April 29, 2024 13:20 GMT

Borrowing Seen Rising Sharply In Calendar Q3 (2/2)

US TSYS/SUPPLY

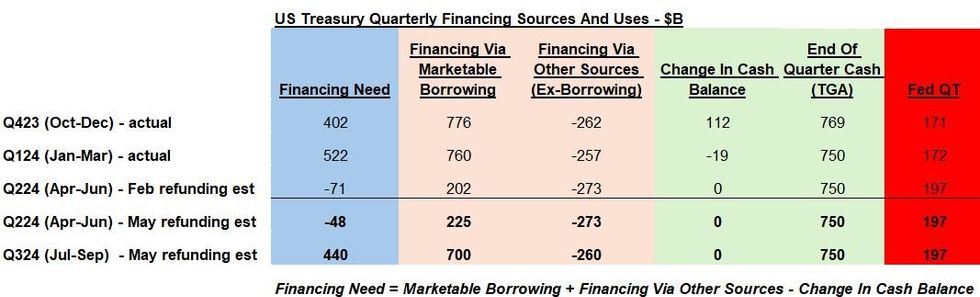

Estimates for calendar Q3 (Jul-Sep) borrowing are in a wide range, of roughly $500-750B, though again that depends at least in part on QT assumptions.

- MNI's rough read of consensus for Q3 is $700B for the Treasury's announcement, which we expect will assume the Fed QT continues unchanged through September (note the QT figures in the table below are slightly higher than the $60B monthly Treasury runoff rate because of the timing of some Treasury coupon payments).

- For perspective, any of the above figures would still be below the $768B average in Q423/Q124.

- And Treasury market reaction is likely to be muted unless there is a big surprise: with coupon auction sizes overwhelmingly (perhaps unanimously) expected to be unchanged for the upcoming quarter, financing adjustments will be made via bills.

- The table below shows where MNI sees where current consensus on the key figures going into the announcement:

Source: US Treasury, MNI estimates of consensus bolded

Source: US Treasury, MNI estimates of consensus bolded

172 words