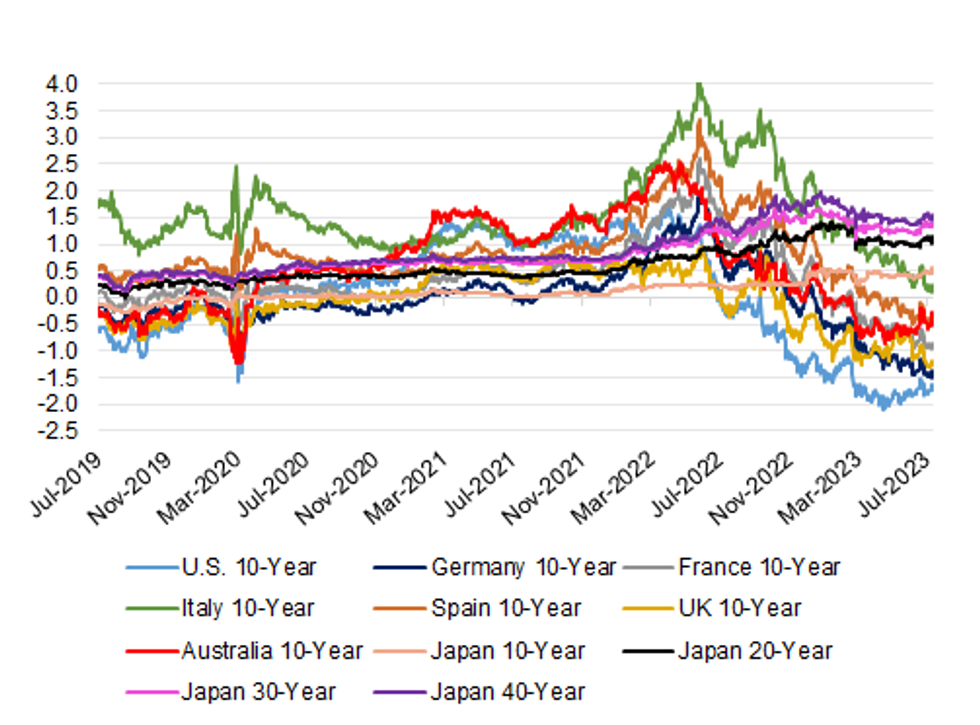

We have covered the prohibitive FX-hedged yield levels of global bonds from the perspective of Japanese investors on numerous occasions in the past.

This hasn’t stopped Japanese participants from deploying capital into foreign bond markets since the turn of the Japanese fiscal year (start of April), with a net Y2.3tn of foreign paper purchased between then and last Friday, per the weekly data from the Japanese MoF.

- A quick look at the Japanese current account data (which is only available through the end of May), reveals a bias towards U.S., French & Australian bond purchases (Japan is the largest offshore U.S. Tsy holder) through first couple of months of the FY, while small purchases of UK bonds were also noted. Elsewhere, Japan shed both German & Italian bonds in that 2-month window, allowing the dominance of French paper in their European portfolio to extend further.

- Owing to the prohibitive level of the FX-hedged yields vs. the long end of the domestic JGB curve, we would suggest that the bulk of these purchases were made in FX-unhedged terms.

- Some have flagged worry that the well-documented BoJ monetary policy tweak delivered overnight could result in further JPY strength, triggering sales of FX-unhedged offshore bond positions on the part of Japanese investors, although sell-side names have generally played that idea down, owing to the perception that the Fed & ECB are at/near terminal rate levels, which could trigger outright bond gains, incentivising Japanese participants to hold positions.

- Still, a degree of repatriation could become apparent if JGB yields continue to drift higher, based on the semi-annual outlooks provided by domestic life insurers and pension funds, particularly if 10-Year JGB yields near the new BoJ hard stop of 1%.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

| FX-Hedged Yield (%) | Conventional Yield (%) | FX-Hedged Pickup Vs. 10-Year JGB Yields (%) | |

| U.S. 10-Year | -1.6354 | 3.9606 | -2.2034 |

| Germany 10-Year | -1.3794 | 2.4590 | -1.9474 |

| France 10-Year | -0.8490 | 2.9900 | -1.4170 |

| Italy 10-Year | 0.2299 | 4.0720 | -0.3381 |

| Spain 10-Year | -0.3683 | 3.4700 | -0.9363 |

| UK 10-Year | -1.1947 | 4.3150 | -1.7627 |

| Australia 10-Year | -0.2938 | 4.0682 | -0.8618 |

| Japan 10-Year | -- | 0.5680 | -- |

| Japan 20-Year | -- | 1.1520 | -- |

| Japan 30-Year | -- | 1.4000 | -- |

| Japan 40-Year | -- | 1.5600 | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.