-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

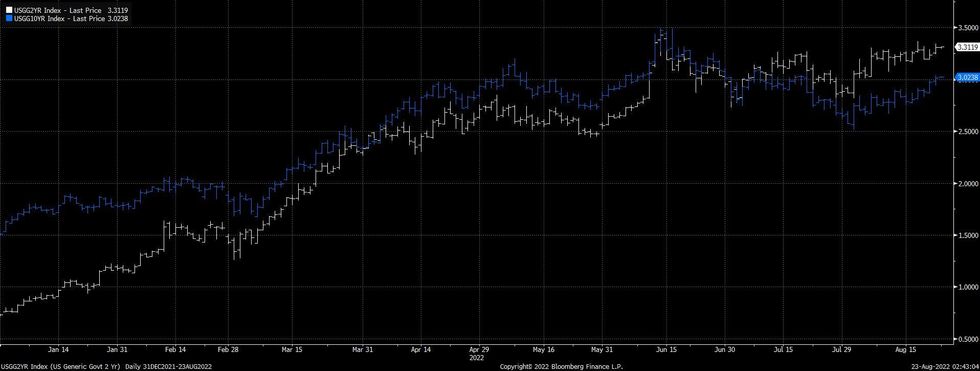

BMO Continue To Favour Flattening in 2s10s

BMO have noted that “the extent to which front-end yields can backup is greater than 10s and 30s; if for no other reason than the policy-dependent nature of trading 2s.”

- “3.45% is the most compelling line in the sand in 2s and the level that was traded in the run up to the June FOMC meeting as the market prepared for the Fed’s ‘surprise’ 75bp hike. As it presently stands, the market is pricing in 66bp of tightening on September 21; it’s tempting to conclude this is investors endorsing a three-quarter point move - although we’ll err on the side of caution given the interim data - most notably August’s CPI release.”

- “In keeping with the adage ‘don’t fight the Fed’, the flattening has further to extend as investors continue to ponder what messaging Powell is preparing to offer on Friday. The FOMC wants to keep the option of 75bp on the table for next month and in the event market pricing allows for a move of such magnitude without disrupting risk assets - the Fed will take it; very similar to the June meeting and the Committee’s decision to seize the opportunity to upsize the cadence of tightening.”

- “Embedded in this outlook is our assumption that risk assets won’t correct too dramatically - a selloff in stocks is already underway, however it’s one that is in keeping with the soft-landing narrative. Accelerating downside for risk is the most meaningful potential offset for 75bp; even if that isn’t our base case scenario. And of course, it will be a hawkish - because a hawkish hike is the hike to have, when you’re having more than one.”

- “When 10s reached 3.497%, it was inflationary angst that was dictating the price action, and since then we have seen slowdown worries become the dominant theme - owing in no small part to Q2’s negative real GDP print, and what was once defined as a recession. To be clear, this does not prevent the price action from running to challenge support at 3.097% or even slightly beyond, but we expect the level at which more substantial dip buying interest will emerge is lower at this point in the year than it was just a few months ago.”

Fig. 1: U.S. 2- & 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.