May 24, 2024 06:52 GMT

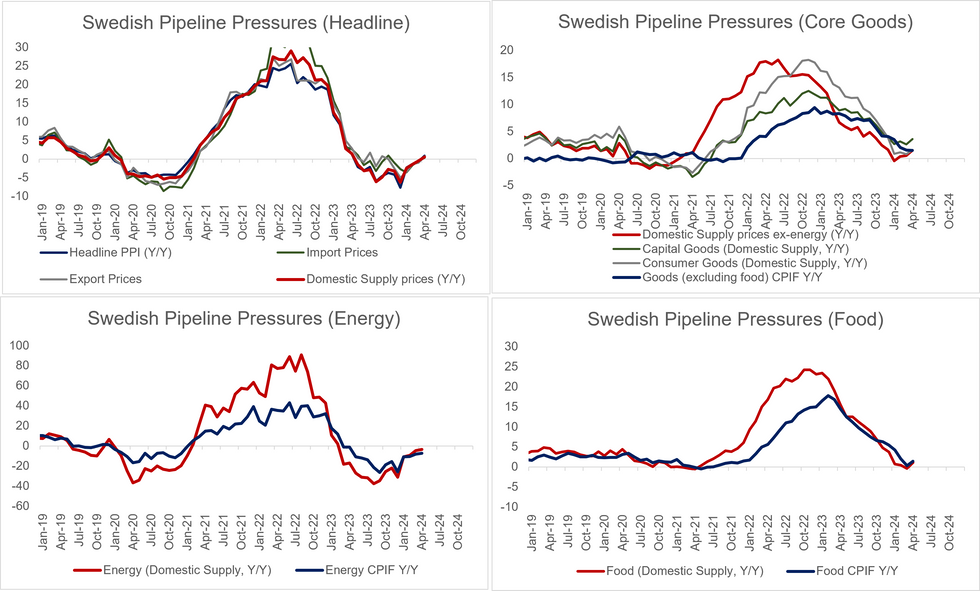

April Pipeline Prices Points To Stalling Of Core Goods CPIF Disinflation

SWEDEN

Swedish April input prices, measured using the price index for domestic supply, rose 0.6% Y/Y (vs -0.4% prior) and 0.4% M/M (vs 0.4% prior).

- The price index for domestic supply combines import prices and the producer price index for home sales, thus gives a better indication of pipeline pressures than the headline PPI print (which was 0.9% Y/Y, 0.5% M/M).

- Domestic supply ex-energy rose 1.5% Y/Y (vs 0.5% prior), while energy prices fell 3.6% Y/Y.

- Meanwhile, consumer and capital goods inflation both accelerated on an annual basis, suggestive of a stalling in core goods CPIF disinflation in the months ahead.

- The SEK weakened against most major currencies on a monthly and annual basis in April, and the cumulative weakening to date will likely be pushing imported prices higher.

138 words