-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

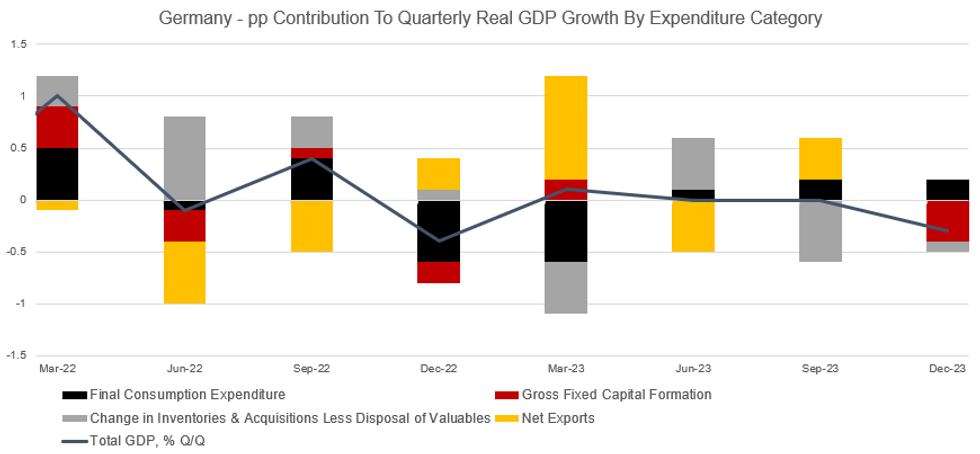

Free AccessConsumption Defies Broader Recession, GDP Outlook Still Weak

Overall German Final Q4 GDP growth was unrevised as expected at a seasonally adjusted -0.3% Q/Q (0.0% prior), and -0.2% Y/Y (-0.3% prior). The data confirm that Germany was, by a very slim margin (Q3 printed -0.01% unrounded), in a technical recession.

- The final release includes a breakdown of GDP components that was unavailable in the initial print, and it suggests that fixed investment was a significant drag to economic growth in the quarter, while private consumption somewhat counterintuitively ticked up.

- Gross fixed capital formation fell at the fastest rate since Q3 2021 (-1.9% vs +0.1% prior), subtracting 0.4pp from overall GDP and reducing fixed investment back to around Q4 2021 levels. Construction and equipment investment decreased -1.7% / -3.5% respectively (all figures Q/Q).

- Private consumption contributed positively (+0.2pp) for the third consecutive quarter, and was upward revised for Q3, from slightly negative to a +0.1pp contribution. That was a counterintuitive result in some ways, particularly with retail sales data being contractionary Y/Y since mid-2022 (in nominal but especially real terms). Additionally, the savings rate increased again compared to last year, coming in at 10.9% (NSA, +0.4 pp vs Q4 2022) as available private household income rose more (+4.4% Y/Y nominal) than consumption (+3.8%Y/Y).

- Elsewhere, the contribution to GDP from net exports was broadly flat, while inventories subtracted -0.1pp from Q4 GDP, far less of a drag than in Q3 when it subtracted -0.6pp.

- On a sectoral Gross Value Added (GVA) basis, construction and manufacturing contracted, mirroring prior hard and soft data. GVA in energy production jumped, however. Survey data including PMIs as well as most momentum indicators as factory orders point to ongoing weakness in the German economy, especially in the manufacturing sector.

- Overall this is a marginally weaker report than expected for fixed investment though a little stronger on consumption (both public and private) when accounting for revisions.

- In light of poor growth, German government has begun putting together some stimulus, but fiscal and political constraints mean the proposed measures (including an enterprise tax relief debated in Bundestag today) are not likely to provide a major impetus to 2024 GDP.

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.