-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

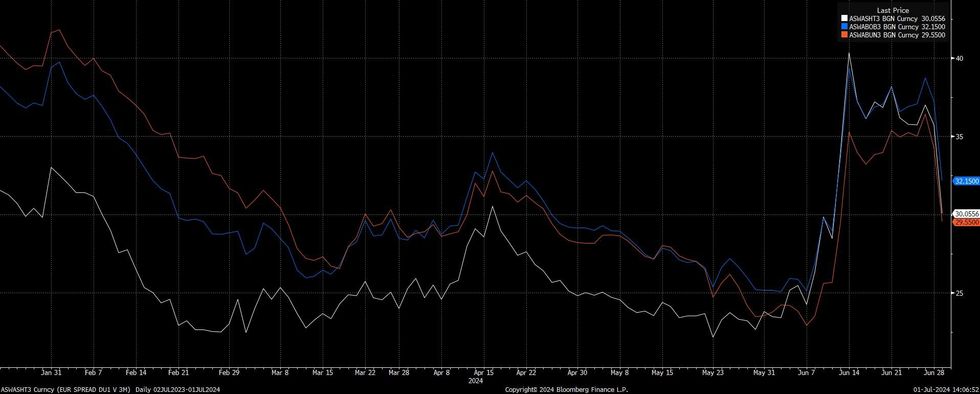

ASWs Narrow In Wake Of French Vote, Boxes Steepen A Little

Most of the major German ASW spreads still sit comfortably wider vs. pre-snap election announcement levels, meaning that at least some French political risk premium remains in place, consistent with wider cross-market pricing.

- While most deem it unlikely that RN will achieve an absolute majority come the end of the second round of voting, questions surrounding political paralysis and the lack of ability to crimp fiscal spending are limiting spreads from tightening further.

- Schatz ASWs have led today's tightening, which is understandable given the relative sensitivities to the French uncertainty seen since the start of June.

- Late Friday saw Morgan Stanley recommend a Bobl/Buxl ASW box flattener, which is now a little offside. Note this was a short-term trade, which they suggested “should provide a near-term risk-off hedge in the event of an adverse outcome in the French elections, with limited downside.”

- Looking ahead, Goldman Sachs point towards an eventual re-tightening in Bund ASWs. Late on Friday they noted that “Bunds have emerged as clear beneficiaries of renewed sovereign risk. This suggests to us that there is better risk reward in ASW tighteners as a means to fade French election risk premium.”

- They concluded that the pre-election move in Bund ASWs was “overdone, and likely reflects positioning following the strong tightening trend of the last year.”

- We flagged this positioning element on several occasions during the initial ASW widening episodes in early June.

Fig. 1: Schatz, Bobl & Bund ASWs Vs. 3-Month Euribor

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.