-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

Can IDR Play Catch Up?

USD/IDR is back to 15638, -0.60% on yesterday's closing levels. The 50-day EMA comes in just under 15500, while mid-November lows were around 15400. On the topside, BI intervention interest appears evident around the 15750 level.

- The rupiah still looks to be lagging the broader global equity rally and improved risk tone. However, local equities continue to stagnate, while net offshore inflows were only just positive for November, compared to stronger momentum elsewhere in the region.

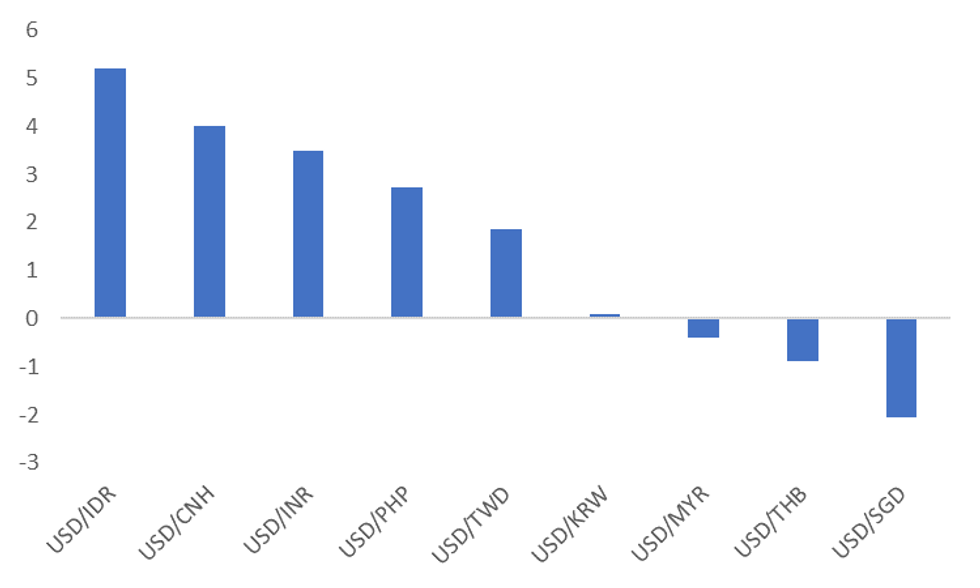

- Still, there is scope for IDR to play some catch up if we see further broad based USD weakness. Relative to its 200-day MA, USD/IDR is still the most elevated relative to other USD/Asia pairs, see the chart below.

- November CPI, which has just printed, continued the recent run of downside surprises relative to expectations. Headline prices moderated to 5.42% from 5.71% prior (5.50% was forecast), while core came in at 3.30%, unchanged and versus 3.42% expected. B

- BI is still likely to tighten in December, but we may see a slowdown in terms of the pace of tightening.

Fig 1: USD/Asia FX Pairs - Deviation From 200-Day MAs (%)

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.