-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessAustralian M'fing Sector Continues To Expand, Frydenberg Pledges Childcare Investment

AUD/USD has stuck to a tight range as trading got underway in Sydney and last trades flat at $0.7716. The rate has ignored local manufacturing PMI readings, which continued to improve.

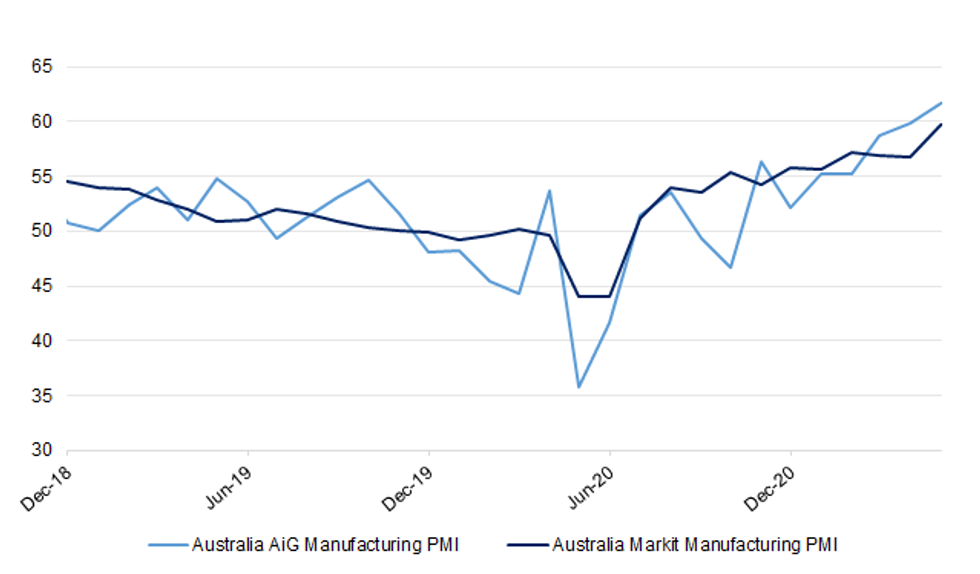

- Australian AiG M'fing PMI improved further to 61.7 in Apr, while final Markit M'fing PMI was revised to 59.7 from the flash reading of 59.6.

- Comments about the upcoming Budget continue to trickle through, with Treasurer Frydenberg noting Sunday that the gov't will unveil A$1.7bn investment in childcare, which is expected to add A$1.5bn to domestic GDP & increase the number of hours worked by 300,000/week.

- Deloitte projected Australia's budget deficit this FY to be A$30bn smaller than predicted by the gov't in their mid-year forecast, owing to stronger hiring and a rally in iron ore prices.

- Tasmanian election held on Saturday saw Liberal premier cling on to power, but it remains unclear if he will command a majority in the state legislature. When this is being typed, the Liberals are one seat short of majority and the results of postal voting (which ends next Tuesday) may prove pivotal.

- The RBA will deliver their latest MonPol decision tomorrow (click to see our latest State of Play piece; the full comprehensive preview is forthcoming). Following that, RBA Dep Gov Debelle speaks Thursday, while RBA SoMP comes out Friday.

- On the data front, focus turns to CoreLogic Logic House Price Index, Melbourne Institute Inflation & ANZ job ads (today), trade balance & housing finance data (Tuesday) & building approvals (Wednesday).

Fig. 1: Australia AiG Manufacturing PMI vs. Australia Markit Manufacturing PMI

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.