-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBAT Sale of ITC May Have Limited Credit Upside; Weak Metrics for PM $Deal

BAT {BATS LN Equity} rumoured for 4% sale (of 29% stake) in ITC totalling ~£1.9b; we see limited upside to name after strong rally since late '22 & likely resumption of share buybacks soon; SocGen equity analyst upgrade Philip Morris to Hold

ET reported earlier today (from sources not disclosed) that Citi & BoA has been mandated to sell a 4%/~£1.9b of BAT's stake in ITC - sale itself is not news but timing (& to some extent the exact amount) has been cloudy with local RBI regulation the hurdle thus far - ET article seems to provide little colour on that outside the mandated banks. Management remarks in earnings last week were indic. of maintaining 25% stake to keep veto rights - that algins with the reports this morning for a 4% sale. For reference BAT had ~£4.7b in cash and net debt of £34.6m (reported £13b in adj. EBTDA) at the end of Dec/FY23.

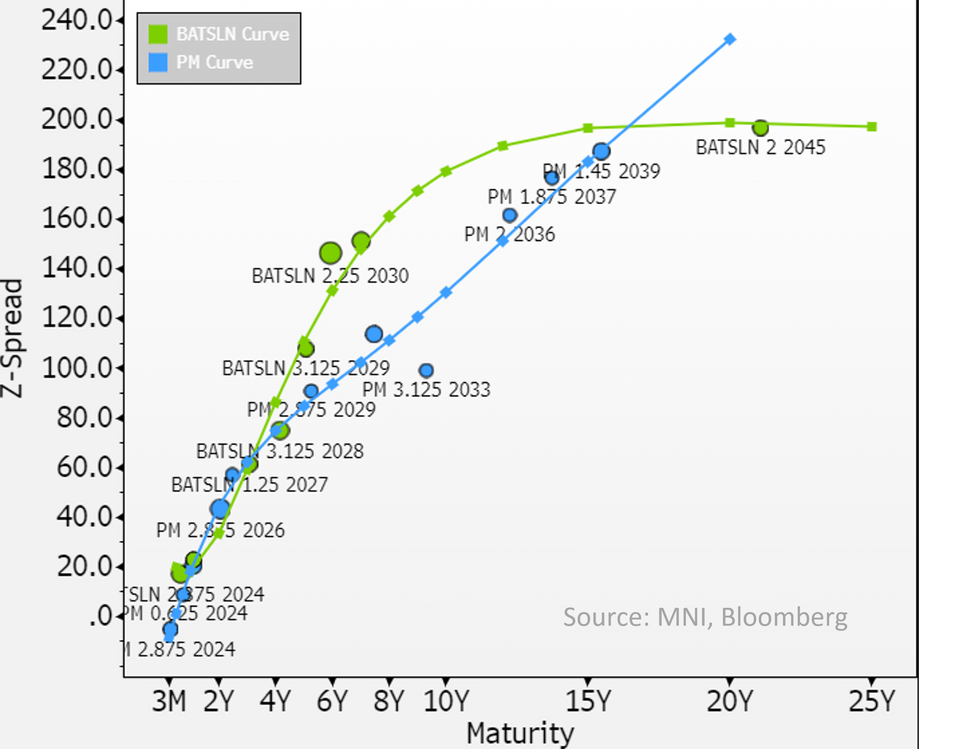

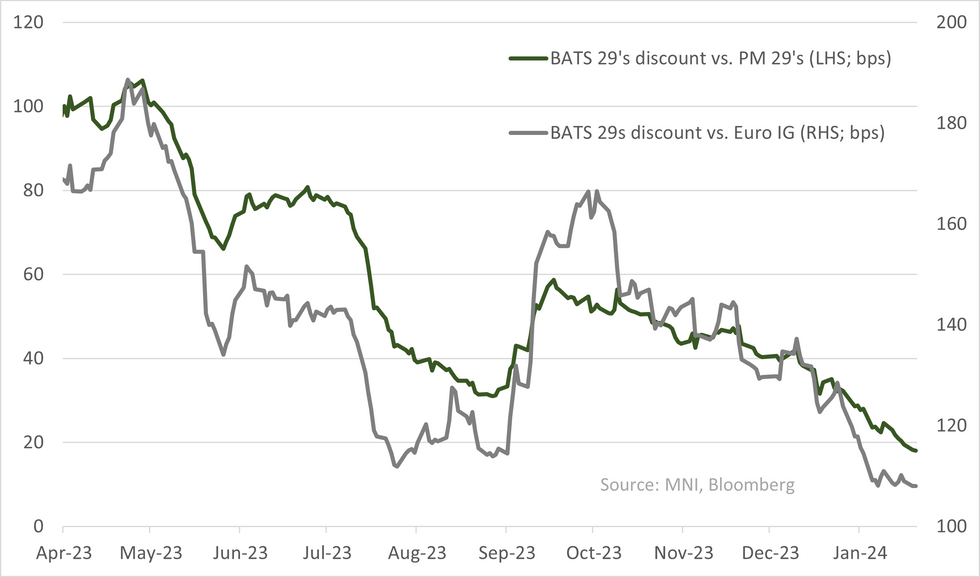

BAT (Baa2 Pos, BBB+, BBB) trades tight on short-end despite a likely turn to resuming returns for equity holders (buybacks are on pause) with it nearly at target leverage (2.6* vs. 2.5*) - that contrasts with PM who is targeting 0.3-0.5* of deleveraging still in FY24 with -1* by '26 (to 2*) & buybacks to only be considered then. Still PM's $ 4-part struggled on Friday in pricing - giving double digit NIC's across the 3 to 10y deals (books covered 2.7*). * Outside of the rating differences & BS direction, BAT's cash use on deleveraging may have had a cost on future growth (particularly in smoke-free alternatives) - that's reflected in part in BAT guidance cuts over the recent past, diverging equity performance vs. PM & forward earnings forecast divergence.

We don't have a firm view on either of the Tobacco names - BAT & PM have compressed their discount & trade tight vs. historical discounts (particularly in the case of BAT's short-end). With PM pricing wide to secondary on Friday, hard to see it's secondary closing its discount vs. index or widening its premium to BAT for now. Both curves little changed today.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.