-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessCovid Trends Look Better, But Malaysia Remains Cautious Ahead Of Holiday

Spot USD/MYR has crept higher in early trade, albeit hasn't yet breached a cycle high of MYR4.2102 printed last Friday. The rate last changes hands +33 pips at MYR4.2087 and a break above MYR4.2102 would open up the 50% retracement of the Mar 23, 2020 - Jan 4, 2021 sell-off at MYR4.2224. Conversely, a dip through Jul 12 low of MYR4.1810 would give bears some reprieve.

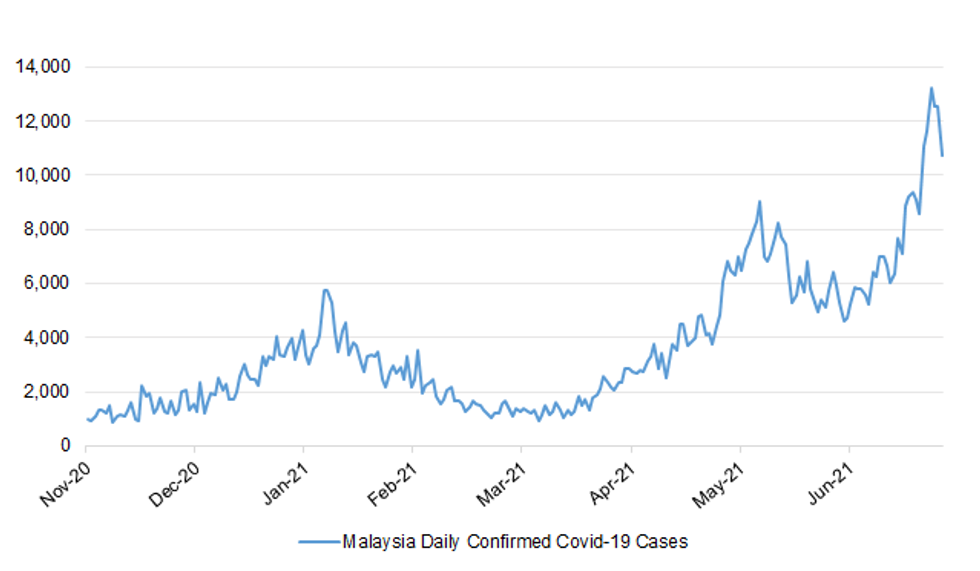

- Malaysia's daily count of new Covid-19 infections has eased over the last few days, reaching its lowest point in a week on Sunday. Selangor remains the main contributor of new cases, but Dep PM Ismail Sabri said last Friday that the authorities wouldn't extend enhanced restrictions in the state.

- Elsewhere, Malaysia is looking at relaxing some of its Covid-19 countermeasures. Science Min & vaccine czar Khairy said that the gov't plans to ease restrictions for individuals who are fully vaccinated against the virus, with details to be announced soon. At the same time, the gov't pledged to ramp up enforcement measures ahead of tomorrow's Hari Raya Haji holiday.

- Officials aim at offering at least one jab to each adult resident of the Klang Valley by August 1 and expect to fully inoculate all adult Malaysians by October, under the newly fast-tracked National Covid-19 Immunisation Programme. The previous target was vaccinating 80% of Malaysian residents by December.

- FinMin Zafrul gave an exclusive interview to the SCMP, in which he signalled the gov't's willingness to cooperate with the opposition over the National Recovery Plan. Zafrul met with some leading opposition figures last week and will host another round of talks in the coming days.

- The main item of note on Malaysia's economic docket this week is monthly CPI data, due Friday. Local markets will be closed for a public holiday tomorrow.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.