-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

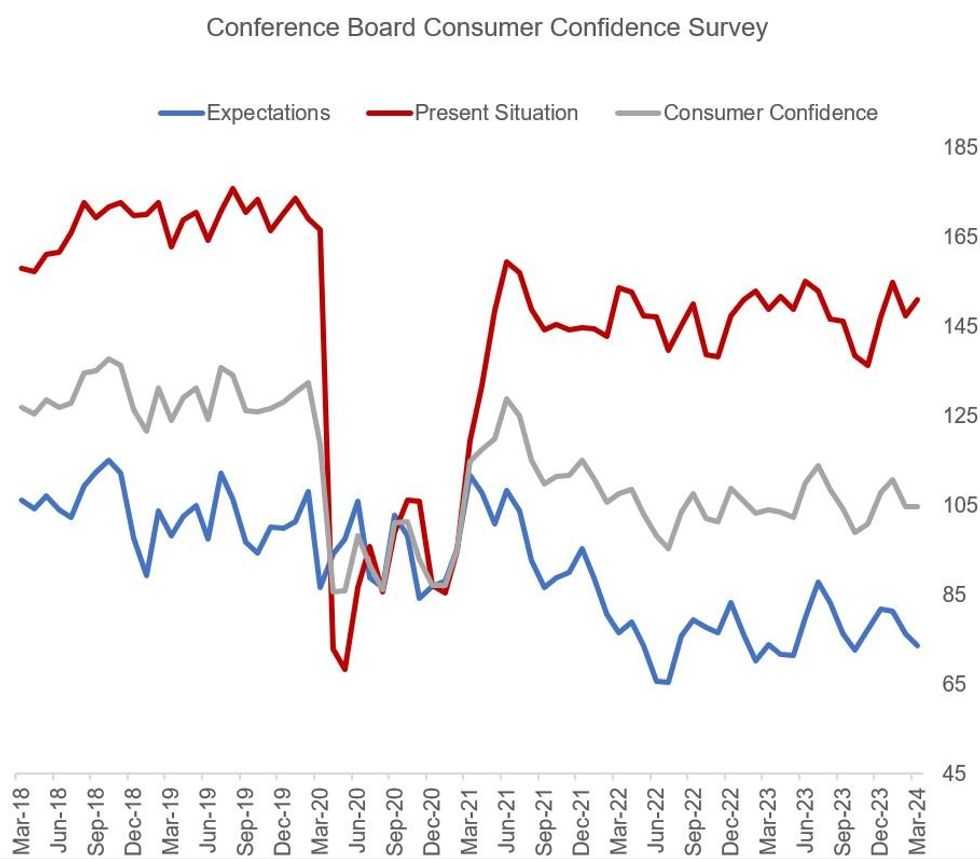

Free AccessConsumer Confidence Remains Subdued, With Current Jobs A Bright Spot

March's Conference Board consumer survey showed an unexpected fall in confidence, including a downward revision to February's reading. While expectations also retreated, the "present situation" component picked up. The internals of the report were fairly weak, with inflation apparently remaining front-of-mind for many respondents. In general the survey readings have been fairly steady since early 2022, consistent with the roughly 2% annual average real personal consumption growth posted over that span.

- The Consumer Confidence index dipped from 104.8 to 104.7, defying expectations of a rise to 107.0 (prior was revised down from 106.7). Present Situation rose from 147.6 (rev. from 147.2) to 151.0, with Expectations slipping from 76.3 (rev. from 79.8) to 73.8.

- Average 12-month inflation expectations were 5.3% (little changed from 5.2% prior), while recession fears continued to fade.

- Consumers had a weaker assessment of current business conditions in March, and were more pessimistic on the outlook for short-term business conditions, the labor market, and their short-term income prospects. However they had a more optimistic assessment of the current labor market. A few interesting observations from the report:

- "Consumers remained concerned with elevated price levels, which predominated write-in responses...over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.”

- "Notably, the employment differential—those saying jobs are plentiful minus those saying jobs are hard to get—rose in March and has been trending higher this year. However, expectations for the next six months slipped to the lowest level since October 2023."

- "The share of consumers expecting an increase in interest rates over the year ahead rose above 50 percent for the first time since November 2023."

- "On a six-month basis, buying plans for interest-rate sensitive items like autos, homes, and big-ticket appliances dipped again. However, based on a supplemental question, planned spending for services in 2024 increased relative to the same time last year."

Source: Conference Board, MNI

Source: Conference Board, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.