April 25, 2024 11:13 GMT

CFIB Survey Sees Rebound In Price And Wage Setting Plans

CANADA DATA

- The CFIB small business barometer saw confidence fall from 52.9 to 47.5 in April for its lowest since Dec.

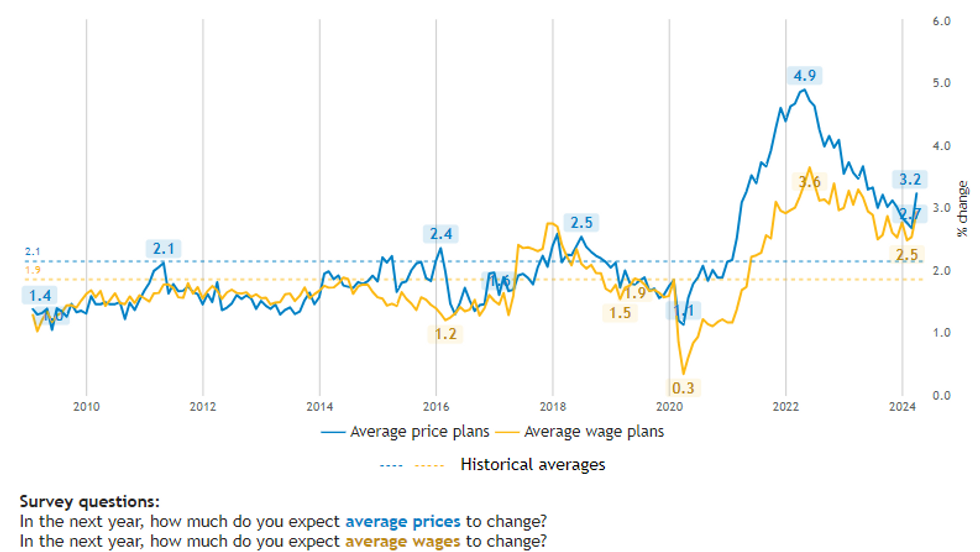

- The most notable development came on price setting expectations for the next twelve months, which jumped from 2.7% to 3.2% for the highest since September.

- It goes against the steady downward trend which saw each month in Q1 below the BoC’s 3% upper limit for the inflation target range.

- Interestingly in a sign of service price strength, the 71.5% of businesses reporting insurance costs as a major cost constraint was a new high for the series.

- On the labour market, average wage plans also bumped higher in April, rising from 2.5% to 2.9% for its highest since October.

- This came with an bounce in the share of businesses reporting shortages of both skilled and un/semi-skilled labour after a sizeable decline in March.

Source: CFIB

Source: CFIB

155 words