-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

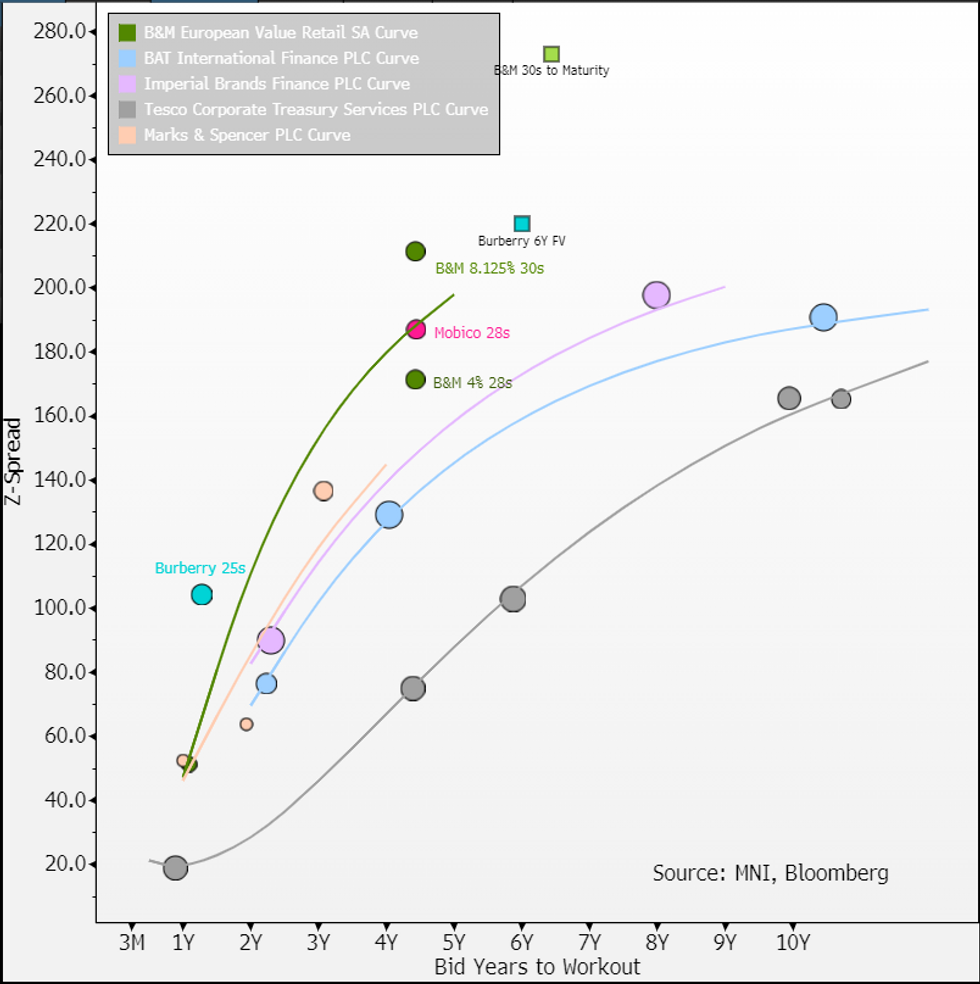

Free AccessBurberry (Baa2, NR) £6Y FV

Fundamentals on the co were pushed out yesterday and linked here. Based on that we are tad confused why its rushing into primary. We don't want to catch a falling knife and if investors share that sentiment it will be forced to pay up on spread. PostNL was prime example of that last week when it had to give a 35bp NIC to revised and 75bps to initial/fundamental FVs. Burberry is on worse footing (our view) given highly discretionary, no FY guidance (postNL's was firm) and no CDS. On below FV we would need a 20bp+ NIC before we start looking at potential value.

£Bchmrk 6Y FV: MS+220 (eqv. ~6.3% or G+217)

- Our FV effectively ignores ratings. Those that care should price to BBB-/1-notch lower. Language at last earnings is indic. of it moving away from historical net 0.5-1x target and instead focusing on maintaining a min. IG rating. This issuance is perhaps further evidence of that. It was already above target at net 1.4x to end FY24. Assuming this is all net supply (no indications otherwise) then another £300m issuance will push gross leverage from 1.9x to 2.3x on LTM EBITDA and consensus NTM EBITDA will take that to 2.6x. Moody's adj. threshold hold for downgrade is (adj.) gross 2.5x.

- Re. FV we have priced wide to staple B&M28s (Ba1/BB+) that benefits from consumers trading down. Note we have a cheap view on the B&M 30s (see above). The Mobico 28s look rich to us - in Euro the 31s trade +130 above the Imperial curve, here its +40. Some of it may be steepness in 28/31s but we still encourage caution on the name given uncertainty on impact of business sales/use of proceeds.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.