-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

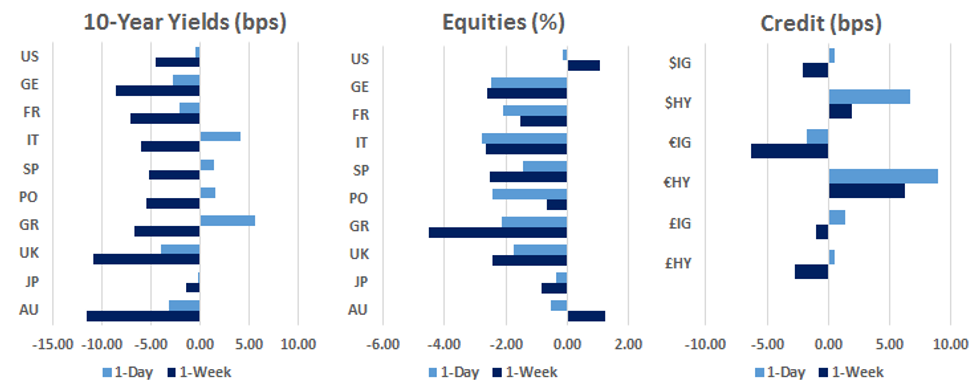

MNI European Morning FI Analysis: A Mixed Bag

US TSYS: Overnight Eurodollar Flows Steals Headlines As Familiar Risks Persist

T-Notes clung to a tight range overnight, last unch. at 139-04, with yields sitting 0.2-0.7bp richer across the cash Tsy curve. Flows were eyed, with some focus on the downside via light screen interest in the 1x2 TYZ0 137.00/135.00 put spread. The familiar sources of risk that we flagged early in Asia-Pac hours on Thursday have dominated news flow during the last 24 hours (namely the fiscal impasse in DC, COVID worry, most notably in Europe, the ongoing Brexit saga and to a degree, Sino-U.S. tensions). Initial jobless claims data went in the wrong direction on Thursday, at least in terms of the health of the economy, while regional activity indicators were mixed. The overarching risk negative factors supported the space in early Thursday dealing, before the bid faded and yields across the cash Tsy curve finished unchanged to 1.0bp cheaper, with the retrace coming in line with a recovery in equities.

- Eurodollar futures sit unchanged to 0.5 tick higher through the reds on heavy volume. Here, a combination of block and screen sales in EDM1 and on screen steepener flow in EDU2/U4 received attention, especially given the lack of headline flow that was evident overnight.

- Retail sales, industrial production & the Uni of Michigan confidence reading headline the local docket on Friday. We will also hear from Fed's Williams and Bullard.

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- DBRS Morningstar on France (current rating: AAA, Negative Trend)

JGBS: Pullback From Overnight Highs

JGB futures sagged during the Tokyo morning, after the pullback from overnight highs (which were just below technical resistance) continued, before the defensive feel in the Nikkei 225 and e-minis crept in, allowing JGB futures to bottom, at least for now.

- Contract last +7, with the super-long end outperforming in cash, while 10s represent the weakest point on the curve.

- In terms of local news flow, Japan's cabinet has decided to tap emergency budget reserves worth Y549bn, as the government looks to support supply chains & farmers, in addition to creating provisions for job subsidies.

- Monthly trade data and 12-month supply headline locally on Monday.

AUSSIE BONDS: Rolling Down Into The Weekend

Spill over from yesterday's RBA commentary, in addition to a stellar ACGB auction and Westpac expressing greater conviction re: imminent RBA easing, supported the Aussie bond space in Sydney trade. YM +0.5, XM +2.5, with the latter well off its SYCOM highs owing to the move in Tsys in NY trade.

- In terms of auction specifics, it looks like the hunt for exposure to rolldown towards the 3-Year benchmark outweighed any desire to hunt out the broader flattening impetus, with the cover ratio surging above 7.00x at the latest ACGB Nov '24 auction, while average yields priced ~0.8bp through prevailing mids at the time of supply.

- The AOFM's weekly issuance schedule provided no real talking points.

- As we flagged earlier, local news flow continues to be dominated by Sino-Aussie tensions, with ABC sources noting that "mills in China are being told to stop buying Australian cotton as speculation grows that a hefty tariff is about to be slapped on the trade." Further details on that matter can be found in an earlier bullet.

- Bills -1 to +1 through the reds.

AUCTIONS/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y6.1563tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1563tn 3-Month Bills:

- Average Yield -0.0834% (prev. -0.0945%)

- Average Price 100.0224 (prev. 100.0254)

- High Yield: -0.0781% (prev. -0.0875%)

- Low Price: 100.0210 (prev. 100.0235)

- % Allotted At High Yield: 26.7333% (prev. 79.9574%)

- Bid/Cover: 3.229x (prev. 2.631x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:- Average Yield: 0.1895% (prev. 0.3070%)

- High Yield: 0.1900% (prev. 0.3075%)

- Bid/Cover: 7.0100x (prev. 6.5405x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 93.8% (prev. 99.0%)

- bidders 42 (prev. 60), successful 9 (prev. 10), allocated in full 3 (prev. 5)

AUSSIE BONDS: Vanilla AOFM Issuance Schedule For Next Week

The AOFM has released its weekly issuance schedule:

- On Wednesday 21 October it plans to sell A$2.0bn of the 1.00% 21 December 2030 Bond.

- On Thursday 22 October it plans to sell A$1.5bn of the 26 February 2021 Note & A$1.0bn of the 21 May 2021 Note.

- On Friday 23 October it plans to sell A$1.5bn of the 0.50% 21 September 2026 Bond.

TECHS

BUND TECHS: (Z0) Uptrend Accelerates

- RES 4: 177.18 High Sep 3 (cont)

- RES 3: 176.94 High Sep 8 (cont)

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- PRICE: 175.86 @ 04:58 BST Oct 16

- SUP 1: 175.35 Low Oct 15

- SUP 2: 175.04 Low Oct 14

- SUP 3: 174.67 20-day EMA

- SUP 4: 174.25 50-day EMA

Bunds continued to rally Thursday, accelerating sharply higher. This week has seen futures clear resistance at 174.97, Oct 2 high and more importantly, the key level at 175.08, Aug 4 high. The breach of 175.08 confirms a resumption of the broader uptrend and sets the scene an extension higher. The next objectives and potential resistance levels are at 176.32 and 176.57, both Fibonacci projections. Initial support is at 175.35, Thursday's low.

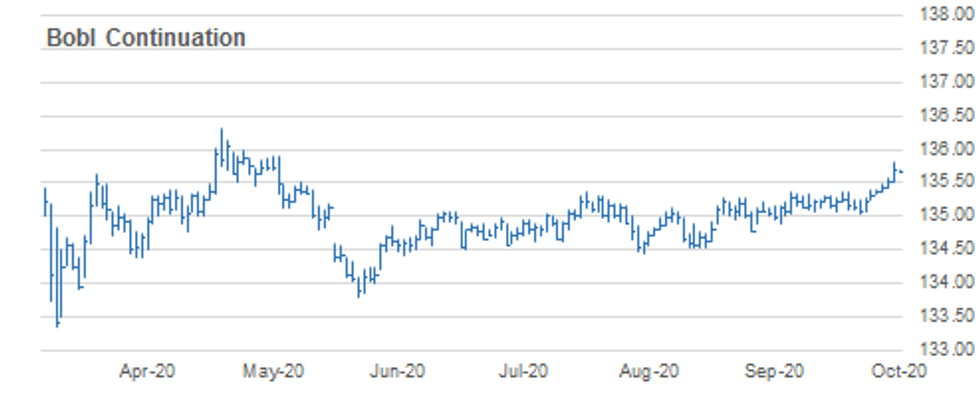

BOBL TECHS: (Z0) Needle Points North

- RES 4: 136.060 2.000 retracement of the May - Jun sell-off (cont)

- RES 3: 136.000 Round number resistance

- RES 2: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.820 High Oct 15

- PRICE: 135.690 @ 05:02 BST Oct 16

- SUP 1: 135.510 Low Oct 15

- SUP 2: 135.370 High Sep 21 and Oct 5 and former breakout level

- SUP 3: 135.285 20-day EMA

- SUP 4: 135.030 Low Oct 6 and key trend support

BOBL futures maintain a bullish tone and gains accelerated yesterday. The contract rebounded on Oct 7 off 135.030. This week's gains have resulted in a clear breach of resistance at 135.370, Sep 21 and the Oct 5 high. The break confirmed a resumption of the uptrend that started early September. The next objectives and potential resistance levels are at 135.907, a Fibonacci projection and 136.00. Initial support lies at 135.510.

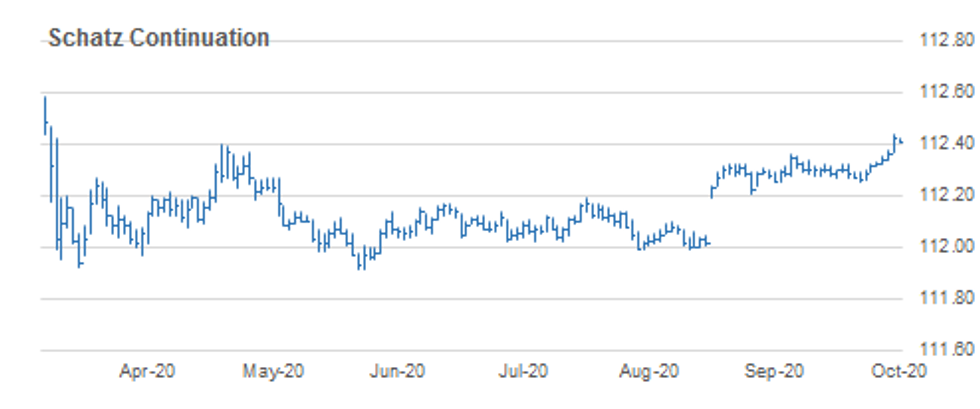

SCHATZ TECHS: (Z0) Sharply Higher

- RES 4: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.437 1.618 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.435 High Oct 15

- PRICE: 112.415 @ 05:17 BST Oct 16

- SUP 1: 112.365 Low Oct 15

- SUP 2: 112.340 Low Oct 14

- SUP 3: 112.305 20-day EMA

- SUP 4: 112.255 Low Oct 7 and key trend support

Schatz futures remain firm and gains accelerated sharply higher yesterday. This week's climb has seen price clar the key resistance at 112.360, Sep 21 high, reinforcing the current positive tone and confirming a resumption of the broader uptrend. The move higher has opened 112.437 next, a Fibonacci projection. Moving average studies are in a bull mode reinforcing current trend conditions. Initial support is at 112.365, yesterday's low.

GILT TECHS: (Z0) Eyeing Key Resistance

- RES 4: 137.44 High Aug 7

- RES 3: 137.14 0.764 proj of Aug 28 - Sep 21 rally from Oct 7 low

- RES 2: 137.04 High Sep 21 and a key resistance

- RES 1: 136.89 High Oct 15

- PRICE: 136.63 @ Close Oct 15

- SUP 1: 136.27 Low Oct 15

- SUP 2: 135.50 Low Oct 14

- SUP 3: 135.06 Low Oct 7 and the bear trigger

- SUP 4: 134.96 76.4% retracement of the Aug 28 - Sep 28 rally

Gilts rallied sharply higher Thursday clearing a host of resistance levels. The break of 136.60, Sep 30 high signals scope for a climb towards the next key resistance at 137.04, Sep 21 high. Clearance of this level would reinforce this week's bullish development and set the scene for a climb towards 137.14 and potentially 137.78 further out, both Fibonacci projection levels. On the downside, initial support lies at 136.27, yesterday's low.

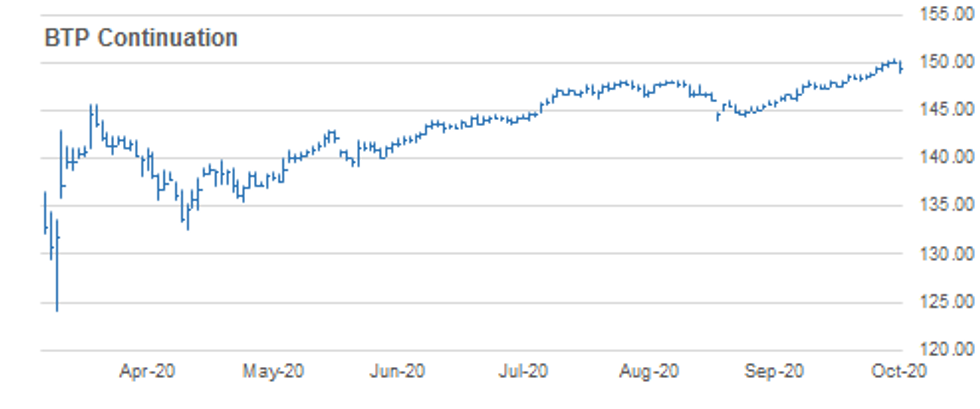

BTPS TECHS: (Z0) Corrective Pullback

- RES 4: 152.00 Round number resistance

- RES 3: 151.29 Bull channel top drawn off the Sep 8 low

- RES 2: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 1: 150.43 High Oct 13

- PRICE: 149.60 @ Close Oct 15

- SUP 1: 149.01 Low Oct 15

- SUP 2: 148.47 20-day EMA

- SUP 3: 147.32 Low Sep 28 and key near-term support

- SUP 4: 146.98 Low Sep 22

BTPS maintains a bullish tone. Resistance appeared yesterday though and futures traded lower in a move that is likely a correction. This week's gains have seen the contract extend higher into uncharted territory and maintain the bullish price sequence of higher highs and higher lows. Resistance and the bull trigger have been defined at 150.43, yesterday's high. Initial support lies at yesterday's low of 149.01.

EUROSTOXX50 TECHS: Reverses Course

- RES 4: 3326.79 High Sep 18

- RES 3: 3305.77 High Oct 12 and key near-term resistance

- RES 2: 3269.87 High Oct 15

- RES 1: 3243.29 20-day EMA

- PRICE: 3192.69 @ Close Oct 15

- SUP 1: 3147.28 Low Oct 2 and key support

- SUP 2: 3097.67 Low Sep 25 and the bear trigger

- SUP 3: 3054.11 Low June 15

- SUP 4: 3012.50 38.2% retracement of the Mar - Jul uptrend

EUROSTOXX 50 suffered a sharp setback yesterday accelerating lower and extending the recent pullback from 3305.77, Oct 12 high.The move lower reverses the recent recovery that started on Sep 25. Attention turns to support at 3147.28, Oct 2 low where a break would expose the key support handle at 3097.67, Sep 25 low. Clearance of this level would represent an important bearish break. Firm resistance is at 3269.87, yesterday's high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.