-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBank Of Thailand On Hold, Cuts Economic Forecasts

Spot USD/THB remained on a tear yesterday and showed at a fresh 13-month high, with the baht extending losses after the Bank of Thailand announced its latest monetary policy decision. The rate last sits +0.005 at THB31.870, with bulls looking for a rally past yesterday's high of THB31.895, towards May 25, 2020 high of THB32.002. Conversely, a retreat under Apr 12 high of THB31.575 & the 50-DMA at THB31.322 would allow bears to sigh with relief.

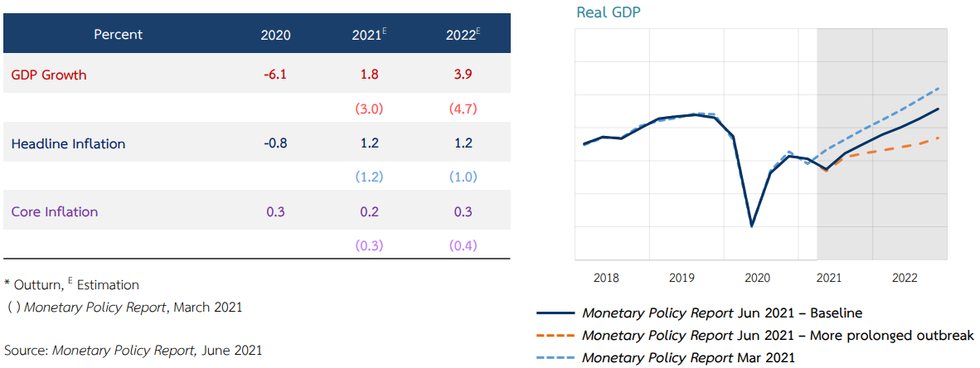

- The BoT left its benchmark policy rate on hold, in line with consensus, while slashing economic forecasts for this year. The Bank now expects domestic GDP to grow 1.8% Y/Y in 2021, after earlier projecting a 3.0% rise, while the 2022 growth forecast was trimmed to +3.9% from 4.7%.

- These revisions came alongside a cut to the forecast of foreign tourist arrivals, now expected to total 0.7mn rather than 3mn. In their post-decision commentary, UOB reminded that "Thailand's urgency to reopen its borders by Oct is crucial to its economic outlook, as tourism revenue accounted for a sizeable one-fifth of its economic output during the pre-Covid-19 period".

- J.P. Morgan observed that "the overall tone of the MPC statement has turned a touch more cautious in line with the forecast revisions," while Goldman Sachs said that they "expect BoT to be one of the slowest central banks to hike policy rates".

- The Thai Customs Dept will release its monthly trade report at 0430BST/1030ICT. Trade surplus is expected to swell to $775mn from $182mn, according to the BBG survey of analysts.

- Meanwhile, several groups of Thai demonstrators will hold protests across Bangkok, as lawmakers debate proposals for constitutional amendments.

Fig. 1: BoT Economic Forecasts

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.