-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessCan A Sustain Period of Equity Inflows Lead To CNY Strength in MT?

- Implied volatility on CNY has been rising in March, with USDCNY consolidating higher, mostly driven by the increase in selling pressure on the offshore yuan (rather than weaker-than-expected PBoC fixing).

- USDCNH has been retracing gradually higher in the past week, approaching its ST resistance at 6.40. Key level to watch remains at 6.41, which corresponds to the 200DMA (rejected on March 15).

- According to a former SAFE official, the CNH weakness is a sign that foreign investors are starting to sell their Chinese assets and that the tighter policy in the West could continue to lead to portfolio outflows and therefore further CNH depreciation.

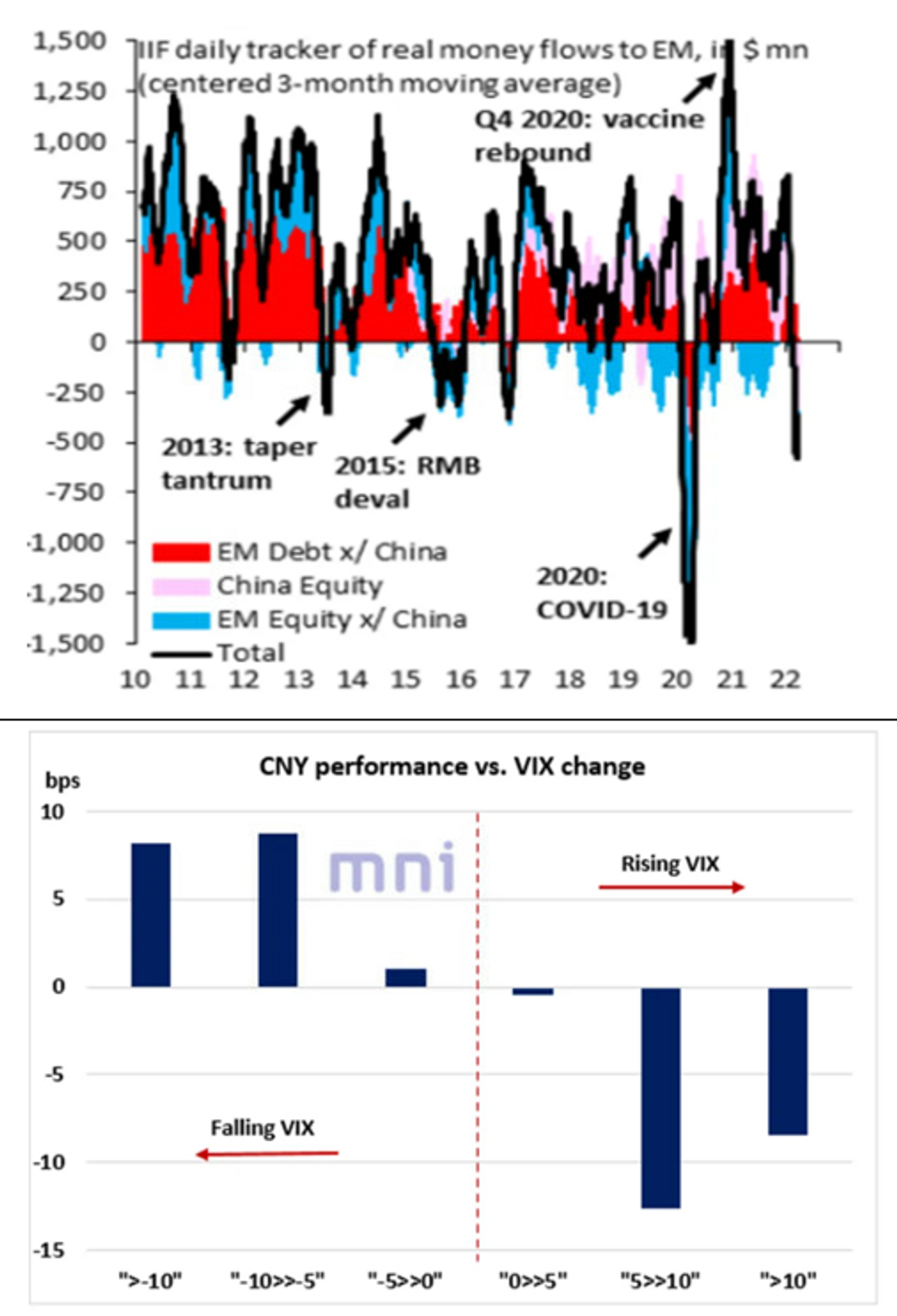

- The top chart (source: IIF) shows that China has been experiencing ‘significant’ capital outflows (equity) in recent weeks (biggest in the past cycle), while the rest of EM has been getting inflows.

- However, equities have regained investors’ confidence in the past two weeks following the headline that regulatory authorities are ‘mulling measures to jointly crackdown earlier this month (March 15). The Hang Seng index is up over 20% since its low.

- Therefore, new equity inflows could lead to CNY appreciation in the short/medium term if the momentum remains firm.

- In addition, as CNY offers interesting carry, the ‘search for yield’ could also be a factor leading to further CNY strength if geopolitical uncertainty eases in the medium term.

- Due to its attractive yield, CNY remains a ‘traditional risk on’ currency that appreciates when volatility eases (bottom chart).

Source: Bloomberg/MNI/IIF

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.