July 08, 2024 19:34 GMT

Consumer Credit Growth Picks Up In May, But Overall Dynamics Subdued

US DATA

DataHomepagemarkets-real-timeCreditEmerging Market NewsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

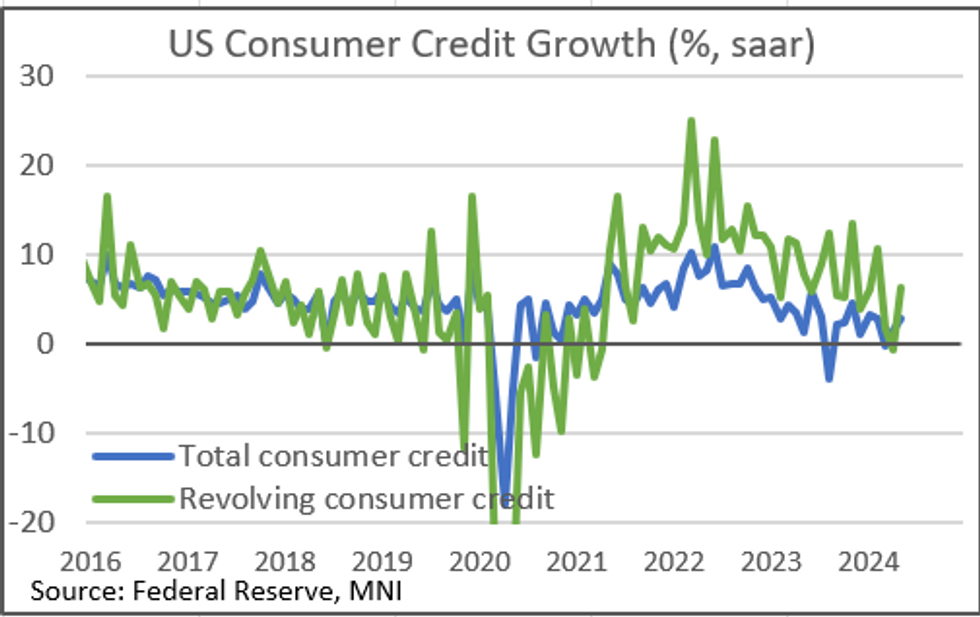

US consumer credit grew by a 4-month high $11.4B in May, above the expected $8.9B and April's $6.5B, per Federal Reserve data. That's equivalent to a 2.7% annualized growth rate (all figures seasonally adjusted).

- Revolving credit (e.g. credit cards) rebounded sharply to rise $7.0B (a +6.3% ann. rate) vs a $0.9B contraction in April, while nonrevolving credit (e.g. student loans, auto loans) softened to $4.3B (a +1.4% ann. rate) from $7.4B prior.

- While these figures are relatively robust compared to Mar/Apr, they are part of a noisy month-to-month series that suggests flat demand for credit from consumers in recent quarters, alongside rising household savings rates and softer consumption.

- Those dynamics have gone hand-in-hand with a loosening labor market, relatively high interest rates and rising delinquency rates, albeit there is little sign of an outright capitulation of consumers with household debt service ratios still at/near multi-decade lows.

- The next quarterly Fed Senior Loan Officer Survey, which gives a broad sense of underlying lending and borrowing conditions, is due out in August. The most recent report in May suggested softer demand across all main categories of consumer loans, which combined with the above factors points to higher-for-longer Fed policy rates having an impact in slowing demand.

210 words