May 21, 2024 23:01 GMT

Brightmine: Pay Deals Rises to 4.9%; But Below Median Rate Over Last Year

UK DATA

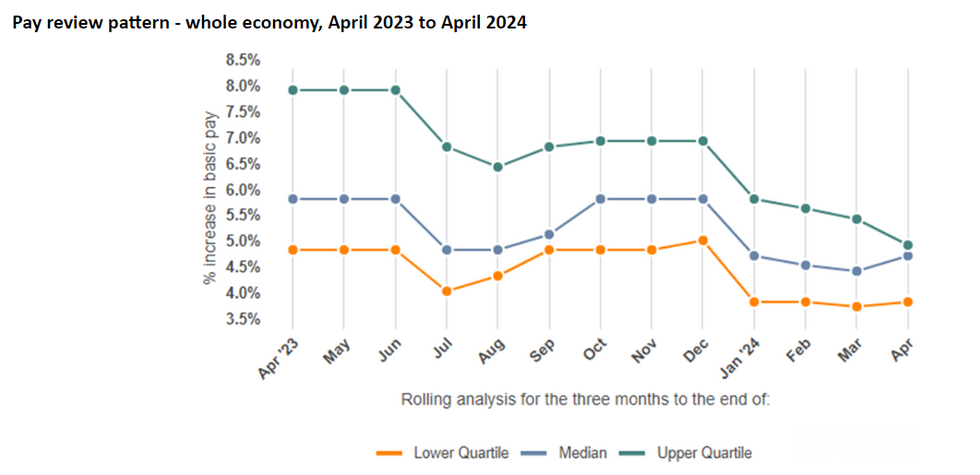

- Brightmine (previously XpertHR) median basic pay awards in the 3 months to the end of April 2024 edged up slightly to +4.9% (vs a revised +4.6% in the prior rolling quarter - originally +4.8% Y/Y 3 month average),

- In terms of pay review pattern, Brightmine found the interquartile range has narrowed falling between 4% and 5.1% - the narrowest since 2021. This data points to the continuation in the reduction in wage growth relative to last year, although not as meaningful a slowdown as the MPC would like. Note that last week's official ONS private sector regular wages number came in line with consensus and 0.1pp below the BOE's forecast, although the MPC has emphasised greater focus on CPI data due later today, specifically Services CPI. (See the MNI UK CPI Preview here).

- Data were collected between 1 February and 30 April 2024, based on a total of 102 pay settlements, representing 355,064 employees.

162 words