May 31, 2024 13:45 GMT

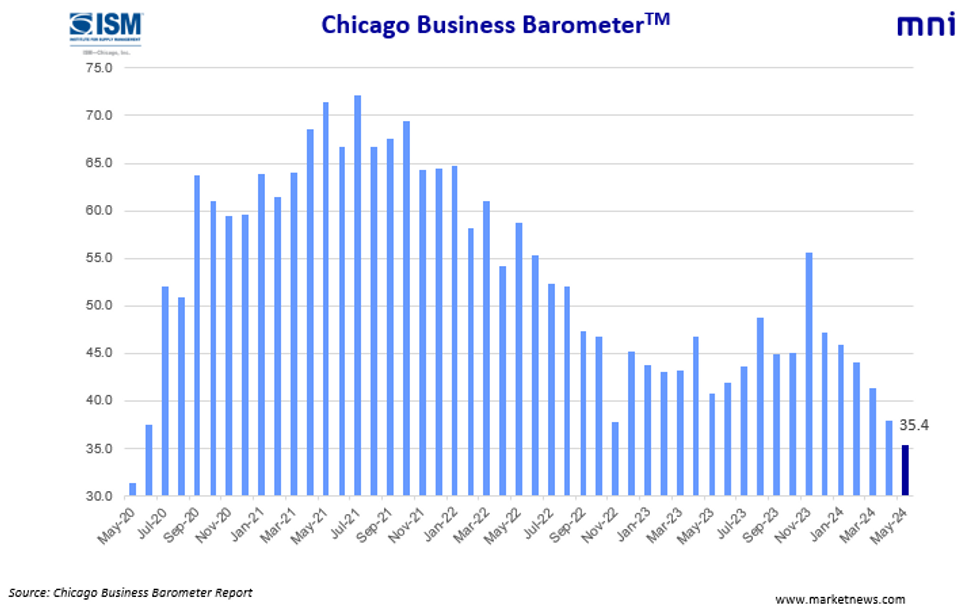

Chicago Business Barometer™ - Slowed to 35.4 in May

US DATA

EM BulletDataHomepagemarkets-real-timeEmerging Market NewsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

The Chicago Business BarometerTM, produced with MNI slowed 2.5 points to 35.4 in May. This is the sixth consecutive monthly decline, making this month’s reading the lowest since May 2020 and 5.5 points below the year-to-date average of 40.9.

- Three out of five subcomponents fell. With the move driven lower by falls in New Orders, Order Backlogs, and to a lesser extent Employment, whilst Production and Supplier Deliveries offset some of this differentiation.

- In particular, New Orders were tempered for the third consecutive month by 9.2 points to the lowest print since May 2020. Nearly half of respondents reported fewer new orders.

- Order Backlogs dropped 8.0 points, reversing last month gains, and making the print the lowest reading since May 2020. Respondents were almost equally split between smaller backlogs and unchanged levels.

- Employment moderated 1.4 points to 37.2, making it the lowest level since June 2020.

- Meanwhile, Production rose 8.1 points to 43.6 after five consecutive months of decline, making it the highest level since January 2024. This has been driven by more respondents reporting stable production than lower production relative to previous months.

- Inventories reduced 5.4 points, reversing last month’s gain to return it to the lowest since March 2024 when there were delays in planned restocking.

- Supplier Deliveries reversed last month’s loss, readding 0.8 points, making it in line with the March 2024 level.

- Finally, Prices Paid edged down 0.9 points to 68.4, although it remains the second highest level since August 2023.

251 words