May 24, 2024 14:51 GMT

Consumer & Transport Weekly

CONSUMER CYCLICALS

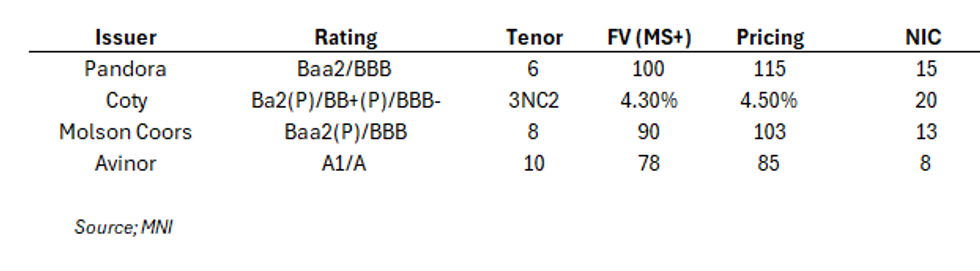

- A high-grade airport not going through its curve perhaps should've been the early indicator that we were in for double digit NICs. Molson, Pandora & Coty who followed didn't disappoint. Our most attractive deal this year has been PVH 29s (30bp NIC) & Elo/Auchan (55bps) but Coty (20bps) and Pandora (15bps) now join them.

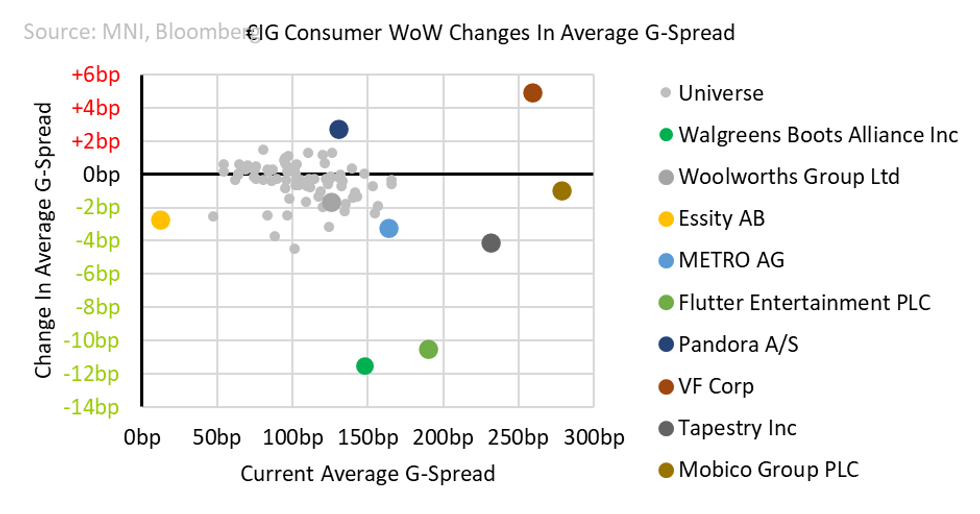

- Unfortunately, a repeat of this week looks unlikely ahead of a seasonal summer lull particularly in July/August. September to Nov might be our next chance to catch value in primary. Secondary continues to be low vol, same high beta names on the move (below) in recent weeks.

- In Macro UK real retail sales (ex. fuel -2%mom & -3%yoy) has mirrored US nominal April weakness - rates trading past it reflecting volatility/weight of this print. We will get a more read from retailers directly including local issuer PVH (parent of Tommy Hilfiger & Calvin Klein) who will include April on earnings in 2 weeks.

- Current/open screen cheaps we have (change since): Woolworths 28s (unch), New Pandora 30s (-4), Dufry 28s (-23), Coty 28s (+0.1pts), Pluxee 28s (+9), New Coty 27s (+0.5pts), Tesco 31s (+4), Edenred 29s (+5), ISS 26s (unch), new Elo/Auchan 28s in primary (-25), new BAT 32s in primary (+8), new Finnair 29s (unch).

227 words